Company Valuation with 6 Key Approaches

Understand Company Valuation with 6 Key Approaches

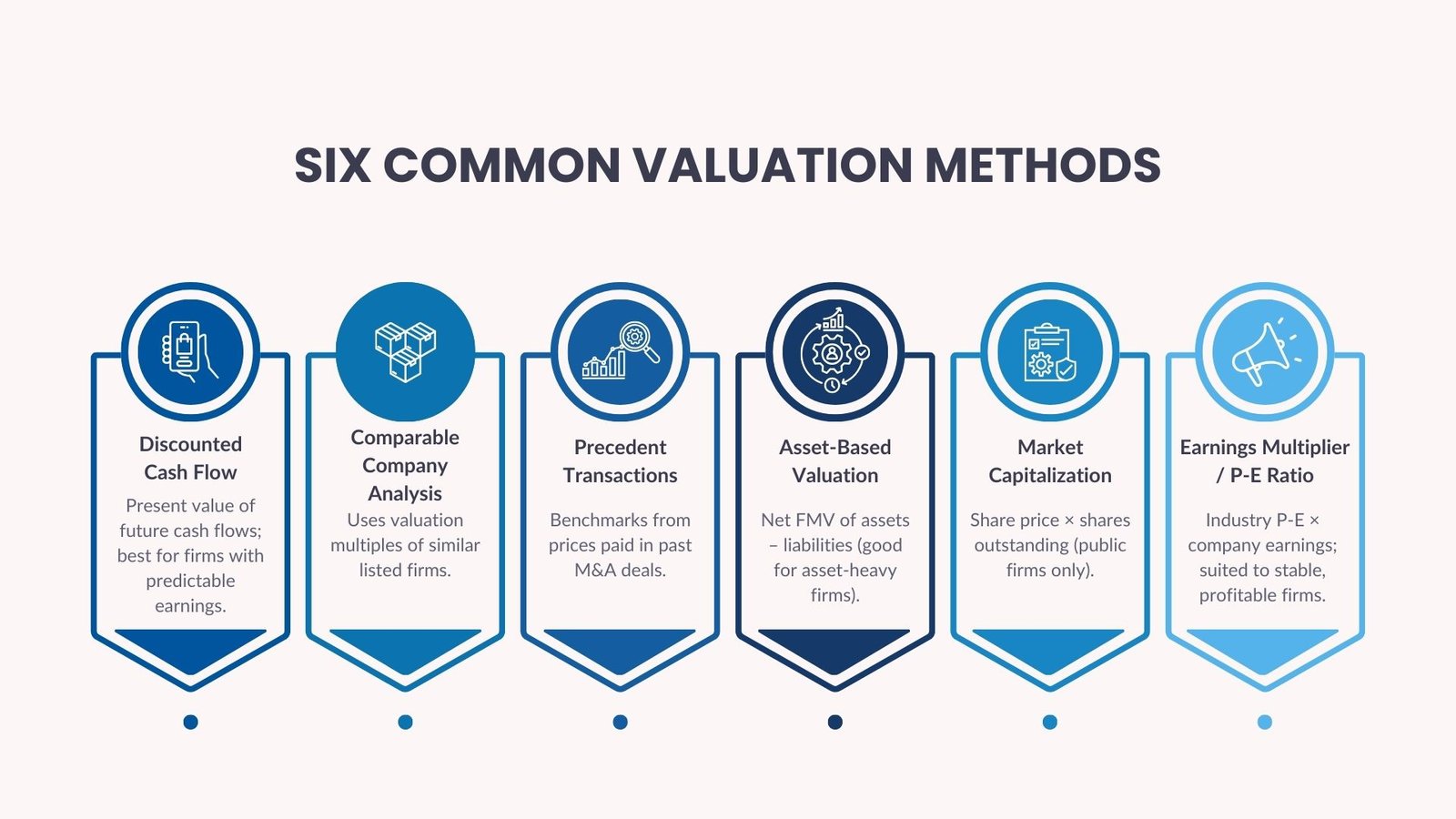

Valuation of a company is an imperative aspect when making a sound direction on mergers and acquisitions, investment analysis and financial reporting. Being a buyer, seller, or investor, or owning a business comes with the potential knowledge of how to evaluate the worth of a company to help make wiser deals and strategic thinking in the future. For instance, a guide to private company valuation top 3 methods Singapore can be useful for business owners and investors to understand the most practical approaches.

Valuation of a business does not have a single way; the best method to undertake depends on the situation and industry, the amount of data present, and the reason for the valuation. This article delves into six common valuation techniques, and decomposes them by discussing how each type of valuation comes about, situations in which to use it, and conclusions it can offer. These insights are particularly relevant in the context of company valuation Singapore for businesses, where choosing the right methodology directly impacts decision-making. Moreover, understanding valuation multiples methods in Singapore company valuation allows stakeholders to benchmark performance and assess fair value in line with industry standards.

Why Valuation Matters

Valuation of a business is at the centre of the economy. Investors utilize it in making the decisions regarding buying or selling stock. When buying the company, buyers evaluate the price of the company that is worth an acquisition. To raise capital, founders might have to engage in value estimation. When assessing financial records or tax commitments, tax specialists, auditors, and regulators use the value as well.

An accurate valuation will encourage transparency, equity of transactions and would be the standard of future development. In addition, when it comes to the application by private firms, where the valuation method depends on the relevant price of shares that do not trade publicly, then its selection is particularly important and sometimes more complicated because of limited financial disclosures.

Method 1: Discounted Cash Flow (DCF) Analysis

One of the most elaborate and prospective utilised methods of valuation is Discounted Cash Flow (DCF). It consists of extrapolating the future free cash flows of the company, a certain span (average time length is 5-10 years), the acquisition of these cash flows in a time line to present value with an apposite interest rate that commonly goes as the weighted average of the cost of capital (WACC).

DCF is a way of capturing the intrinsic value according to how the company can produce cash in the long-term perspective. It is also most useful in the situation where there are predictable and stable future cash flows in business. The inconsistent revenue may not be advisable on start ups and start up companies since there is a lot of uncertainty in making forecasts.

Although DCF is effective, it is very fragile because it depends on assumptions regarding revenue growth, margins, capital spending, and the discount rate. It does not require much variation in any of these to make the difference. Hence, it needs to be well versed with the business and market dynamics in order to develop a credible model.

Method 2: Comparable Company Analysis (CCA)

Comparable Company Analysis, or ‘comps, can be defined as using the financial ratios of similar publicly traded companies in order to gauge the value of the company under analysis.

The rationale of the approach is that businesses are also valued alike in an efficient market condition. Analysts compare multiples used by similar firms and use it with the financial figures of the target firm to determine a reasonable range of valuation.

CCA is popular since it is comparatively simple and market-based. However, it might not be easy to identify really comparable firms particularly when one has a unique business or one with a niche market. The differences in terms of size, profitability, growth and risk profile may need adjustments. The market sentiment is also measured in this method of valuation which can be over or under-valued depending on economic cycles.

Method 3: Precedent Transactions Analysis

In this method, one investigates the prices charged during previous sales of other businesses. Taking a look at the price of similar companies that have actually been bought through real mergers and acquisitions deals would give you an idea of what your company is worth in the same circumstances.

Past deals present actual, practical evidence of the market at work with the added rider of control premiums and synergies buyers might have known about. It comes in handy particularly in the case of acquisitions and sale of business.

But the approach is also associated with problems. There could be limited availability of data in transactions of privately owned businesses. Relevance can also be an issue because time gaps may have occurred between a similar deal and now, and the market or the industry may have changed a lot.

Method 4: Asset-Based Valuation

Asset-based valuation aims at the net worth of the physical assets of the company with the intangible resources as they are tough to value, minus the liabilities; leaving the equity value. This comes in handy when banks have assets-heavy businesses e.g. real estate, pipeline building or manufacturing.

There are two principal valuation variations, first is the book value which consists in the use of historical cost a/c details in the balance sheet and second is the liquidation value i.e. how much the assets would be valued in a compulsory sale.

Although the implementation of this approach is simple enough and based on the accounting data, it might not be representative of the earning potential of a business. It tends to bypass such intangible assets as brand equity, customer relations or intellectual property unless the asset is specifically valued. It is therefore not very appropriate with tech companies, service providers or small firms that have very little physical asset but high growth potential.

Method 5: Market Capitalization

The least complex and most direct valuation procedure in the case of a company that has been listed in the stock market is the market capitalization which is also known as market cap. It is obtained by multiplying current share price and total outstanding shares.

This measure is the opinion of business value by the market and is quite easily provided through financial sources. Market cap is a common point of further investigation and can even be utilized to pair like with unlike in order to compare companies of varying size.

Nevertheless, it only gives the value of equity and does not include the debt or other liabilities. It is also brought under the influence of the current market fluctuations, market mood and speculation and therefore, not as credible a term as an individual indicator of intrinsic value.

Method 6: Earnings Multiplier or Price/Earnings (P/E) Ratio

The price-earnings (P/E) ratio is the most popular and well known measurement tool. It is a ratio that gauges the correlation between a firm and the existing share value and the amount of earnings it is making per share (EPS). The P/E Ratio is based on the price that investors i.e. are ready to pay as per $1 of the earnings.

In order to determine the value of a business based on P/E ratio, analysts would employ a similar industry P/E multiple on the net income of the target company. Suppose, other similar companies are trading at 20x earnings and the target makes 10 million a year, then it could be valued at 200 million.

Such a technique finds value especially with the case of established, profitable companies. However, it is not as informative when the companies experience unstable earnings, negative profitability, or one-time irregular positive or negative profits. Moreover, the P/E ratio does not take account of future growth unless it is transformed to PEG ratio (P/E-to-growth).

Choosing the Right Valuation Method

The purpose of the valuation and the nature of the business would determine the choice of the best valuation method. In case of investment decisions, DCF and comparables would be combined and more effective. Asset-based or precedent transactions may be necessitated to provide tax or legal reporting. When making an M&A it is not uncommon to find different models being utilised to triangulate a defensible offer by the buyers.

A combination of several methods is also typical with a weighted average to generate a balanced picture and high levels of unreliable inputs. An example of that would be using a combination of DCF and CCA and making certain adjustments to take the industry differences into consideration which results in the more realistic outcomes.

The Role of Professional Judgment

Although valuation models rely on the formulas and measures, it is important to employ professional opinion. To value the shares of each of them, each approach should make careful assumptions not just in terms of growth but also in terms of risk, industry trends and also company specific issues. This is why it is usually the role of seasoned analysts, investment bankers, and corporate finance professionals to supervise the exercise so as to make it accurate and relevant.

It is an art as well as a science of valuation. Even the best technically sound models may give biased results when preconceptions enter into the picture or the reasoning misses the point in contexts. So, it is important to unite quantitative with qualitative consideration.

Final Thoughts

Knowledge in valuation of companies provides the stakeholders with the skills of making a superior financial, strategic and operating decision. Whether you are getting ready to go public as an IPO, raise equity financing, or just performing your due diligence of an acquisition property, the six fundamental valuations techniques will serve you well.

Although every tool has advantages and disadvantages, a thorough valuation of a company usually includes a few methods to take into consideration the complexity of of contemporary business. This will provide you with a rather sophisticated and complex idea of what a company is really worth- and how to capture that value.