How Market Income and Asset Based Valuation Methods Differ

Learn How Market Income and Asset Based Valuation Methods Differ

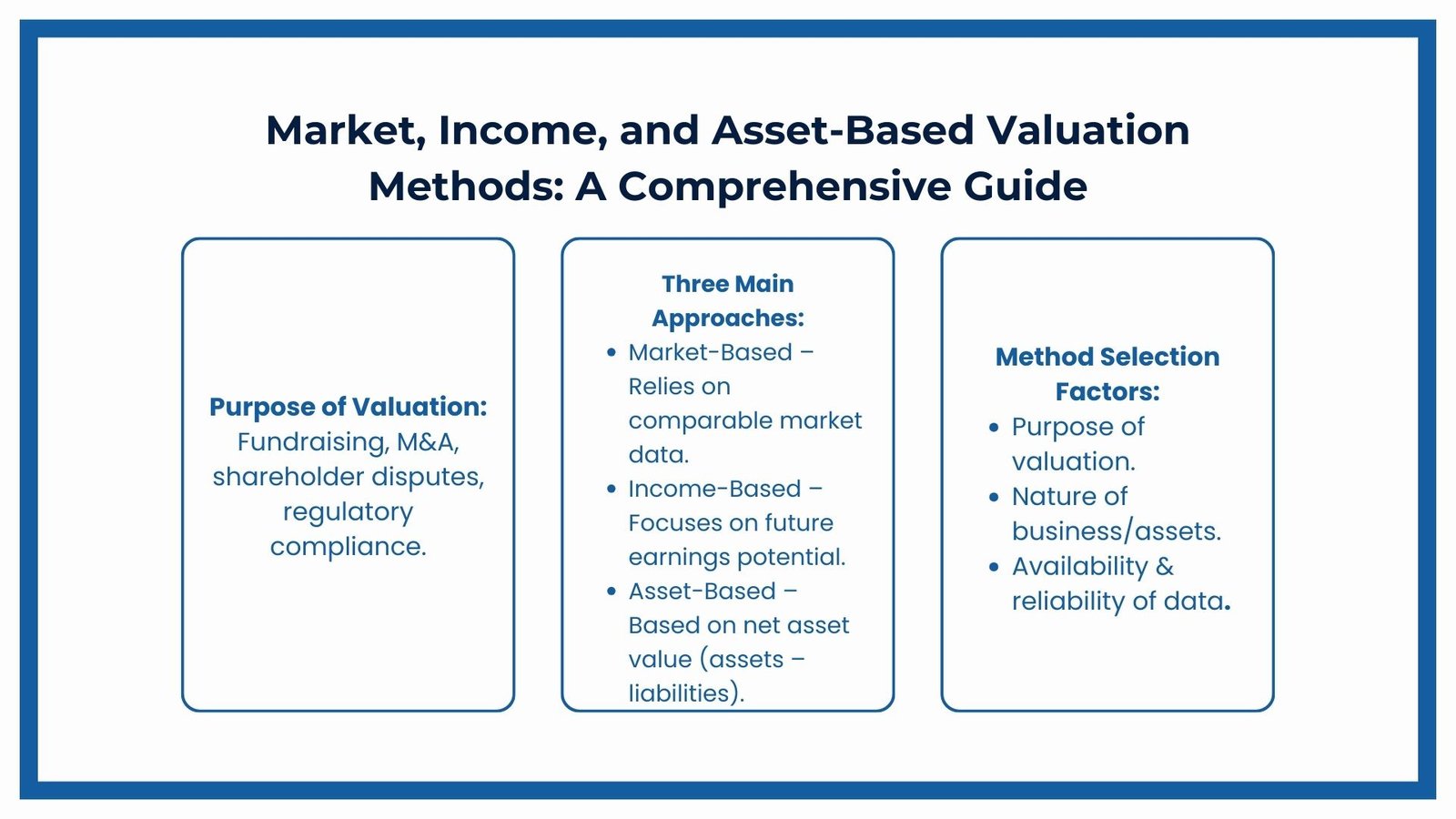

One of the pillars of informed decision-making in business is valuation. The fair value of a company or asset is needed to fundraise, to merge and acquire, in terms of shareholder disagreement, and in the case of regulatory compliance. Out of the numerous valuation models that exist, three prevailing schemes are market-based, income-based and asset-based methods that have been popular throughout industries and jurisdictions. These are considered among the best company valuation methods for Singapore companies because they provide reliable frameworks across contexts.

Although the two approaches can be distinguished by the fact that they share the common goal of estimating value, their efforts are oriented differently. The first are dependent on market indications, the second one depends on the future potential of the company to make money, and the third is based on the inherent value of the assets used in the business. For deeper insights, professionals often look at various multiples used in company valuation Singapore to complement these approaches and enhance accuracy.

There are several approaches to selecting the appropriate method, which would depend on the purpose of the valuation, nature of the property and the accessibility of reliable information. The top 3 methods for private company valuation Singapore align with these broader frameworks and give business owners, investors, and advisors the practical tools to evaluate companies effectively.

This tutorial discusses the theory, practice and practical discussion of the approaches, although also covers strengths and weaknesses of each of the approaches in practical valuation applications.

Understanding the Market-Based Approach

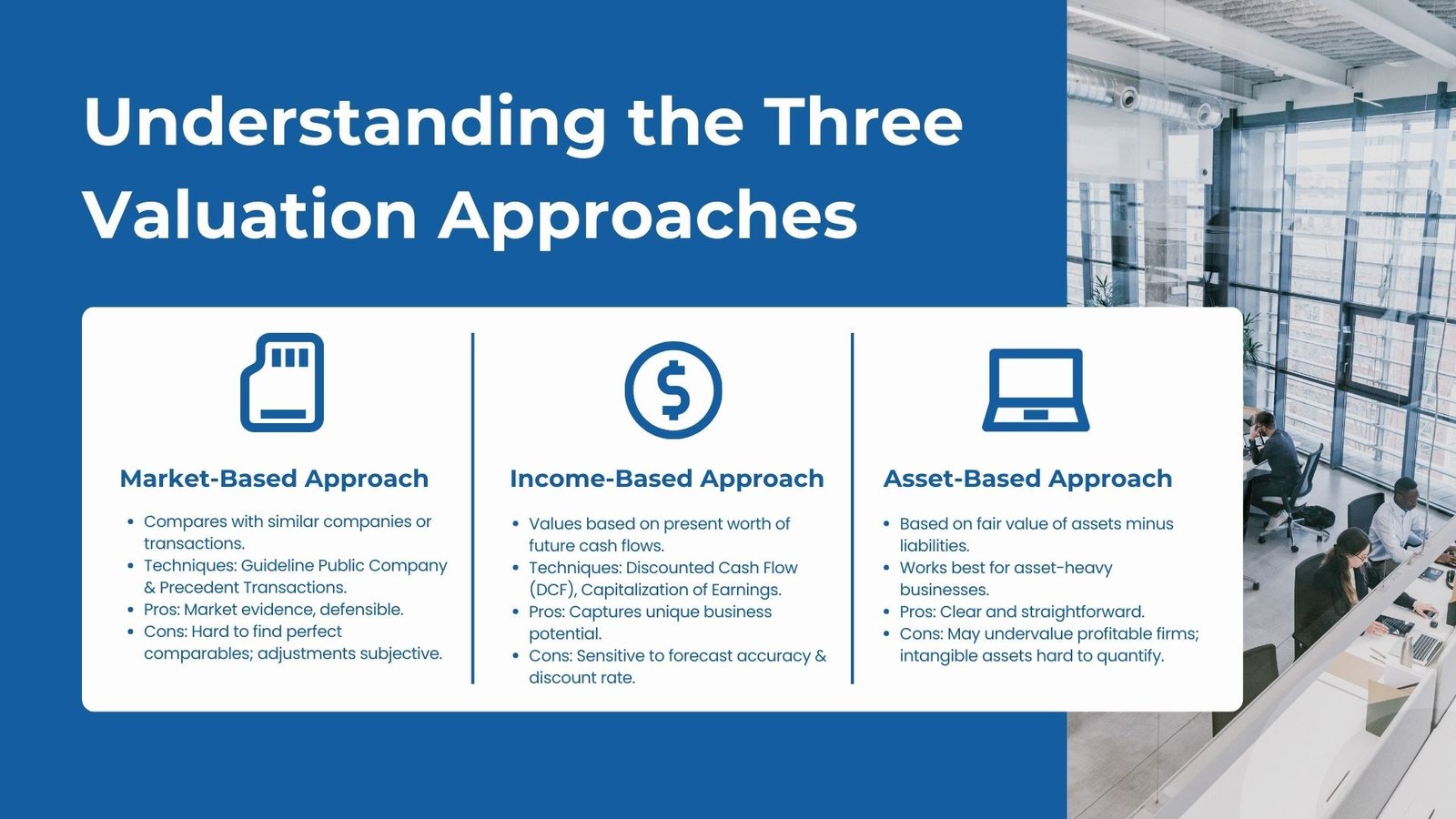

Market-based methods compare a subject company or asset with other businesses or open market transactions, and values are determined accordingly. This process presupposes that the market forces are a credible indication of the value because the prices are established on the basis of willing buyers and sellers offering or taking goods on a competitive basis.

There are two main techniques to prevail in the market-based strategy: the guideline public company approach and precedent transactions approach. The former relies on valuation multiples of publicly traded companies that are similar to the subject company, like price-to-earnings (P/E) or enterprise value-to-EBITDA (EV/EBITDA) ratios compared to the latter using transaction prices that are used in actual acquisitions of comparable companies.

The market-based approach has been identified as one of the significant advantages that include the ability to base judgments on observable evidence in the market, which can render the valuation more easily defensible to various regulatory or litigating purposes. The difficulty is, however, to find really comparable companies or transactions. Direct comparison even by industry is flawed because of varying scale, regional focus, profitability and growth potential. Usually, adjustments have to be made to compare the comparables to the subject company and this has a subjective nature to them.

The method is quite relevant to those industries where there exists an active merger and acquisition market or to those industries where there exist publicly traded competitors. A hypothetical tech startup would be worth considering by looking at the prices paid in acquisitions of other startups operating in the same field which would be adjusted relative to the maturity of the products, revenues, and market of the startup.

The Income-Based Approach: Future Earnings as a Measure of Value

The income based method values in terms of present worth of future economic benefits that asset/business would yield. There is a philosophic basis in that it is held that the worth of an asset is directly proportional to its capacity to generate income over a period of time.

The discounted cash flow (DCF) analysis is the most popular of income-based techniques. This can be done by estimating the future cash flows within a forecast period in addition to the termination value, which establishes the amount that might represent the value during the forecast period into the future, before discounting to the present by using relevant interest rate. The discount rate consists of the risk of the investment and the value of money.

The second form is the capitalisation of earnings technique that is rather applicable to the stable enterprises with steady cash generation. Rather than estimate value by forecasting future cash flows in detail, it uses a capitalisation rate on a standard measure of current earnings.

The income-based model is superior due to the fact that it picks up the unique attributes of the financial and operational aspects of the business instead of assuming that one is a comparator of market comparisons. It is particularly useful in a unique or specialised firm with little market comparables.

The reliability of the method on the other hand is greatly affected by the accuracy of the forecasts and the effectiveness of the discount rate. Unrealistic revenue estimates or underestimating of risks may add huge multiples to the valuations. Also, extraneous events, e.g., economic cycles, pending regulation or a break in the competitive environment may hastily change the future profitability viewpoint diminishing the exactness of the initial evaluation.

The Asset-Based Approach: Valuing Tangible and Intangible Resources

The value implication of the asset-based model is that it is calculated on the net asset value (NAV) of the business, which basically refers to the fair value of total assets less liabilities. It mirrors the value of resources that a business possesses both tangible and intangible assuming that the resources were able to be sold independently at an open market.

It best applies to businesses that are heavy on assets like manufacturing firms, real estate holding firms or investment vehicles whose value is directly based off of the underlying assets. The asset-based valuations may be progressed on a going-concern basis or on a liquidation if the business is to be dissolved and the assets sold off separately, frequently at a discount, to pay debts.

Liquidation process also starts with identifying and valuing all the assets, whether land, buildings, machinery, inventory, and financial investments and valuing it at fair market value. This is followed by liabilities deduction to get to net asset value. Notably, intangible property that is exchangeable like the patents, trademarks, and goodwill may be included, as long as they can be dependably quantified.

Although the asset based method is clear and that it is relatively easy in model form when we have high quality asset valuation, it tends to undervalue profitable companies whose earnings potential is good. This is due to the fact that it does not measure fully the intangible elements which could explain the future income but are not represented in the balance sheet- brand strength, customer relationships or proprietary technology.

Selecting the Right Valuation Approach

Not all valuation methods are the same, with one being the most acceptable or “best.” This will be determined by the context, purpose and nature of assets of the business under valuation. As an example, where the technology companies are involved in the merging and acquisitions, the income-based approach can prevail since it is used to concentrate on the growth ability of the company and associated future revenue streams. On the contrary, in the industries where the transaction market is active, the market-based approach may be used to get the highly relevant benchmarks.

There are instances where valuers combine two or more approaches to allow them to counter-check the findings in order to enhance the reliability. Using an example, a valuer may begin with a DCF calculation to reflect the income generating ability of a business in which case he or she can follow up the valuation with market multiples of similar companies and ensure that the valuation so arrived has a market context in the current market conditions. On the same note, in companies with asset-heavy properties, the asset-based approach and the income-based approach could be used and more emphasis placed on the approach that best reflects that of the industry.

After all, the validity of a valuation technique does not rely solely on the identified technique but also on the quality of information, the correctness of assumptions and the personal experience used to refine the data. A good valuation provides a clear rationale in choosing a specific method, inputs as well as adjustments as considered in order to reflect circumstances of the subject company.

Limitations and Challenges of Each Approach

Although these three methods serve as the base of the majority of valuations, all three ones have certain challenges. The reliability of the technique referred to as the market-based approach depends entirely on the quality and relevance of the comparables relied upon; comparables are not easy to find in thin or volatile markets. The income-based method is at risk of biases or the economy not being expected and this may affect the accuracy of the forecasts and the rate of discount used. Although it is anchored on the tangible values, the asset-based approach may not identify the strategic and operational strengths of the firm not listed on the balance sheet.

The professional valuers need to overcome such restrictions using analytical scrutiny, support findings using more than one method and reveal the assumptions and limitations of their own work.

Conclusion

Each valuation method in the market-based, income-based, and asset-based approaches offers quality information about the worth of a company, although they look at the issue at hand in varied perspectives. The market-based technique equates value with the present reality of the market, the income based method emphasizes future earning strengths, and the asset based technique estimates the worth of the intrinsic resources.

Selecting the appropriate method, or methods, comes through superior knowledge of the business and its industry as well as why the valuation is being done. These methods when used skillfully, accurately and transparently create a strong basis on which to base your strategic decisions whether in acquisitions, analysis of investments or reporting on the same.