Why Overvaluing Your Business Can Harm Your Fundraising Efforts

Why Overvaluing Your Business Can Harm Your Fundraising Efforts

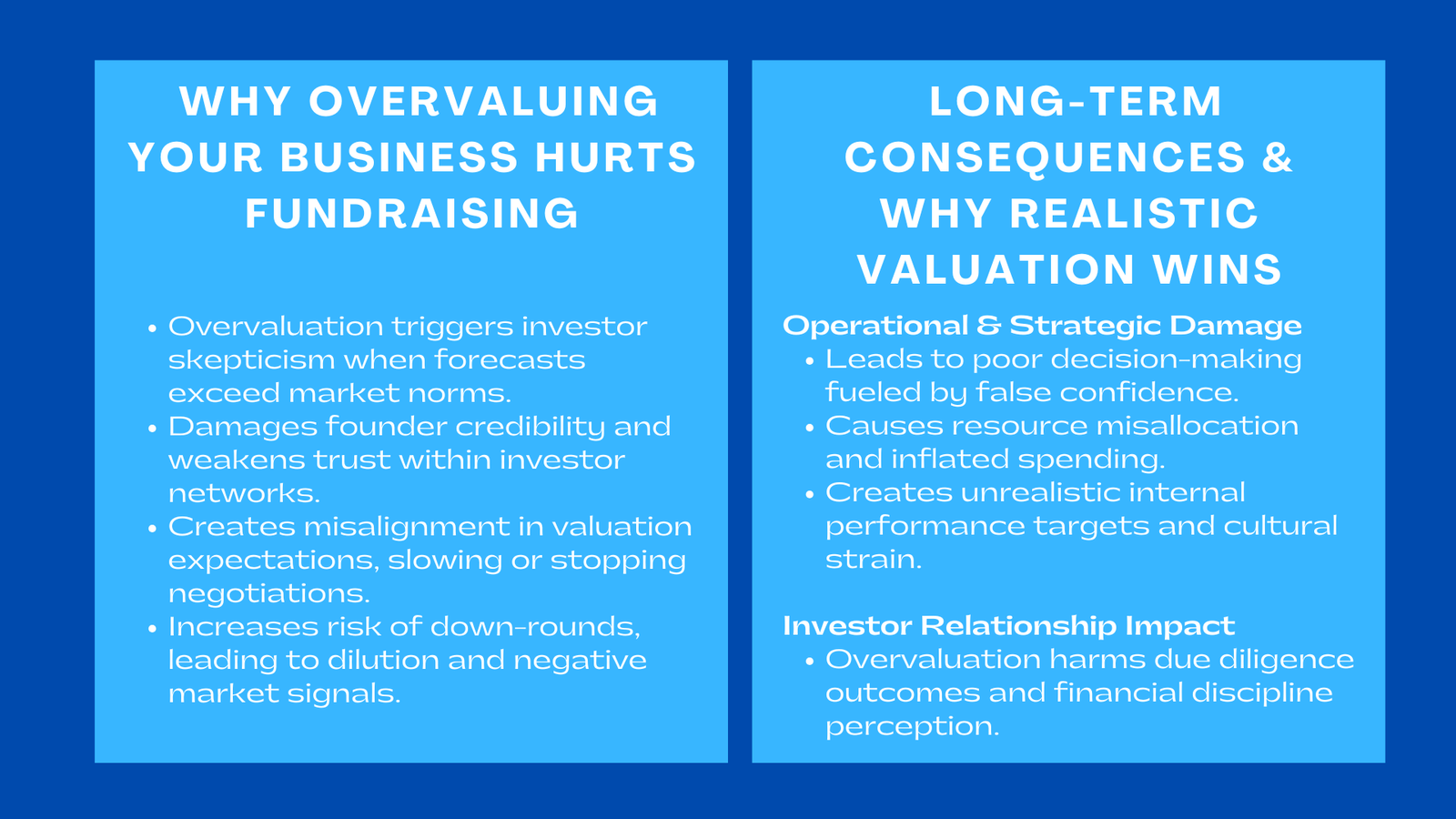

In the current competitive investment environment, entrepreneurs are tempted to give the most positive view of the worth of their company. A premium price appears desirable: it implies prestige, promises of future, and an impression of power to investors. However, overvaluation is among the most harmful errors that can be made by the founder – particularly during raising of capital, especially for those seeking guidance on how to value fundraising Singapore with professional guidance.

The paper only covers one area, which is: why the overestimation of your business is directly detrimental to your fundraising, which results in distrust among investors, negotiation failure, and financial long-term ramifications. Knowledge on why this occurs enables founders to locate their businesses in better places, position their expectations well, and raise funds under conditions that can sustain them in the long-run.

1. Exaggeration Stops the Bad Cheque Bouncing.

1.1 Investor Cynicism of Overstated Figures.

Shareholders are used to employment of hundreds of business proposals annually. Investors are very quick to be suspicious when financial forecasts are too rosy or when the valuations are way above market standards. The reason behind this skepticism is that the experienced investors are aware of the industry average multiples, risk, and growth curve.

An example of this is a consumer app startup that forecasts a 300 percent growth per year with no historical traction that might seem like it is disconnected with the reality in the market. Inconsistencies are noticed by the investors and even good sides of the business become doubted.Because startup valuation accuracy is a central expectation in capital markets, overvaluation immediately signals inexperience or poor financial discipline.

1.2 Damage to Founder Reputation

Reputational trust is currency in the field of fundraising. The founders who are always doing over-valuations are prone to jeopardizing their relationship with the venture capitalists, angel investors, and strategic partners. Investment networks tend to be tight and when the numbers cannot be matched with the operational reality, the financial numbers spread very quickly.

When a founder kills relationships at the start by making unrealistic valuations, subsequent rounds will become much more difficult or even impossible to finance.

2. Unrealistic Valuations translate to the failure of negotiations.

2.1 Lack of alignment between the expectations of the Founders and Investors.

Valuation is what defines the extent of equity to be given to an investor by way of funding. Increased valuation will see founders giving up less equity. Investors on the other hand assess the same financials and market conditions and can differ drastically with the suggested figure.

Such a misalignment slows down or kills the negotiation process. In the event that both sides are still interested, the conflict brings about delays, friction and mistrust.

An example is a health-tech start up with a requested valuation of $5 million at a seed round with no revenues who encountered pushback on valuation by investors. The negotiations took months to stall down to nothing, not due to the non-existence of a business, but due to the absolute valuation to avoid constructive negotiations.

2.2 NIU More Down-Round Risk.

Although a founder may manage to raise capital at a high valuation, the business will find it hard to keep that valuation in subsequent rounds. In cases where the performance is lower than expected, the subsequent financing round can be at a lower valuation which is called a down-round.

Down-rounds, which are the dilution of a founder, discourage their teams, and are indicative to the market that the company is financially unstable. Emotional cost may be also debilitating, since teams tend to tie valuation with perceived success.

3. Overvaluation Distorts The Strategic Decision-Making.

3.1 The feeling of strength and momentum is a false one driving individuals toward an unforeseen outcome.

When founders perceive their company to be more valuable than it is, they have a tendency to make decisions, which are made on perceived value and not operational reality. This can be excessive spending, early growth or misestimation of cash-flow needs.

A startup stemming out of retail technology enhanced by a high valuation in a preliminary angel round spread out aggressively into new markets. In cases where sales have not performed properly the business was hit by liquidity problems, which could have been prevented in case of more conservative, evidence-based valuation.

3.2 Misallocation of Resources

Instead of concentrating on the basic elements, founders might focus on those activities that will impress the investor, like the new feature, the upgrades of the brand, market entry strategies, etc. The distortion of the value causes risky behavior indirectly since the overvalued figure gives misleading expectations on the upcoming revenue and cash flow.

This outcome translates to operational inefficiency, non-cohesive priorities, and there is a high probability of burnout in the organization.

4. The Overvaluation has Effects in the Long-term relationships between investors.

4.1 Future Negotiations Are More Problematic.

Investors monitor performance in terms of valuation. Investors are wary of subsequent funding when the companies are unable to achieve milestones associated with high valuations. They might seek additional equity, change terms to their disadvantage or reinvestment may not be done at all.

To illustrate, a logistics company worth 20 million dollars could not sustain its valuation as the expansion expenses were increasing at a faster rate than expected. The deal was much less founder-friendly as investors in subsequent rounds asked to have liquidation preferences and protective features.

4.2 Loss of Bargaining Power

Such overpricing will undermine the negotiations of the founder. Whenever the numbers do not reflect the business reality in operation, investors have leverage and they can demand strict conditions to put at bay the perceived risk. The founders who are pressurized to take terms that are not favorable, might lose the strategic control of their company.

Contrarily, a realistic valuation promotes good negotiating relationship and builds confidence with one another.

5. The Overvaluation undermines Investor Faith in Financial Discipline.

5.1 Red Flags to Financial Modelling.

Advanced investors scrutinize cash-flow projections, mathematical models, and assumptions of growth with accuracy. When the assumptions of the projections are based on unrealistic growth rates or costs, the valuation is shattered to pieces.

The fact that there are inflated numbers indicates financial illiteracy, lack of analytical ability, and judgment as a leader of the founder. In a fundraising environment governed by investor fundraising expectations, financial discipline is non-negotiable.

5.2 Falsehoods in the Due Diligence.

Oversight Due diligence reveals over-valuation in a short time. Confidence wanes when the investors compare the internal records with the valuation model and observe that the model is skewed to certain areas, like low expenses or inflated market share. Other investors pull out during the process and they end up wasting weeks or months of negotiations.

An inflated valuation to a company entering due diligence is seldom a company that is going to walk out of the process with a deal done.

6. Overvaluation Damages Team and Operational Culture.

6.1 This is because of unrealistic internal performance targets.

Internal goals are frequently motivated by valuation. Employees might take excessively ambitious goals when they think that the company is valuable more than it should be based on fundamentals. Inability to achieve these targets impacts performance sustainability, culture and morale.

6.2 Misaligned Incentives

The teams can seek to be able to grow anyhow in a bid to justify the valuation numbers as opposed to long-term business operations. The trend may promote temporary decision-making, money-making strategies or premature recruitment, all of which create stress in operations.

7. The Rationale Why Realistic Valuation Is a Strategic Advantage.

7.1 Builds Trust With Investors

Transparency, discipline and self-awareness is shown by a realistic valuation. To the investors, this is a message of good leadership. Grounded business valuation enables businesses to raise funds, negotiate good terms and find good quality investors.

7.2 Safeguards Long-term equity value.

Sound valuation tightens the limit on undue equity dilution of the founders and keeps the expectations of the investors in touch with the long-term business potentials. A sustainable valuation puts the business in a position to succeed in the future without course corrections.

Conclusion to Why Overvaluing Your Business Can Harm Your Fundraising Efforts

Valuing your business too high can appear helpful in the short-run, but in the long-run, it puts in place long-term challenges that hamper the fundraising process. The loss of credibility to the breakage of negotiations, misalignment of strategies, and the down-rounds in the future are the possible outcomes. An authentic, supported valuation is better at enhancing investor confidence and also empowers the sustainability of growth and access to long-term capital.

In a world in which discipline, transparency, and proven assumptions are valued, founders who adopt proper valuation habits have a much greater probability of getting money and establishing long-term success.