Comparing Valuation Approaches Which One is Best for Startups vs Established Companies

Comparing Valuation Approaches: Which One is Best for Startups vs Established Companies?

Business valuation serves as a crucial bridge between financial data and strategic decision-making. Whether for investment purposes, mergers and acquisitions, fundraising, or internal planning, the process of determining a company’s fair value requires both analytical discipline and contextual understanding. However, not all businesses are created equal. The valuation method suitable for a newly launched technology startup differs substantially from that used for a mature, revenue-stable corporation.

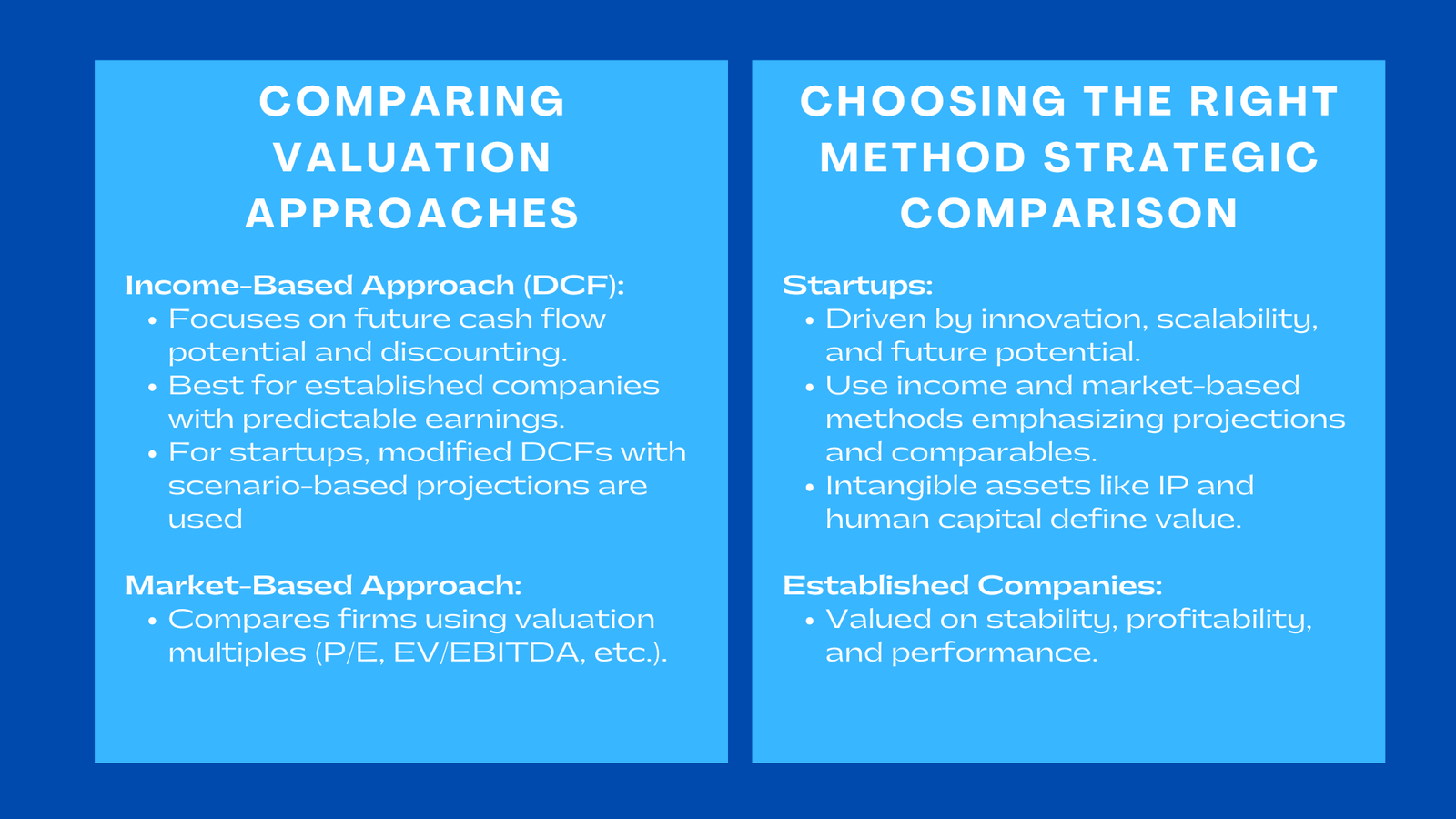

Understanding these distinctions is essential for analysts, investors, and entrepreneurs who wish to derive accurate, defensible, and meaningful valuations. Each valuation approach—whether income-based, market-based, or asset-based—carries its own assumptions, strengths, and limitations. This article explores best business valuation methods for startups and established companies, how these methods compare in practice and which are most appropriate depending on a company’s stage of development and operational maturity.

Understanding the Foundation of Business Valuation

Valuation as a Strategic Tool, Not Just a Financial Exercise

Valuation is often misunderstood as a purely numerical process. In reality, it is a strategic exercise that combines financial modeling, market intelligence, and managerial foresight. The value of a business does not exist in isolation—it reflects its future potential, competitive positioning, and the external market conditions in which it operates. In this context, business valuation Singapore ValueTeam provides comprehensive insights that align financial analysis with strategic decision-making.

For startups, the emphasis of valuation is on potential growth, innovation capacity, and scalability. These companies often operate with minimal historical data, meaning projections and assumptions about future performance take precedence. Established companies, by contrast, are assessed on demonstrated financial strength, consistent profitability, and proven operational efficiency. Hence, the choice of valuation method depends largely on whether the company’s value is rooted in what it will achieve or in what it has achieved.

Why One Approach Cannot Fit All

There is no universal valuation model that applies equally to every company. The diversity of business structures, industries, and financial histories makes it impossible to rely on a single standardized framework. For instance, a market-based valuation might work well for a publicly traded company with many comparables but will fail for a niche startup with a unique business model. Similarly, asset-based valuations may underestimate technology-driven firms where intangible assets—like patents or brand value—form the core of enterprise worth.

Recognizing this complexity is the first step in developing an adaptable, context-sensitive approach to business valuation.

The Major Valuation Approaches Explained

The Income-Based Approach: Capturing Future Potential

The income-based valuation method, particularly the Discounted Cash Flow (DCF) model, estimates value based on the present worth of a company’s future cash flows. The model assumes that the intrinsic value of a business is derived from its ability to generate income over time.

This approach is most suitable for companies with predictable revenue patterns, stable margins, and a well-defined business model. For established companies, DCF offers a detailed, forward-looking framework that incorporates revenue growth rates, capital expenditures, discount rates, and terminal values. Its strength lies in its precision—when supported by reliable data, it provides a clear representation of long-term financial performance.

However, when applied to startups, the DCF method encounters major limitations. Young companies often lack consistent cash flows or a proven track record, making their future projections highly speculative. The volatility in early-stage markets, combined with high uncertainty about scalability, renders traditional income models less reliable. To address this, analysts sometimes modify the DCF model by integrating probability-weighted scenarios or using shorter forecast periods to accommodate uncertainty.

The Market-Based Approach: Reflecting Real-World Transactions

The market-based approach derives a company’s value by comparing it to similar businesses that have been sold or are publicly traded. It relies on valuation multiples—such as Price-to-Earnings (P/E), Enterprise Value-to-EBITDA, or Revenue multiples—to determine what investors are willing to pay under current market conditions.

This method works exceptionally well for established companies operating in mature industries, where ample market data exists. Publicly available information about peer companies provides benchmarks that enhance objectivity. For instance, in sectors like retail or manufacturing, analysts can easily find comparable transactions to estimate valuation ranges.

In the case of startups, the market-based approach can be both helpful and challenging. While it provides an external reference point, finding truly comparable companies is often difficult. Startups frequently operate in emerging or disruptive markets where no direct peers exist. Even when comparables are identified, they may differ significantly in business model, funding stage, or geographic focus. Therefore, market-based valuations for startups tend to rely on broader industry averages or transaction data from venture capital rounds rather than exact peer comparisons.

The Asset-Based Approach: Measuring Tangible Worth

The asset-based approach determines value by calculating the net fair market value of a company’s total assets minus its liabilities. This method is straightforward and highly transparent, making it suitable for companies with substantial physical assets, such as manufacturing firms, construction businesses, or real estate developers.

For established companies with strong balance sheets, this approach can provide a reliable baseline value, particularly in scenarios involving liquidation or restructuring. However, the asset-based method has limited relevance for startups or service-oriented companies. It fails to account for intangible assets like intellectual property, brand reputation, or future earning potential—all critical elements of startup value creation.

In the context of early-stage companies, an asset-based valuation would almost always underestimate the true economic value, since innovation, growth prospects, and market positioning cannot be quantified solely through tangible assets.

Comparing Valuation Approaches for Startups and Established Companies

Startups: Emphasizing Growth, Innovation, and Future Potential

Startups are driven by vision and scalability rather than historical earnings. Their primary assets are intangible—ideas, technology, intellectual property, and human capital. As a result, valuation for startups requires a forward-looking mindset. Investors often prioritize future cash flow potential, market opportunity, and the quality of the founding team over existing financial data.

For startups, modified income and market approaches are most effective. The DCF model can be adjusted to include milestone-based cash flows or probability-weighted outcomes that reflect uncertainty. In addition, market comparisons drawn from recent funding rounds or acquisitions of similar startups can offer valuable guidance.

While the asset-based approach rarely suits startups, it may still play a supporting role when tangible assets—such as proprietary technology or equipment—hold measurable value. Nonetheless, startup valuation remains as much an art as a science, blending quantitative estimation with qualitative judgment about future potential.

Established Companies: Relying on Data, Stability, and Performance

Established businesses, in contrast, are valued primarily on proven financial performance and predictable cash flow generation. They have historical data that enables detailed financial modeling, making income-based approaches like DCF particularly powerful. Such companies also operate in competitive environments with numerous peers, allowing for robust market-based comparisons.

The asset-based approach becomes more relevant when these companies possess significant tangible resources or operate in industries with high capital intensity. In cases of mergers, acquisitions, or liquidation, it provides a clear reference point for fair value determination.

What distinguishes valuation for established firms is the focus on consistency and sustainability rather than hypothetical potential. The emphasis lies on how efficiently the company uses its assets, manages costs, and sustains profitability over time. The predictability of these factors allows analysts to produce valuations with greater confidence and narrower error margins.

Hybrid Valuation Models and the Importance of Flexibility

In many real-world scenarios, analysts use hybrid models that combine multiple valuation approaches. This blended methodology helps offset the limitations of any single method and ensures that the final value reflects both current performance and future potential.

For example, in technology acquisitions, analysts may use an income-based DCF model to capture expected future cash flows while cross-referencing results with market-based multiples from similar deals. Similarly, for mid-sized companies transitioning from startup to growth stage, incorporating both tangible and intangible asset valuations ensures that neither the balance sheet nor the innovation potential is ignored.

Hybrid modeling enhances credibility and accuracy, especially when dealing with businesses at the intersection of development stages. It also provides a clearer narrative to investors, highlighting not just how much the company is worth, but why it holds that value.

Factors Influencing Method Selection

The decision between valuation methods depends on several interconnected factors—industry dynamics, data availability, risk tolerance, and investor perspective. For high-growth sectors like fintech, biotechnology, or software, income-based and market-based approaches dominate due to their emphasis on innovation and scalability. In asset-heavy sectors such as manufacturing or energy, asset-based methods retain importance.

Additionally, the audience for the valuation—be it venture capital investors, corporate boards, or regulatory bodies—affects the choice. Investors may favor methods emphasizing future returns, while accountants or auditors prioritize asset-backed evidence. Understanding the stakeholder context ensures that valuation outputs are relevant, defensible, and strategically aligned.

The Strategic Value of Comparative Analysis

Beyond determining worth, comparing valuation approaches provides deeper insight into business performance. When different methods yield significantly divergent results, it signals that underlying assumptions require review. For example, if an income-based valuation produces a figure much higher than market-based results, it may indicate overly optimistic revenue projections. Conversely, if asset-based values exceed income estimates, it could reflect underutilized assets or operational inefficiencies.

This comparative perspective transforms valuation from a static calculation into a dynamic analytical process. It helps decision-makers understand what drives value within the business, where risks reside, and which strategies could enhance future growth.

Conclusion to Comparing Valuation Approaches Which One is Best for Startups vs Established Companies

Valuation is both a science of precision and an art of interpretation. The right approach depends on the company’s stage of growth, business model, and strategic goals. For startups, methods emphasizing potential—such as modified income or market-based approaches—capture the essence of innovation and comparing income market and asset-based valuation approaches future opportunity. For established companies, the reliability of historical data makes income and asset-based valuations more applicable, producing consistent and defensible results.

Ultimately, the best valuations emerge not from rigid adherence to one method but from thoughtful integration of several. By comparing, testing, and interpreting results within the business’s unique context, analysts can arrive at valuations that not only quantify financial worth but also reveal the story of a company’s growth, resilience, and future promise.