Key Documents and Data Needed for Accurate Business Valuation

Key Documents and Data Needed for Accurate Business Valuation

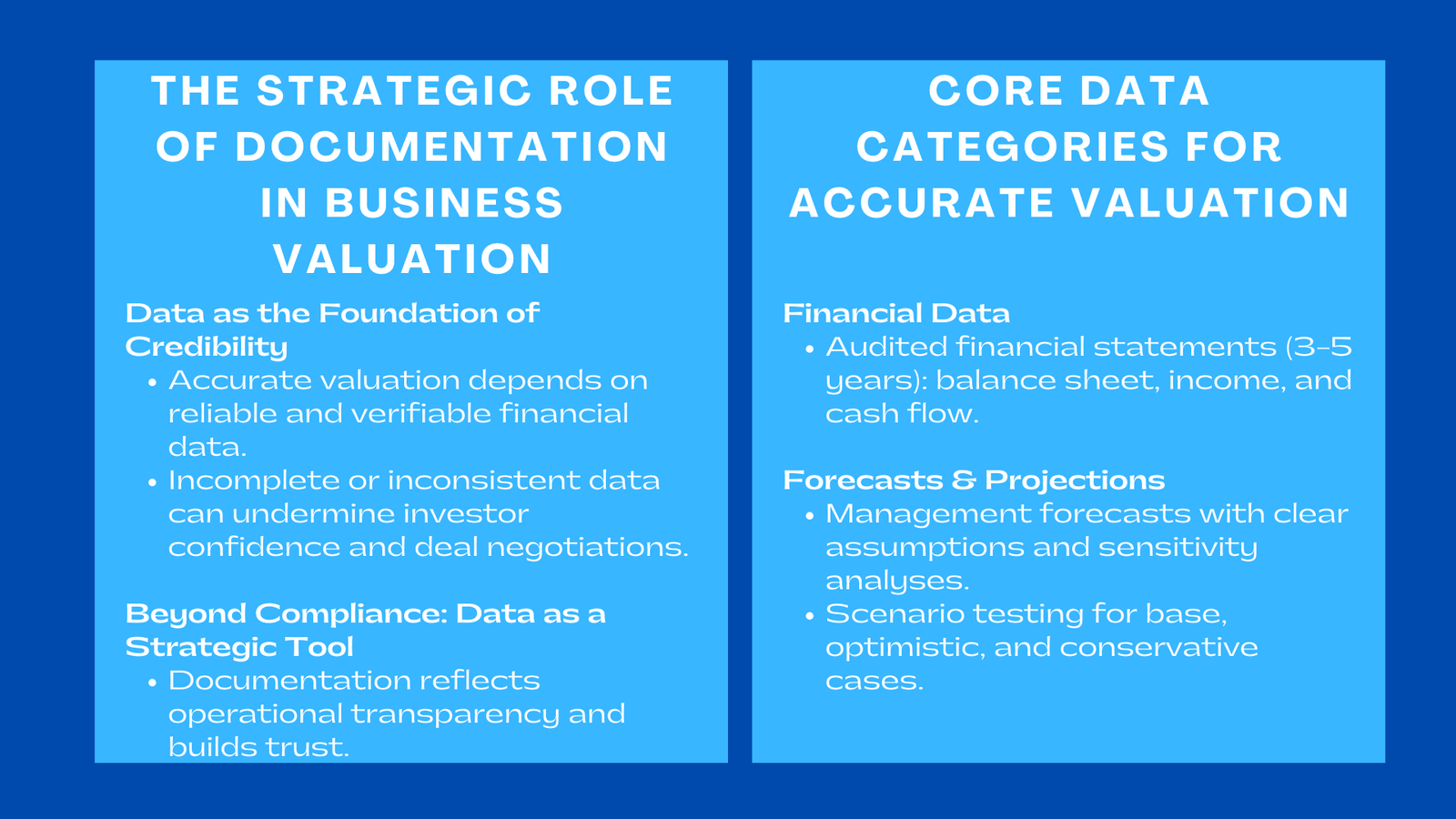

Accurate business valuation depends fundamentally on the quality, completeness, and reliability of the information used. No matter how sophisticated the valuation models or how experienced the analysts, the final figure will only be as credible as the data supporting it. For CFOs, investors, and valuation professionals, collecting the right documents and validating them thoroughly is the foundation of any sound valuation exercise.

In modern business, where intangible assets, market volatility, and cross-border transactions have become the norm, the data-gathering phase is not a simple administrative task — it is a strategic process. The purpose is not merely to compile financial statements and key documents required for business valuation but to uncover a 360-degree view of the company’s financial, operational, and strategic position. This ensures that the valuation reflects the company’s true economic potential rather than a distorted snapshot of its accounting records.

The Strategic Importance of Documentation in Valuation

Data as the Backbone of Financial Credibility

In valuation, data functions as the backbone of financial credibility. Investors and acquirers base their decisions on trust — trust that the reported earnings, cash flows, and assets accurately represent reality. Without proper documentation, that trust evaporates. A valuation supported by incomplete or inconsistent data risks undermining negotiations, delaying transactions, or even triggering regulatory scrutiny. In this context, business valuation services in Singapore, such as those offered by ValueTeam, play a crucial role in ensuring transparency, accuracy, and confidence throughout the valuation process.

CFOs must therefore treat documentation not as a compliance formality but as a core component of value creation. The ability to produce clean, well-organized, and verifiable data signals operational transparency, which directly enhances investor confidence. Furthermore, robust data sets allow analysts to perform deeper financial modeling, stress testing, and scenario planning — all critical to arriving at a fair and defensible valuation.

Beyond Numbers: Understanding the Business Context

While financial statements form the numerical core of a valuation, they cannot tell the entire story. Contextual information — about the company’s strategy, market position, risk profile, and growth prospects — transforms raw numbers into meaningful insights. CFOs and analysts must therefore integrate both quantitative and qualitative data into their valuation process.

A company with modest historical profits but high customer retention and proprietary technology might be worth far more than its recent financials suggest. Conversely, a business showing temporary profitability due to short-term cost cutting might have limited long-term value. Only by understanding the broader business context can financial data be interpreted correctly.

Step One: Collecting Core Financial Documentation

Historical Financial Statements as the Foundation

The cornerstone of any valuation is a company’s historical financial statements. These include the balance sheet, income statement, and cash flow statement, typically covering the last three to five years. The purpose of this data is to provide a clear view of revenue trends, cost structure, profitability, and capital efficiency over time.

However, CFOs must ensure that these statements are accurate, reconciled, and compliant with relevant accounting standards. Audited financial statements are ideal, as they add credibility and reduce the risk of material misstatements. If only management-prepared accounts are available, they should be accompanied by detailed supporting schedules — including notes on inventory, receivables, payables, and fixed assets — to aid in verification.

Supporting Schedules and Detailed Breakdowns

Beyond the primary financial statements, valuation professionals require supporting data that explains key line items. For instance, detailed revenue breakdowns by product, region, or customer segment provide insight into growth drivers and concentration risk. Similarly, schedules of operating expenses, depreciation policies, and financing terms reveal the sustainability of earnings.

Equally important are reconciliations between accounting profits and taxable income, as differences may indicate deferred tax liabilities or aggressive accounting treatments. These granular details allow analysts to normalize earnings — removing one-time or non-recurring events to arrive at a sustainable baseline for future projections.

Step Two: Assembling Forecasts and Management Projections

Forward-Looking Financial Plans

While historical data reflects where the business has been, forecasts reveal where it is heading. Management projections are indispensable for income-based valuations, such as discounted cash flow (DCF) analysis, where future cash flows form the basis of value. CFOs must prepare detailed forecasts of revenue, operating expenses, capital expenditures, and working capital requirements over a minimum of three to five years.

The reliability of these forecasts depends on the assumptions underpinning them. Growth rates, pricing strategies, cost controls, and macroeconomic conditions must all be explained transparently. Unrealistic or overly optimistic projections will compromise credibility. Therefore, best practice requires CFOs to document the rationale behind each assumption, referencing historical trends, industry benchmarks, and external market data.

Stress Testing and Sensitivity Analysis of Forecasts

To ensure that management forecasts are realistic, analysts often perform stress testing and sensitivity analysis. These tests evaluate how changes in key variables — such as sales growth, discount rates, or cost inflation — affect projected cash flows. CFOs should be prepared to provide alternative scenarios: a base case, an optimistic case, and a conservative case.

This approach not only strengthens the analytical integrity of the valuation but also demonstrates the company’s resilience under different market conditions. Investors appreciate transparency regarding downside risks as much as upside potential, and well-prepared forecasts show that management understands both.

Step Three: Gathering Operational and Commercial Data

Revenue, Customer, and Supplier Information

Operational data provides insight into the company’s competitive position and stability. Detailed customer and supplier lists — including the proportion of sales or purchases attributable to top clients and vendors — help assess concentration risk. A company dependent on one or two major customers faces higher valuation risk than one with a diversified base.

In addition, information about contracts, pricing terms, and recurring revenue agreements allows analysts to estimate predictability of cash flows. Businesses with long-term contracts or subscription-based models tend to receive higher valuation multiples due to their stable income streams.

Operational Efficiency and Performance Metrics

Operational data extends beyond revenues and costs to include performance metrics that drive profitability. For manufacturing firms, this may involve production yields, equipment utilization rates, and inventory turnover. For service-oriented or technology firms, key indicators include employee productivity, customer acquisition cost, and churn rate.

Collecting and analyzing these metrics helps the valuation team link operational efficiency with financial outcomes. It also highlights opportunities for improvement that can directly enhance future value.

Step Four: Reviewing Legal, Regulatory, and Tax Documentation

Legal Structure and Ownership Documents

Legal clarity is essential in valuation. CFOs must provide documents verifying the company’s ownership structure, shareholding agreements, and subsidiary relationships. These documents ensure that the valuation correctly reflects the entity being valued and that all ownership rights and obligations are accounted for.

In cases involving joint ventures or minority interests, shareholder agreements must be reviewed for clauses related to voting rights, profit distribution, and buy-sell provisions. These legal elements can significantly impact both control premiums and minority discounts applied in valuation models.

Licenses, Contracts, and Compliance Records

Analysts also require evidence that the company operates within legal and regulatory frameworks. Business licenses, intellectual property registrations, environmental permits, and compliance certifications should be readily available. Any pending litigation, disputes, or contractual contingencies must be disclosed, as these could materially affect value.

Similarly, major contracts — such as supplier agreements, distribution deals, or leases — should be reviewed for duration, termination clauses, and renewal terms. Long-term, transferable contracts add to value, while restrictive or expiring agreements may reduce it.

Tax Records and Liabilities

Tax compliance is another vital component. CFOs should provide recent tax filings, assessments, and correspondence with tax authorities. Deferred tax assets and liabilities must be identified, as they can materially affect net asset value. Transparency regarding historical audits or disputes helps mitigate investor concerns and prevents surprises during due diligence.

Step Five: Compiling Information on Intangible Assets

Intellectual Property and Proprietary Technology

In the modern economy, intangible assets often represent the majority of enterprise value. CFOs should prepare a comprehensive inventory of intangible assets, including patents, trademarks, copyrights, trade secrets, proprietary software, and data rights. Documentation should include registration details, renewal schedules, and ownership certificates.

Valuation professionals will use this information to apply methods such as the relief-from-royalty or excess earnings approach, quantifying the economic benefit derived from these assets. Having complete, well-documented intellectual property records enhances valuation credibility and strengthens the company’s negotiating position in any transaction.

Brand, Customer Relationships, and Human Capital

Beyond legally protected assets, brand value, customer loyalty, and human capital are significant intangible drivers. CFOs should provide evidence of brand equity through market surveys, customer satisfaction scores, and marketing performance reports. Information on employee retention rates, incentive structures, and training programs reflects organizational strength and sustainability.

By quantifying these softer elements, analysts can more accurately reflect the full value of the enterprise, rather than relying solely on tangible assets or earnings multiples.

Step Six: Market and Industry Data

Macroeconomic and Sector Context

Every valuation must be grounded in the economic and industry environment in which the company operates. CFOs should compile relevant market research, industry reports, and economic forecasts that contextualize business performance. Understanding industry growth rates, technological disruptions, and competitive dynamics allows analysts to calibrate assumptions realistically.

For example, a manufacturing firm in a declining industry will be valued differently from a tech startup in a high-growth sector, even if their historical earnings are similar. Providing credible third-party data strengthens the valuation model and aligns it with market realities.

Comparable Company and Transaction Data

For market-based valuation approaches, access to comparable company data is indispensable. CFOs should provide information on competitors, including revenue, profitability, and recent acquisition multiples. If available, internal benchmarking against peer performance helps analysts gauge the company’s relative position.

Where public data is unavailable, CFOs may work with valuation consultants to source transaction databases or industry publications. The goal is to ensure that valuation multiples are derived from relevant, current, and comparable cases.

Step Seven: Non-Financial and Governance Data

Corporate Governance and Management Quality

Investors increasingly view governance quality as a key determinant of value. CFOs should provide documentation on board composition, decision-making processes, internal controls, and audit policies. Strong governance reduces perceived risk and enhances investor confidence, particularly in cross-border or private equity transactions.

Environmental, Social, and Governance (ESG) Factors

In recent years, ESG considerations have become integral to valuation. Companies demonstrating responsible environmental practices, ethical labor standards, and transparent reporting tend to command valuation premiums. Providing sustainability reports, ESG ratings, and compliance documentation signals long-term resilience and stakeholder alignment.

Step Eight: Ensuring Data Integrity and Consistency

Verification and Cross-Checking

Data integrity is paramount. CFOs should ensure that all figures reconcile across financial statements, management accounts, and forecasts. Inconsistencies between datasets — such as mismatched revenue numbers or cash flow figures — immediately raise red flags during due diligence.

Independent verification, such as audits or third-party confirmations, enhances confidence. When discrepancies exist, providing clear reconciliations and explanations demonstrates professionalism and control.

Version Control and Accessibility

Valuation projects often involve multiple stakeholders — auditors, consultants, bankers, and investors. Establishing centralized data rooms or secure digital platforms for document sharing ensures consistency and accessibility. Version control mechanisms prevent confusion and help maintain a single source of truth throughout the process.

Conclusion to Key Documents and Data Needed for Accurate Business Valuation

Accurate business valuation is impossible without accurate data. Every financial projection, assumption, and conclusion rests on the integrity of the underlying documentation. For CFOs, mastering the data collection and validation process is both a technical and strategic responsibility.

From audited financial statements and tax records to forecasts, contracts, and intangible asset inventories, each document contributes to the story of a company’s value. Equally important is the contextual data — essential data for accurate company valuation market research, governance reports, and ESG disclosures — that situates the business within its competitive landscape.

A company that maintains transparent, well-organized, and verifiable data not only achieves more accurate valuations but also builds lasting credibility with investors and partners. In a world where financial transparency equals trust, the meticulous management of valuation data is no longer optional — it is a hallmark of financial excellence and strategic foresight.