How Professional Valuation Help MA

How Professional Valuation Services Can Help in Mergers and Acquisitions

Introduction: How Professional Valuation Help MA

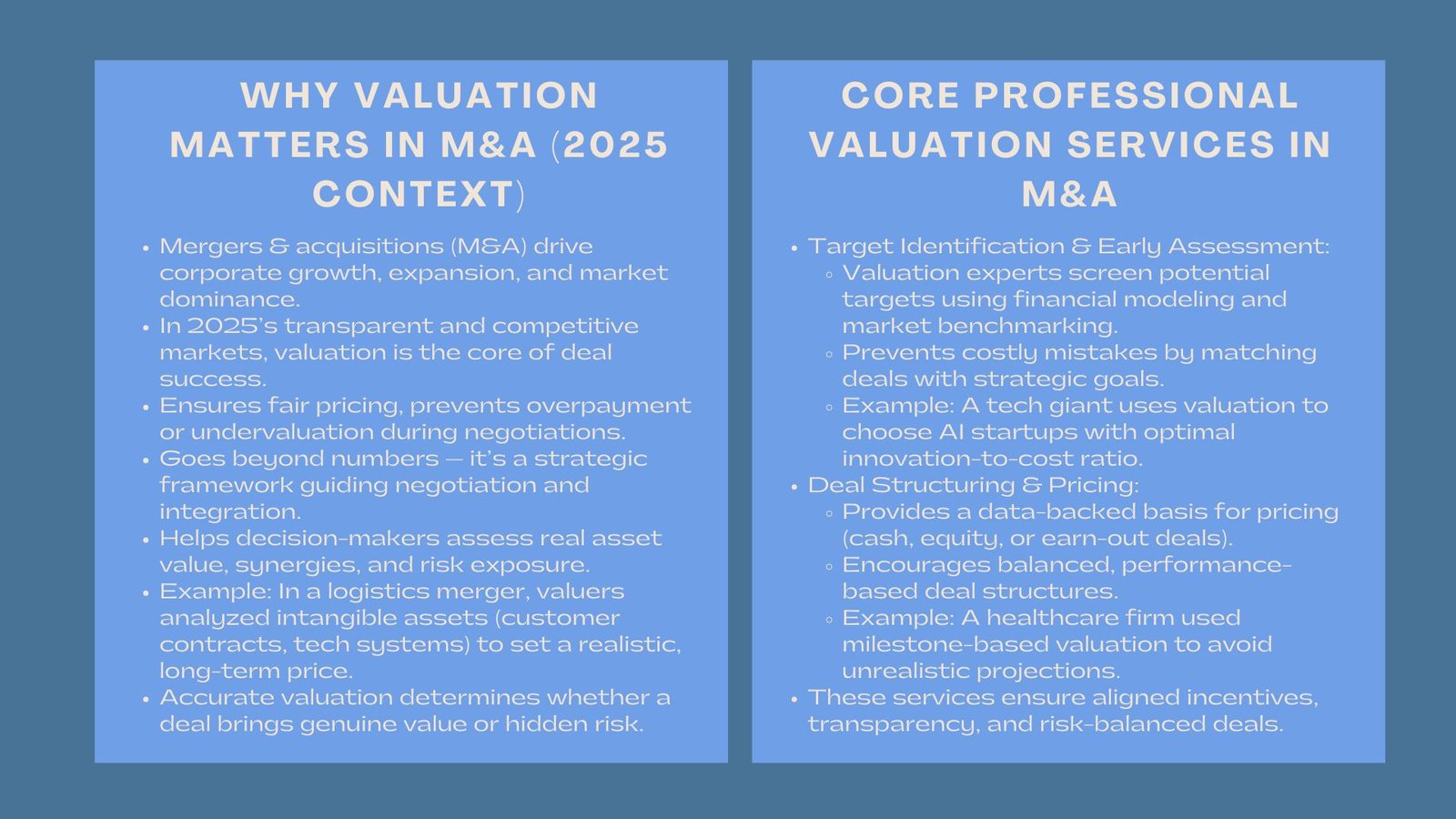

Merger and acquisition (M&A) is considered to be one of the strongest tools of corporate growth, expansion, and domination in the market. However, behind all successful transactions, there is one important component, which is valuation. With the world markets turning out to be more competitive in 2025 and the investors requiring more transparency, professional valuation services will have the indispensable role in helping to decide whether a deal will bring about a genuine value or financial risk.

A company that wants to acquire a competitor, merger with a strategic partner or a company that wants to sell a subsidiary, the right valuation will enable the decision-maker to know the real value of assets, synergies and risks. Valuation has become not only a technical procedure but also a strategy that defines the negotiation, compliance with the regulations and the success of the post-deal.

1. The role of valuation in Mergers and acquisitions.

1.1 Establishing the ground to be fair in negotiation.

The business worth is the starting and ending question of a merger or an acquisition. The buyers will be overpriced and the sellers will be losing out on cash without an objective valuation. Professional appraisal services offer an objective, evidence-based estimation of the value, and both the parties share a common sense of the economic reality of the company.

Another example is the takeover of a mid-sized logistic company by a multinational transport company, where a professional valuer did not look at the physical properties of the company such as vehicles and warehouses, but instead took into consideration intangible elements such as customer contracts and technology systems. This middle ground also enabled the two parties to settle on a reasonable long term priced price as opposed to a short term financial performance-based price.

1.2 Valuation is a strategic decision tool

Valuation is not simply pre-deal process in 2025, but is a decision-making instrument. Valuations are tools employed by companies to analyse strategic fit, gauge their potential synergies and predict returns on mergers taking place. Through the incorporation of new analytics, new valuation models determine how the merging of two organizations can create new revenue, cut expenses, or increase coverage.

The latter is an especially important insight in cross-border M&A, where the cultural, regulatory, and currency risks also need to be included in financial forecasts. A correct valuation gives visibility in time of uncertainty, and the executives make informed and well-informed decisions.

2. Basic Services of Professional Valuation in M&A.

2.1 The initial step is the identification of the target and primary initial assessment.

Valuation specialists help in determining appropriate targets of acquisition before even a deal is negotiated. By financial modelling and market benchmarking they will find out how potential targets match the strategic and financial goals of the acquirer.

As an example, a technology giant that decides to enter into the field of artificial intelligence can examine a number of startups, where some have higher levels of intellectual property maturity. The initial valuation is useful in eliminating the set targets that provide the most reasonable ratio between innovation potential and cost of acquisition. Engaging corporate valuation experts at this early stage saves time and prevents costly missteps.

2.2 Deal Structuring and Pricing

Valuation services are provided by professionals, who can structure a transaction in a manner that is risk-reward balanced. No matter whether the transaction is cash or equity swaps or earn-out, the valuation becomes the value benchmark in the pricing decision.

In one striking instance, a medical equipment firm in Europe purchased a healthcare start-up on an earn-out basis based on future performance in sales. The analysis of predictive milestones by the valuer avoided issues of disagreements about unrealistic growth targets. This explains that valuation enables flexible performance-based structures of deals that align the incentives between a buyer and seller.

3. Risk management by Precise Valuation.

3.1 Hidden Liabilities Identification.

Unidentified liabilities during the M&A process can greatly reduce the enterprise value: an impending lawsuit or environmental risks, or even old technology. These unnoticed risks are revealed through professional valuation services through a thorough due diligence.

As an illustration, valuers in a mining sector acquisition determined that there were underreported costs incurred in rehabilitation and compliance penalty that diminished the fair value of the target. In the absence of this analysis, the buyer could have experienced tremendous losses after the acquisition. Valuation, on the other hand, serves as a protection against overestimation and proper risk management.

3.2 Evaluation of the realisation of synergy.

Quantification of synergies – the benefits accrued after merger is one of the most demanding things in M&A. They can be cost cuts, entry into a new market or an improvement in technology. Scenario modeling is used by the valuation professionals in order to find out whether anticipated synergies are attainable and realistic.

The value of synergy is often exaggerated by companies to support high prices of purchases.By incorporating M&A financial valuation techniques, experts ensure that synergy projections are grounded in data, not optimism. This improves transparency and enhances investor confidence in the transaction’s viability.

4. The Role of Valuation in Regulatory and Accounting Compliance

4.1 Meeting Financial Reporting Standards

Accounting after mergers must involve a careful allocation of the purchase price among assets and liabilities acquired during the process of acquisition and this procedure is referred to as Purchase Price Allocation (PPA). The professional valuation services are used to make sure that this allocation is in accordance with the international financial reporting standards (IFRS or US GAAP).

As an example, valuation experts were able to identify and value intangible assets like trademarks, software and customer relationship when a regional e-commerce business was purchased by a Singapore-based holding company. Properly prepared PPA not only made them compliant with the accounting regulations but also reduced the chances of audit conflicts in the future.

4.2 Supporting Tax and Legal Documentation.

Taxation in M&A also depends on valuation as proper valuation of assets has an impact on depreciation schedule, goodwill, and capital gains tax liability. In the cross-border transactions, where two or more jurisdictions are at play, valuation experts can assist in aligning disparities in taxation rules and avoidance of taxation.

Legal consultants consider valuation documents to justify fairness opinions, fight off shareholder legal disputes, and justify the terms of deals to regulators. Professional valuation in essence is the interface between finance, law and compliance – making the transaction fire resistant.

5. The Idea of Technology and Data in Current M&A Valuation.

5.1 Advanced Analytical Tools

The way valuations are conducted has been changed by technology. With data-driven modeling, AI-driven predictions and forecasting, and predictive analytics, valuers can now appraise deals more precisely and quickly than they have in the past. These software run through huge volumes of financial, market and operational data, and can spot trends that are not visible to human analysts.

As an example, the valuation machine learning systems can be used to calculate the industry benchmark, customer data, and risk indicators to determine how the merging of two companies may impact market share or profitability. The given insights enable acquirers and investors to make more informed decisions.

5.2 Real-Time Scenario Modeling

In dynamic markets, the fixed valuation reports may be out of date in a matter of weeks. With modern systems of valuation, simulation of scenarios in real time can now be done, i.e., how an alternate in interest rates, a crisis in its supply chain or a change in regulations will impact enterprise value.

The method is most useful in international dealings. An American company that buys a supplier in Asia, such as one, can simulate the effect of changed currency or tariff levels on the net present value of the transaction. This agility makes the valuation of the transaction to be relevant in the entire transaction life cycle.

6. Value Tracking and Post-Merger Integration.

6.1 Oversight of the Real performance.

Once the transaction has been done, valuation does not cease. Performance tracking should be a continuous process to ensure that desired synergies and returns are achieved. Professional valuation services provide frequent re-valuation, which aids the management to know whether integration post-merger can be delivering the expected value.

An example of this is a financial institution that acquired a digital banking firm where the valuation reviews were used to determine user retention, increase in revenues and cost efficiencies. This enabled the executives to change integration plans as they went along to maximize long-term returns.

6.2 Building on Investor Relations.

Frequent post-merger valuations are also good in terms of communication to the investors. The shareholders would want transparency on the contribution of acquisitions to the total corporate value. Recalculated valuation reports offer believable information that the management is generating returns to the shareholders.

To investors, a company practicing disciplined valuation is perceived to be more credible and professionally managed which may have a positive impact on stock performance and access to capital.

Conclusion

By 2025, professional valuation services will cease to be an option during mergers and acquisitions, but rather a strategic need. Valuation serves all of the stages of transaction life, including target screening and deal pricing, regulatory compliance, and integration of the two companies after a merger.

The entrepreneurs and the corporate leaders that invest in sound valuation procedures get not only the correct figures, but also foresight, transparency, and strategic control. With the changes in the global markets, the quantification and defense of value will remain the ultimate determining factor between a successful deal and an expensive miscalculation.

Valuation as a profession is more than making the price, it is creating sustainable value that can be measured in the future, in all M&A decisions.