Accredited Private Public Company Valuation

Private vs Public Company Valuation: What Investors Should Know

Guide on Accredited Private Public Company Valuation

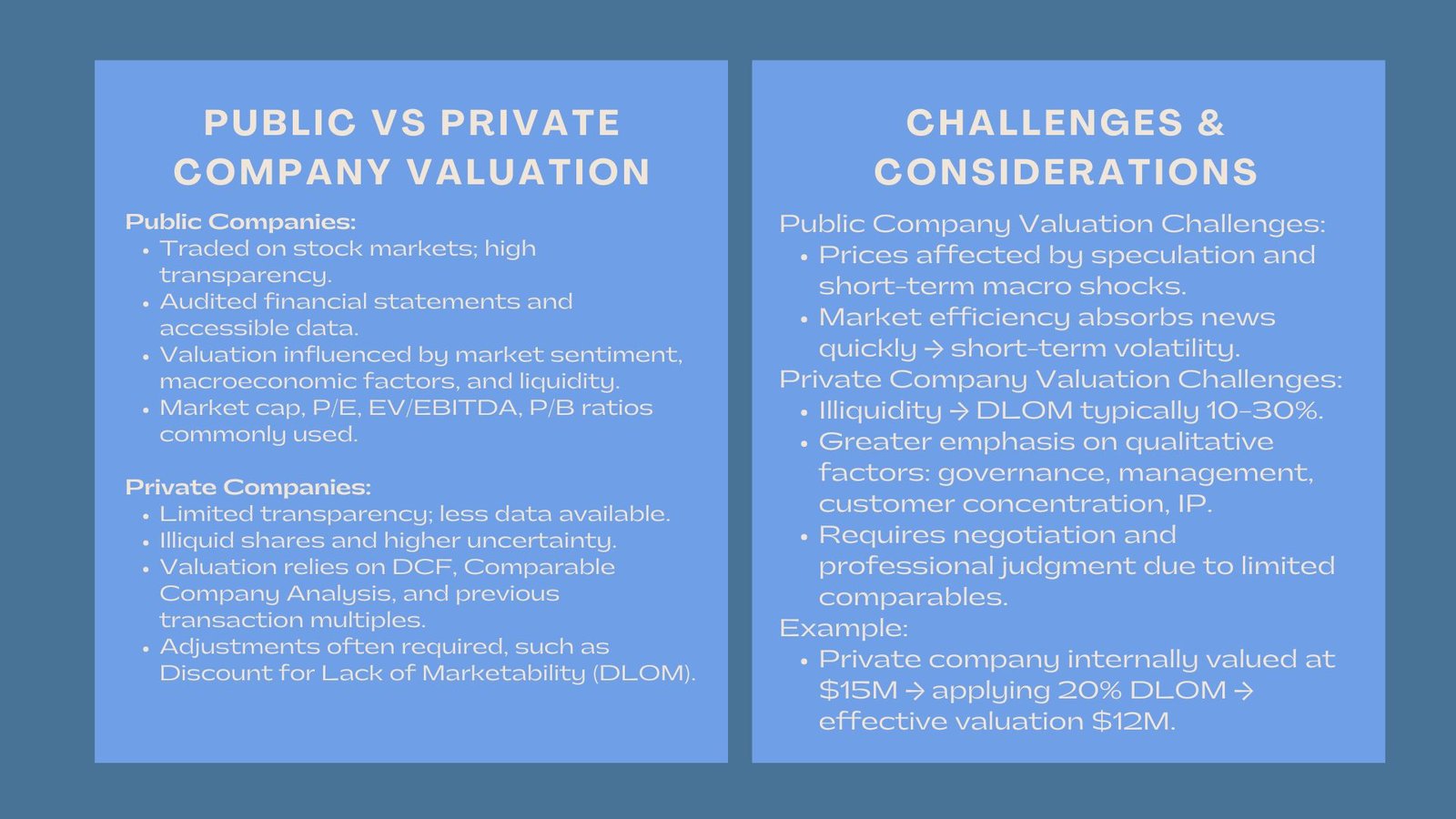

The critical aspect of the sound investment is valuing companies, and it, nevertheless, is determined differently in private and public entities. The valuations of publicly traded companies are part of a clear market where the financial statements are available, investors are able to contribute to these firms and the data available is readily accessible. As a contrast, private companies are run in a less transparent environment where there is limited information, lack of liquidity, and increased uncertainty. Public companies operate in transparent markets, with audited financial statements, open investor participation, and easily accessible data. In contrast, private companies operate in a less transparent environment, with limited information, lower liquidity, and higher uncertainty.

Knowledge of these differences is vital to the investor. The valuation methodology has an influence on the price of deals and expectation of returns as well as portfolio risk. This paper discusses the major differences, procedures, and hurdles in the valuation of private and public corporations- and what every investor ought to be aware of when undertaking capital placement judgments.

This article provides an in-depth look at how public and private companies are valued, the challenges and considerations for each, and practical strategies for investors to make informed decisions.

Public Company Valuation: Data Transparency and Market Pricing

Public firms are quoted on stock markets and have to publish audited financial reports, management statements and stock market reports. Consequently, their valuations depend on the immediate investor sentiment, industry trends and the economy.

Market capitalization as the sum of share price and outstanding shares is the most widespread technique of company valuation among publicly traded companies. Valuation ratios of Price-to-Earnings (P/E), EV/EBITDA, and Price-to-Book (P/B), are also applied by the investors to make comparisons between the performance of peers.

Market efficiency also makes sure that any information is absorbed into stock prices as fast as possible- it also implies that valuations are fragile because of speculation in the market or macroeconomic shocks.

Public company valuations are influenced by market sentiment, macroeconomic factors, and investor behavior. Market efficiency ensures that news, earnings reports, and other financial disclosures are quickly incorporated into stock prices. While this efficiency provides transparency, it also exposes valuations to short-term fluctuations due to speculation, macroeconomic shocks, and market psychology.

Example: Consider a fast-growing tech firm trading at a P/E of 35 while the industry average is 25. This premium may indicate strong market confidence in growth, but it also signals potential overvaluation if the firm does not achieve projected earnings. Investors must interpret such metrics in the context of the broader industry and economic trends.

Moreover, liquidity is an important feature of public company investment. Shares can typically be bought or sold quickly, providing investors with flexibility and an ability to react to market movements. This contrasts sharply with private company investments, where liquidity is limited.

Private Company Valuation: Limited Data and Subjective Assumptions

In contrast to the work of the government, those of how to value private companies for investment decisions Singapore do not have a publicly traded share and no disclosed requirements. This is an opaque situation that poses a challenge to valuation. Financial statements that are availed by the company, management interviews and benchmarking in the industry are usually the areas that are relied upon by analysts.

There are three major methods that prevail in the valuation of the company privately:

Discounted Cash Flow (DCF): it estimates future cash flows of the project and discounts such with a suitable risk-adjusted discount.

Comparable Company Analysis (CCA): involves the application of valuation multiples of similar, but not large, and liquid, public companies.

Previous Transactions: the review of the prices of similar private acquisitions.

One unique consideration in private company valuation is liquidity risk, as shares cannot be sold easily in an open market. To account for this, investors apply a Discount for Lack of Marketability (DLOM), typically ranging from 10–30%, which reflects the difficulty of selling shares before an exit event such as a sale or IPO.

Example: A private company may be internally valued at $15 million based on cash flows and projected growth. Applying a 20% DLOM reduces the effective valuation to $12 million, accounting for the illiquidity and potential difficulty in exiting the investment.

Private company valuation also requires a deeper focus on qualitative factors. Governance structures, management quality, customer concentration, and intellectual property can significantly impact the perceived value and risk profile. Investors must carefully analyze these factors alongside financial metrics to form a complete picture.

Bridging the Valuation Gap

Risk perception is one of the biggest issues amid comparisons of the private vs public company valuation for investors Singapore worth. This is because transparency, scalability and liquidity tend to boost the valuation of the public companies. Privately owned firms particularly those at an immature stage are generally more risky and demand higher returns potential to attract investors.

The highly advanced models applied by private equity firms are aimed at diluting the multiples in the public to reflect the variation of governance, scale and exit periods of investors. Valuation is also linked because the same valuation gap is reduced because of maturing of the private companies or because of the initiation of an initial offering of the company (IPO) where the financial reporting models match the expectations of the investors.

Example: A startup with an EV/EBITDA multiple of 6x compared to 10x for public peers may appear undervalued. Post-IPO, with increased transparency, marketable shares, and audited reporting, the multiple could rise to align with public industry standards.

Bridging the valuation gap also involves understanding risk-adjusted returns. Private investors often target higher internal rates of return (IRR) to compensate for illiquidity, longer investment periods, and operational uncertainty. Recognizing these differences allows investors to make informed decisions and identify opportunities that may not be apparent in public markets.

Conclusion

The art of the distinction of private and public company valuation will enable the investor to make risk oriented judgments. The market-driven and dynamic value of a public company is compared with the assumptions, negotiation, and professional judgment based on the valuation of a private company.

It is important to note that investors should only understand that in a publicly traded market they have access to liquidity and transparency but with a private investment they are likely to get superior returns though with a higher level of risk and less instant price sensitivity.

Finally, the greatest investors are taught to strike a balance between the two worlds: public market discipline and the opportunity of a private market analysis. By grasping these valuation differences, investors will be able to recognize value absent in others- and lock in long-term returns in any market and in the private sector.

Ultimately, the most successful investors are those who integrate financial metrics, qualitative insights, and market context to make data-driven decisions while accounting for risk and liquidity considerations. Mastery of both private and public valuation techniques enables investors to capture opportunities that others may overlook, ensuring sustainable, long-term growth in any investment environment.