Professional Company Valuation Services Explained

Learn Professional Company Valuation Services Explained

In the modern business environment, understanding the value of a company has never been more important. Whether a business owner is preparing for a sale, seeking investors, complying with regulatory requirements, or making strategic decisions, company valuation forms the foundation for informed choices. Professional company valuation services offer expertise, objectivity, and structured methodologies to determine a company’s worth with accuracy and credibility. These services go beyond simple number crunching; they involve financial analysis, market assessment, risk evaluation, and often a deep dive into industry-specific trends.

This article examines the role of professional company valuation services, how they are conducted, why they matter, and what businesses can expect when engaging valuation experts. It also looks at the different scenarios where valuation is crucial and explores the methods commonly used to arrive at a reliable estimate.

The Role of Professional Valuation in Business Decision-Making

Professional company valuation is not just a technical exercise but a strategic tool that guides significant business decisions. While an owner might have a rough idea of what their business is worth, the figure must be backed by robust evidence and accepted valuation principles. This is where certified company valuation specialists Singapore come in, bringing a disciplined approach that accounts for financial performance, market position, competitive advantages, and future earning potential.

Valuation is vital in scenarios such as mergers and acquisitions, where the stakes are high, and negotiations depend heavily on the agreed-upon value. It also plays a central role in securing financing, as lenders and investors want assurance that the business has a sound basis for its claimed worth. In disputes, whether between shareholders, in divorce proceedings, or in legal claims, a professional valuation provides an impartial and defensible figure that courts or arbitrators can rely on. Furthermore, valuation supports compliance with financial reporting standards, ensuring businesses meet local or international accounting requirements.

By relying on professional company valuation services Singapore, companies gain access to a process that is consistent, objective, and aligned with regulatory expectations. This helps to minimise bias, avoid inflated or understated valuations, and build credibility with stakeholders. For leaders and strategists, combining valuation expertise with other analytical tools—such as taking a learn decision making with game theory Singapore course—can further strengthen business planning and long-term growth strategies.

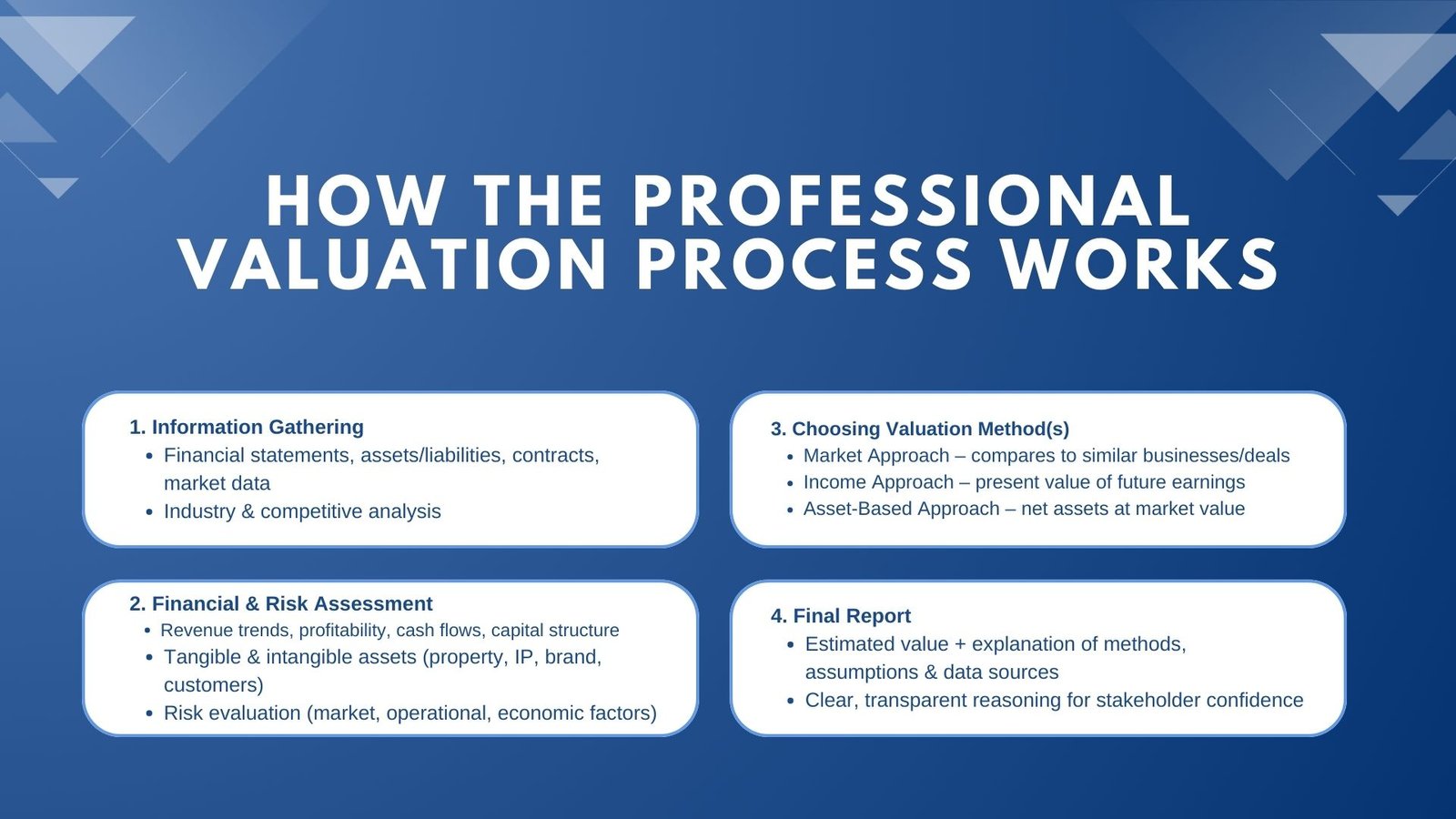

The Valuation Process: From Information Gathering to Final Report

The process of professional company valuation typically begins with a thorough information-gathering phase. The valuer will request historical financial statements, details of assets and liabilities, contracts, market data, and information about the company’s operations, management, and competitive environment. Understanding the company’s industry dynamics is equally important, as market trends, regulatory changes, and technological developments can significantly influence value.

Once data is collected, the valuer assesses the company’s financial health, examining profitability, revenue stability, cash flow patterns, and capital structure. They also evaluate both tangible and intangible assets, from physical property and equipment to intellectual property, brand recognition, and customer relationships. Risk assessment is another core element, as higher perceived risk can reduce value by impacting expected returns.

The next stage is selecting the most appropriate valuation approach or combination of approaches. The choice depends on factors such as the purpose of the valuation, the availability of reliable data, and the nature of the business. After applying the chosen methodology, the valuer prepares a detailed report. This document not only states the estimated value but also explains the reasoning, assumptions, and data sources used, ensuring transparency and enabling stakeholders to understand and trust the results.

Common Valuation Approaches Used by Professionals

Professional valuation services typically rely on three primary approaches: the market approach, the income approach, and the asset-based approach. Each approach offers a different lens through which to view value, and in many cases, multiple methods are applied to cross-check results.

The market approach determines value by comparing the business to similar companies that have been sold recently or are publicly traded. This method reflects what the market is currently willing to pay, making it particularly relevant when preparing for a sale or acquisition. It requires access to accurate transaction data and careful adjustments to account for differences in size, location, and operational scope.

The income approach focuses on the business’s ability to generate future cash flows. These future earnings are projected and then discounted to their present value, taking into account the risks and uncertainties involved. This approach is widely used for established companies with predictable income streams and is valued for its forward-looking nature.

The asset-based approach calculates value based on the company’s net assets, subtracting liabilities from the total asset base. This can be particularly relevant for asset-heavy companies or those undergoing liquidation, although it may understate value for businesses with significant intangible assets or strong earnings potential.

Professional valuers determine which method or combination best suits the specific case, ensuring that the approach reflects both the nature of the business and the purpose of the valuation.

Why Businesses Engage Professional Valuation Services

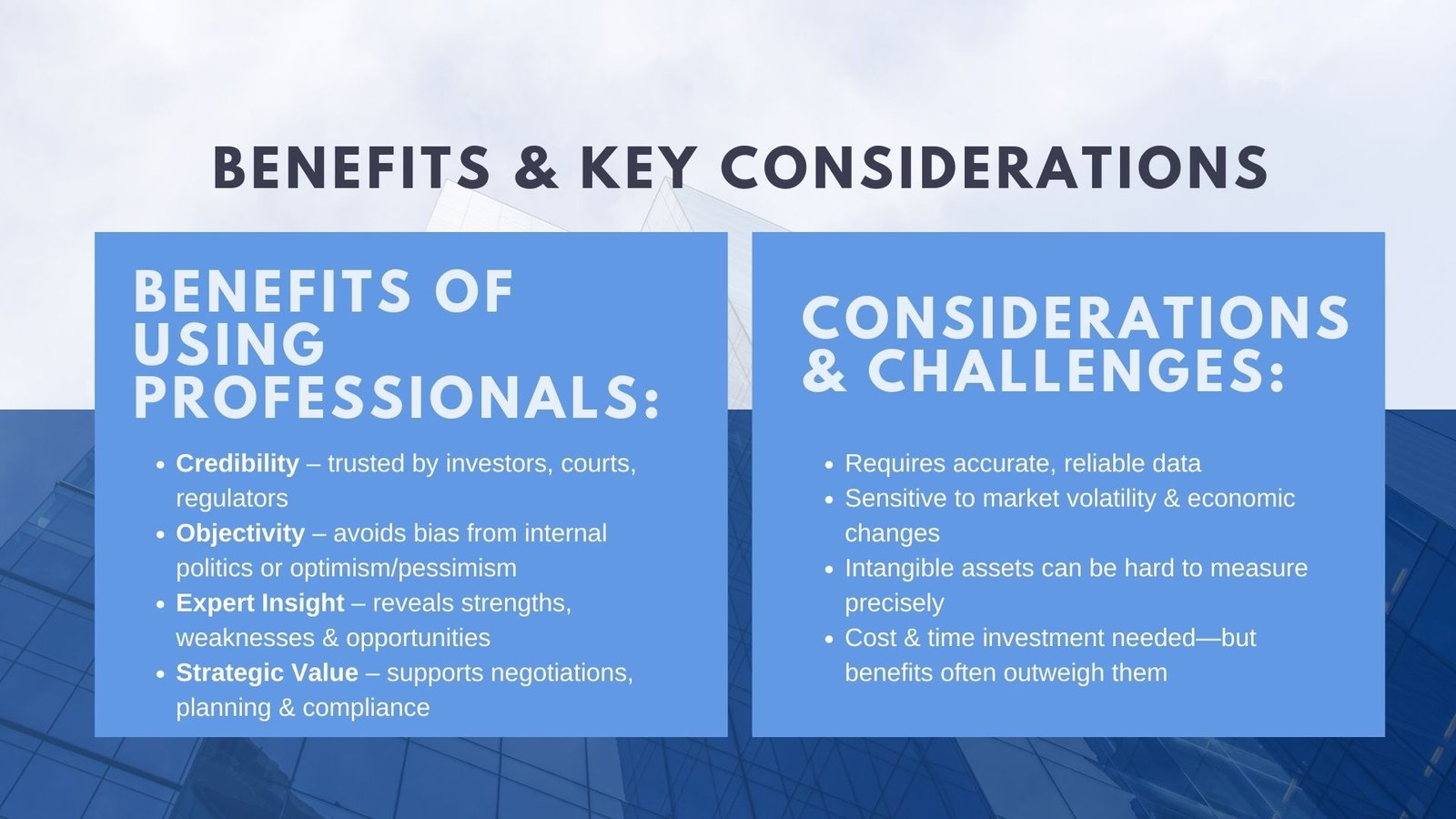

Engaging a professional valuer provides benefits that go far beyond producing a number. One of the most significant advantages is credibility. A professionally prepared valuation carries weight with investors, buyers, courts, tax authorities, and regulators, as it adheres to established valuation standards and is supported by evidence. This is particularly important in transactions and disputes, where an unsubstantiated valuation can undermine trust or lead to costly disagreements.

Professional services also bring technical expertise and industry knowledge. Valuers often have backgrounds in finance, accounting, or economics, and they stay informed about market trends, industry benchmarks, and changes in regulatory frameworks. This expertise ensures that valuations are accurate, relevant, and compliant with applicable standards such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Another reason businesses turn to professionals is the need for objectivity. Internal valuations can be influenced by optimism, pessimism, or internal politics. An independent valuer removes this bias, focusing solely on facts, analysis, and standard methodologies.

Moreover, professional valuation services can reveal insights into a company’s strengths, weaknesses, and opportunities. The process often uncovers areas for improvement, such as operational inefficiencies or underutilised assets, providing management with valuable strategic guidance.

Challenges and Considerations in Professional Valuation

While professional valuation services are designed to provide accuracy, the process is not without challenges. One significant factor is the availability and quality of data. Valuers rely heavily on accurate financial records, market information, and industry data. If these are incomplete, outdated, or unreliable, the accuracy of the valuation can be compromised. Professionals often address this by validating data from multiple sources and making informed adjustments.

Economic volatility is another challenge. External factors such as changing interest rates, inflation, geopolitical events, or industry disruptions can alter assumptions about future earnings or asset values. Valuers must account for these uncertainties and reflect them in the risk assessment and final estimate.

The treatment of intangible assets can also complicate valuation. Assets such as brand reputation, patents, or customer loyalty may be central to a company’s value but are difficult to measure with precision. Professional valuers use specialised methodologies to estimate their worth, but such valuations still involve a degree of subjectivity.

Finally, the cost and time required for a professional valuation can be a consideration, especially for small businesses. However, the long-term benefits of accuracy, credibility, and strategic insight often outweigh these short-term constraints.

The Strategic Value of Professional Valuation Services

Professional company valuation services provide far more than a number on a page. They deliver a comprehensive analysis of a company’s financial position, operational strengths, market environment, and future potential. This analysis supports strategic planning, investment decisions, compliance, and negotiations, giving business leaders the confidence to act decisively.

In an era where business environments change rapidly and stakeholders demand transparency, professional valuations help ensure that companies are represented fairly and accurately in financial terms. They also serve as a common reference point in complex negotiations, enabling transactions to proceed on a fair and informed basis.

By understanding the role, process, and benefits of professional valuation services, businesses can better appreciate why engaging experts is not just an option but, in many cases, a necessity. Accurate valuation is the language of trust in the business world, and professionals ensure that this language is spoken clearly and credibly.