Company MA Goodwill Valuation Certification

Goodwill Calculation and Impairment in M&A Deals

Introduction: Company MA Goodwill Valuation Certification

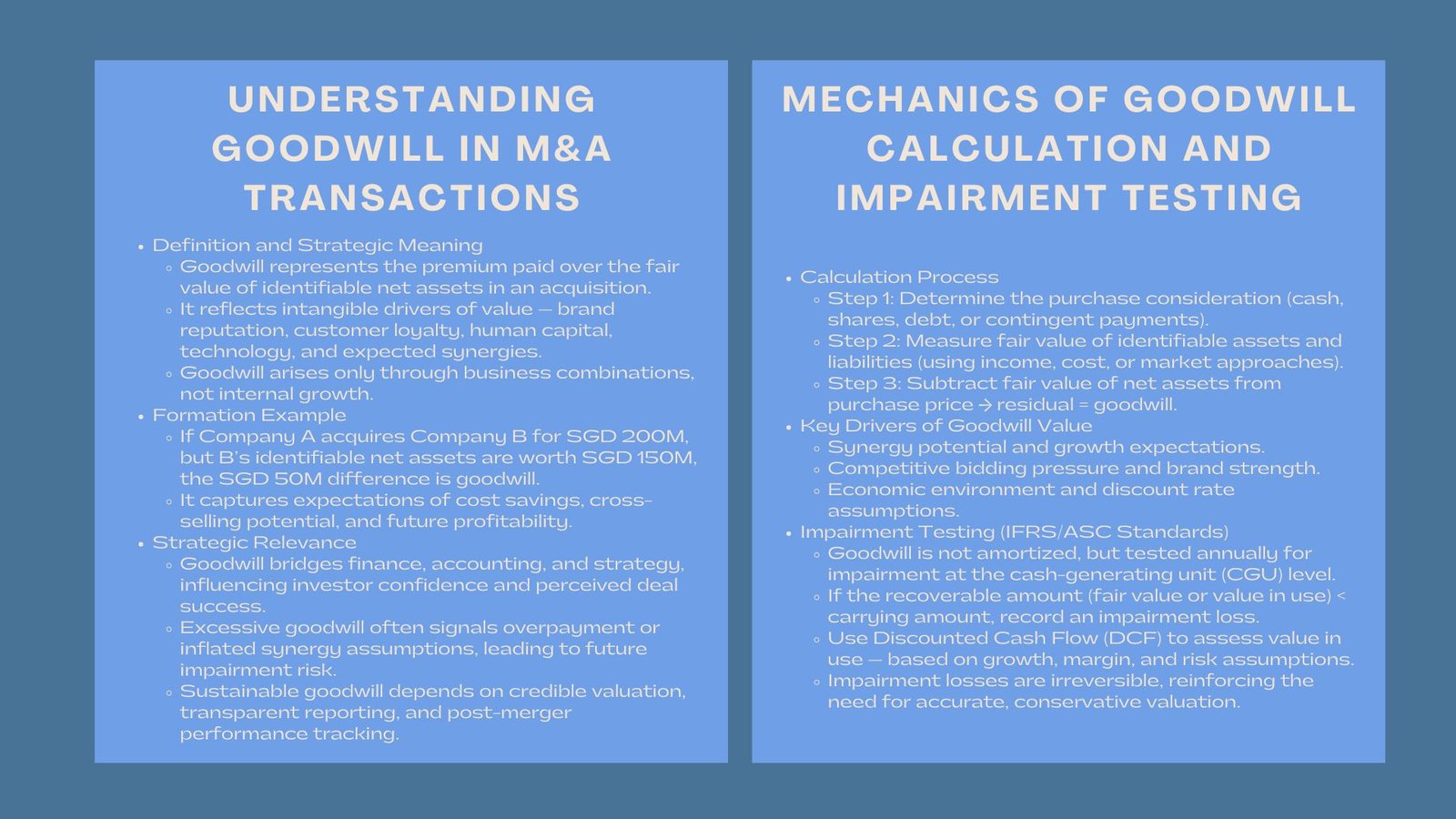

Acquisitions and mergers (M&A) are usually associated with payment of premium that is above the fair value of identifiable net assets of a target company. That value-added known as goodwill encompasses the expectations of the buyer about the synergies, brand equity, intellectual capital and future profitability that cannot be seen on the balance sheet. Goodwill is a product of strategic optimism as well as an accounting concept in financial accounting that needs to be measured meticulously and continuously assessed.

Valuation wise, goodwill is essential in either building sustainable value of an acquisition or over capitals the acquisition. It stands at the crossroad between accounting, corporate finance and strategic forecasting with an impact on the perception of investors and regulators of the success of an M&A transaction.

The paper will examine how goodwill is computed, managed and tested to impairment with reference to M&A transactions especially in the concepts related to the principles, issues, and the realities inherent in current financial reporting practices.

Understanding the Nature and Importance of Goodwill

What Goodwill Represents in an Acquisition

Goodwill is the part of the price of acquisition which cannot be directly ascribed to the identifiable assets or liabilities. It includes the aspects of brand reputation, customer loyalty, proprietary processes, management expertise, and future synergies. Goodwill is in a way an estimation of the confidence of the buyer in any subsequent returns that are beyond the current profile of the target which is reflected in the balance sheet.

Goodwill cannot be considered to be of an accounting nature unless one of the entities purchases another one, that is to say, goodwill does not come about as a result of an internal brand growth or natural growth. When recorded, it will be an intangible asset that will be tested on an annual basis on impairment other than amortized systematically. This not only renders goodwill a long lasting mirror of strategy anticipations, but a contributor to the existence of volatility in the future.

How Goodwill Arises During the M&A Process

Goodwill is created when fair value of identifiable net assets is lower than that of purchase price. Assume Company A buys Company B at SGD 200 million whereas Company B identifiable assets less liabilities are fair at SGD 150 million. The SGD 50M result is goodwill, and is included as intangible asset in the financial statement of the acquirer.

This number is not a real resource and it is an expectation of future savings-in the form of cost savings, cross selling possibilities, or market growth. Therefore, the goodwill is closely connected with the strategic sense of the acquisition.

The Strategic and Financial Implications

Goodwill is not just a bookkeeping accrual, but it affects perceptions of success in the deal, use of money, and disciplined management. Goodwill can be an indication of investor confidence in post-merger synergies but it can also create doubts on whether they are over paying or assuming high values.

This means that goodwill should be handled with caution in the companies as it has to be noted by a strong valuation analysis and continuous monitoring of performance indicators that substantiate its carrying value.

The Mechanics of Goodwill Calculation

Identifying and Measuring Fair Value

Goodwill calculation starts with finding out the fair value of all identifiable assets and liabilities of the target in order to be precise. Those that are considered in it are both tangible assets such as property, equipment, and stock, and intangible assets such as trademarks, patents, and customer relationships. Valuation process usually incorporates numerous approaches such as income approach to cash-generating assets, market comparables approach to real estates, and cost approaches to specialized machinery.

After ascertaining the fair values, they are combined together and deducting them to total purchase consideration. The amount left goes as the goodwill figure. This measure emphasizes the significance of sound valuation information and objective practices in order to avoid inflated goodwill recognition.

Factors Influencing the Goodwill Amount

The extent of goodwill in an acquisition is influenced by a number of variables which include:

- Future development expectations and synergy expectations of the buyer.

- Competitive bidding forces that increase the cost of purchase.

- Brand awareness and intellectual capital of the target in the market.

- The interest rate conditions and the economic environment of the time of the deal.

All of these factors are to be evaluated using a valuation prism so that the goodwill amount has underlying reasonable economic justification. Excessive goodwill could be brought about by too many positive synergies or too high brand premiums which could be impaired later on.

Linking Goodwill to Strategic Intent

The goodwill must be in line with the strategic goal of the acquirer. In case the acquisition is an expansionary measure to expand the geographic reach, increase its innovation power, or expand its customer networks, these motives must be captured in the composition of goodwill.

In the dynamic and cross-border situation of M&A in Singapore, valuation experts focus on transparency in the connection between goodwill and future performance indicators. It is through this alignment that investors and auditors can discern what strategic basis the goodwill balance is based on and that helps in enhancing accountability after the acquisition.

Goodwill Impairment Testing: Concept and Process

Why Impairment Testing Is Critical

The amortization of goodwill does not take place but the goodwill has to be impaired on an annual basis under IFRS and other standard accounting rules. This is necessary to make the carrying value of goodwill realistic and that of the current performance of the business. In case the recoverable amount of cash-generating unit (CGU) of goodwill is lower than its carrying amount, an impairment loss should be reported.

This mechanism ensures that investors are not subjected to inflated balance sheets and makes the management responsible in upholding the economic reasonability of good-will recorded.

Conducting an Impairment Test

The impairment testing of goodwill is by estimating the recoverable portion of the CGU on which goodwill has been charged. The recoverable amount is sum of fair value, and less costs of disposal, or the value in use.

The valuation practitioners normally use discounted cash flow (DCF) models in determining value in use. This involves making projections, which are cash flows in the future, the right rate of discount, and macro-economic trends. It is a quantitative and judgment-based process, which requires precision in assumptions of the growth, margins, and risk factors.

In case the recoverable amount is less than the carrying value, any excess is recognized as an impairment loss, which directly decreases net income during a reporting period. Since impairment losses under the IFRS cannot be eliminated, then conservative valuation and constant monitoring are the key.

Post-Merger Monitoring and Performance Review

The process of goodwill impairment is not over after annual test. The performance monitoring after the merger is crucial because it helps determine whether the strategic assumptions of goodwill are being fulfilled. In cases where the integration process fails to bring about synergies expected or in cases where the market conditions worsen, impairment might be inevitable.

Sudden impairment shocks that destroy investor confidence can be prevented by transparent reporting, early warning systems like monitoring customer retention rates, brand strength and operational efficiency.

Practical Application: Goodwill in M&A Financial Reporting

Integration of Accounting and Valuation Disciplines

Understanding goodwill calculation and impairment in M&A transactions requires bridging the technical disciplines of valuation and financial reporting. Valuation experts quantify the fair value of assets, while accountants ensure these valuations comply with reporting standards. The collaboration between these functions ensures that goodwill figures are both economically grounded and regulatory compliant.

The integration is especially important when it comes to cross-border M&A when the accounting frameworks, tax regulations, and disclosure requirements may make the process of goodwill reporting more complicated. The use of IFRS in Singapore is giving a steady base, though international investors would want transparency to be achieved beyond compliance.

The Role of Independent Valuation Specialists

As the measurement of goodwill and impairment is complicated, the involvement of independent valuation advisors is becoming more and more popular when it comes to supporting the process of financial audit and the management decision-making. They also have the responsibility of checking assumptions, model validation and third party assurance that goodwill balances can be justified.

Such third-party validation increases the level of credibility and minimizes the risk of conflicts with auditors or the regulator. It also enhances investor confidence particularly in areas where most of the enterprise value is carried by intangible assets like the brand and technology.

The Connection to Post-Merger Financial Health

Goodwill will be the indicator of the post-acquisition success. Constant impairment charges could mean that the acquisition has not performed as per expectations, whereas no increase in goodwill balances could be an indicator of efficient integration and long-term performance.

It is against this reason that analysts and investors tend to examine trends of goodwill in relation to different reporting periods. Firms that consistently uphold integrity at the goodwill level do not just portray good management of their finances, but also have a sense of discipline in implementing their strategies.

Strategic Insights for Managing Goodwill Value

Aligning Goodwill with Performance Metrics

In order to maintain goodwill value, the management should match the financial targets with the assumptions that had been used in the initial purchase price. These involve sustaining revenue growth, cost effectiveness and synergy realization objectives.

With frequent internal reviews, which are not mandatory impairment tests, the signs of value erosion are uncovered early. When the performance parameters have started to get out of track, then timely actions like restructuring or strategic realignment can eliminate the future impairment.

The Impact of Market and Economic Conditions

Goodwill recoverability can also be affected by external factors like inflation, changes in interest rates and competitive forces. An increase in discount rates decreases the present value of the future cash flows, making it more likely to get impaired.

Scenario-based impairment testing should be used by companies operating in volatile markets to determine how sensitive the company is to changes in economic conditions. This is a proactive strategy of strengthening the resilience and making it clear to the investors regarding the strength of goodwill valuation.

Integration of ESG and Brand Value into Goodwill

The contemporary valuation methods have been appreciating the fact that environmental, social and governance (ESG) factors and brand reputation have a bearing in regard to goodwill sustainability. Firms that have good ESG profiles and brands that are trusted are in a better position to sustain the value of goodwill during recessions in the market.

By incorporating ESG and brand evaluation into their post-merger appraisals, acquirers can have a holistic view of intangible value and fulfill corporate strategy with the expectations of stakeholders and the long-term preservation of goodwill. It is especially applicable in such regions as Singapore, where investors are concerned with the issue of responsible business and sustainable development.

The Broader Perspective: Goodwill in the Context of Value Creation

In today’s competitive landscape, goodwill has evolved from a static accounting figure to a dynamic indicator of strategic foresight and value creation. The concept of post-merger goodwill valuation and accounting underscores how intangible factors—culture, customer relationships, innovation capacity—define enterprise success far beyond the balance sheet.

Goodwill is an opportunity of growth to the acquirer, but it comes with responsibility. To preserve the said value, it must be executed diligently, reported openly, and with an always-present adjustment between the strategic goals and the financial results.

Conclusion

Goodwill is at the core of the contemporary valuation of M&A an unquantifiable expression of belief, prospect, and strategic aspirations. It takes more than technical precision to compute and operate, it involves an insight into what pushes real economic value once a transaction has been consummated.

Careful valuation methods, clear financial reporting and proactive monitoring can help companies to make sure that goodwill is always a reliable demonstration of their acquisition strategy and not a forerunner of future write-downs.

Simply, goodwill management that works makes post-acquisition accounting a history of value creation over time: strategic intent, financial discipline, corporate integrity have to meet to create long-term success.