Understanding Different Approaches to Business Valuation

Understanding Different Approaches to Business Valuation: Income, Market, and Asset-Based Methods

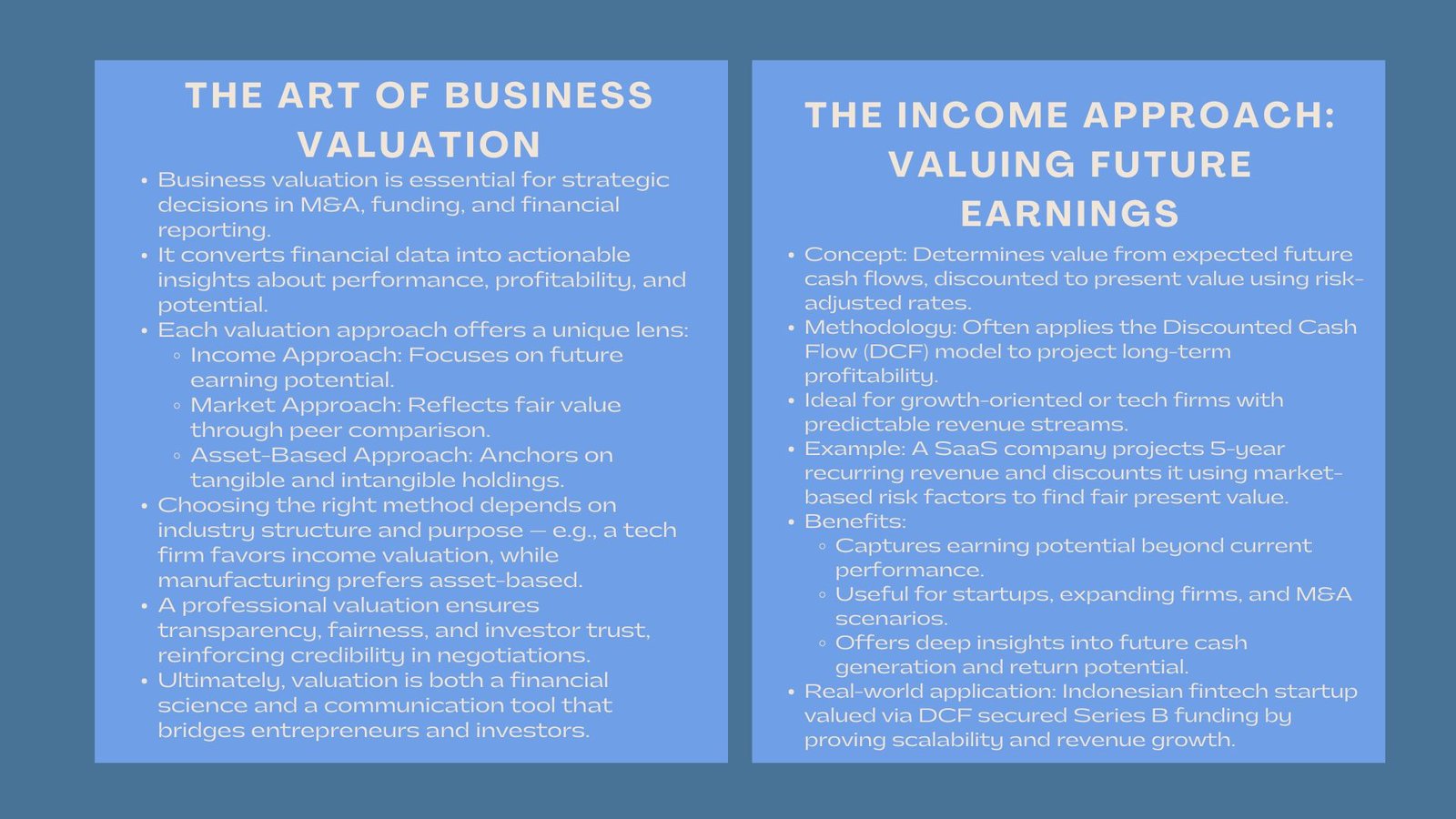

In the modern economy that operates on investments, business valuation is essential in influencing the decision making surrounding mergers, acquisitions, funding and strategic development. It is important to know how the value of a company is calculated whether the company is looking at the investors, a sale or about to do the financial reporting.

However, this is done not by all valuation techniques. The three approaches, income, market and asset-based, all provide a unique perspective through which the worth of a company may be measured. With a clear understanding of these frameworks, the business owners and financial experts are able to make more informed decisions, align their expectations to those of the investors, and justify their valuations with certainty.

1. The Art of Business Valuation.

1.1 The Importance of the Valuation Methods.

All businesses, both large and small across different industries should be able to make their value quantifiable. The valuation methods provide financial data that has been converted into actionable insights on the performance, profitability, and potential of a company.

As an illustration, a technology company that is expected to experience significant growth would experience a high valuation on an income basis, whereas a manufacturing company that has a lot of equipment would have a higher valuation under an asset-based perspective. It is important to understand which approach to use to get fairness and precision in financial negotiations by determining what approach is most appropriate in your business situation.

A professional business valuation approach not only clarifies a company’s position in the market but also supports transparency — a key factor in attracting investor trust.

1.2 Tailoring the Valuation Method to Business Type

Both industries are different in terms of financial structure and risks. As an example, service-based enterprises rely on intangible resources such as intellectual property and brand name, whereas more of an asset-based company, such as the logistics or construction, place more reliance on tangible assets.

As such, the appropriate and valuation methodology is based on the financial background, market standing, and the use of valuation such as raising capital, succession planning, and strategic restructuring.

2. The Income Approach: Earning Potential in the future.

2.1 Concept and Methodology

The income method measures a business by its capacity to produce cash in the future. It pays attention to the anticipated profitability, discounted to its current value. This approach presumes that the value of an organization is in the future of the revenue of the organization but not only current assets or past performance.

The most common methods in this approach are Discounted Cash Flow (DCF) method where the cash flows projected are discounted at the right rate that incorporates risk and opportunity cost.

To take an example, a software-as-a-service (SaaS) company with a recurring subscription-based revenue can determine the projections of revenues in the next five years using the DCF and a discounting factor to estimate the effects of uncertainty and inflation.

2.2 Benefits of the Income Approach.

This approach provides a visionary view, which is best suited to startups, growth-stage companies, or expanding companies. It compliments well with the industries where future performance exceeds current asset value.

In addition, it offers a subtle insight into the profitability, which is handy in mergers or analysis of investments where future potential cash flow forms the most important value-creating factor.

2.3 Real-World Application

As an example, an Indonesian fintech startup raised a Series B round was valued based on the DCF estimates using increasing volumes of user acquisition and digital transactions. The fact that the methodology was data-driven and linked to potential returns made the investors like it.

Professional discounted cash flow valuation services ensure such estimates remain grounded in realistic assumptions, combining financial modeling expertise with market insights.

3. The Market Approach: Benchmarking Against Peers

3.1 Concept and Principles

Business value is established in the market approach as it is compared with other related companies that are sold or publicly traded. It is based on actual market data acquisition multiples, earnings ratios or stock prices to determine the amount that a rational buyer would pay in prevailing market conditions.

This methodology presupposes that similar market activity is an indication of fair value. Valuation multiples, including Price-to-Earnings (P/E), Enterprise Value-to-EBITDA (EV/ EBITDA), or revenue multiples are usually used by analysts based on the industry practice.

3.2 When the Market Strategy is the most appropriate.

It works best in the active markets where the similar data are readily accessible. In reality, using technology or retail industry, there are many transactions that offer concrete grounds of comparison.

Conversely, such a strategy can be less effective in a niche or new industry where there is little deal information. However, it provides a sense of reality against over-optimistic valuations based on financial projections only.

3.3 Real-World Example

Take an example of a local logistics company and consider its value before a merger. The analysts consider the recent acquisitions of other logistics companies of the same nature in Southeast Asia based on EBITDA multiples and geographic expansions. This valuation will then be in tandem with market trends and negotiations will be fair and competitive.

This method is powerful as it is relatable, and investors know market comparables without issues leading to transparency and confidence.

4. The Asset-Based Approach: Net Assets Value.

4.1 Concept and Application

The asset based approach values the assets by deducting the liabilities with the total assets. This simple approach dwells on both tangible and intangible resources – both machinery and real estate as well as patents and goodwill.

It best applies to industries or companies that are liquidated and are asset-intensive and the worth of the holdings is more than the potential earnings. The adjustments usually put down fair market value as opposed to book value.

4.2 Advantages and Limitations

This approach will establish a tangible basis especially when there is financial distress or restructuring. But it is prone to underestimate firms that are intensive in terms of intellectual capital or brand equity.

To illustrate, a firm that has few physical resources yet good relationships with their clients might seem undervalued using this approach. On the other hand, this method would be quite applicable to a real estate developer because of the physical aspect of its assets.

4.3 Real-World Case

When a merger occurred between a Singapore based construction company, the valuation followed majorly an asset based scheme. Its portfolios of net assets were comprised of its equipment, land and projects. This gave a clear negotiating ground, striking a balance between equity partners and investors.

5. Selection of an Appropriate Approach to Valuation.

5.1 Purpose-Driven Selection

The correct approach will be based on the purpose of the valuation. Income and market methods prevail in the case of investor funding or M&A. The asset-based approach proves more applicable in order to be liquidated, restructured, or insured.

The blended model is often employed by professional valuers and entails a combination of various strategies to come up with a balanced estimate that captures the financial performance and the dynamics of the market.

5.2 Considerations that Determine the Method Choice.

The size of the company, availability of data, potential of the growth, and activity in the market are some of the main factors to be considered. For instance, startups tend to prefer income-based models whereas an established corporation may approach market benchmarks or asset-assessments.

Knowing these subtleties helps decision-makers to move the valuation results toward the strategic objectives.

6. The Changing Position of Technology to Business Value.

6.1 Data Intelligence and Artificial Intelligence.

The development of modern valuation is based more and more on complex analytics, automation, and real-time information. AI-based applications facilitate the process of valuation by pulling financial data, transaction history, and industry measures and provide even faster and more reliable information.

These online applications are able to not only improve accuracy but also minimize human bias, which provides uniformity in diverse valuation conditions.

6.2 The continuous valuation models

Periodical revaluation is necessary in unstable markets. Technology enables the businesses to have a live valuation dashboard that is updated with the change of the financial and market conditions. Such real-time method assists businesses in nimble choice in the process of negotiating funding or expansion.

Conclusion: Understanding Different Approaches to Business Valuation

The income, market and asset-based approaches are some of the key areas that one should understand when valuing a business. All approaches suggest a different point of view: the income approach focuses on the earning potential, the market approach focuses on the relative fairness, and the asset-based approach bases the value on the reality.

In this fast financial world in 2025, the combination of these methodologies guarantees full and valid valuation results. Companies which undertake professional valuation do not only make investments more credible to investors but also have a competitive edge in raising capital, mergers, or long-term planning.

With art and science of valuation, companies are able to turn financial information into strategy intelligence that forms the foundation of sustainable growth.