Top 10 Business Valuation Mistakes That Can Cost You Millions

Top 10 Business Valuation Mistakes That Can Cost You Millions

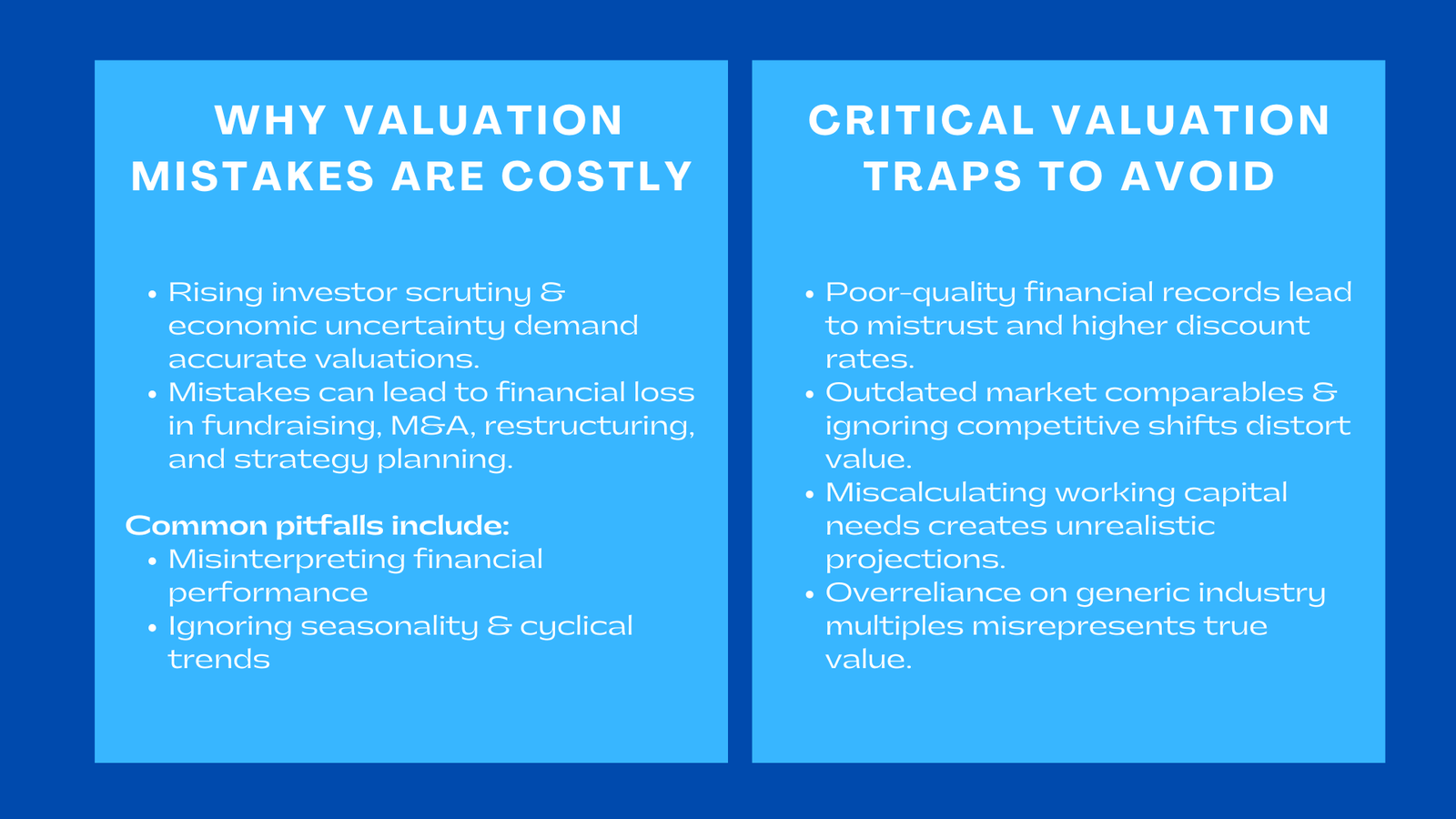

Under a financial environment where investor questioning is on the increase and economic turbulence is an ever present issue, business valuation more than ever has to be correct. In many cases, companies rely on professional business valuation services in Singapore to ensure accuracy and compliance. An inaccurate valuation will cause serious financial losses to a company whether it is preparing to be sold, raising funds, restructuring, or planning long-term strategy. Any slight negligence can bend investment choices, undermine bargaining grounds, or lead to failure to adhere to the rules and regulations.

The article is devoted to a single topic, which is the most expensive valuation errors made by companies, and the reasons why they occur, based on real-life examples. In order to know more about these pitfalls, business owners and financial leaders have an opportunity to enhance their valuation practices, safeguard corporate value, and enhance investor confidence.

1. Misinterpreting Financial Performance

1.1 Overlooking Normalized Earnings

One of the most common valuation errors involves failing to adjust earnings for non-recurring or abnormal expenses. Companies tend to be dependent on crude financial reports that have unusual entries, like one-time legal expenses, reorganization expenses, or irregular rises in earnings. The valuation analysts can easily overstate or underscale the actual earning potential of the business in the absence of normalization.

An example is that a manufacturing firm which has had an unusually high sales in one year because of temporary government incentives would seem to be stronger than it is. Those investors basing their decisions on these unadjusted figures will be making decisions on false profitability.

1.2 The Fallacy of Disregarding Seasonality and Cyclical Trends.

Retail industry, tourism, and agriculture are seasonal industries. Valuations that are made based on data that is generated during peak times are misleading. A retail brand with half of its income during year-end holidays should be rated on an annualized season-adjusted basis. Otherwise, the valuation can cause unrealistic expectations in the investment and ineffective internal planning.

2. Incorporating the Wrong Approaches of Valuation.

2.1 Wrong Fit for Industry

All approaches do not apply in every sector. Using the same model to a SaaS firm and an actual real estate developer will give faulty results. Income-based models are usually needed by tech companies because of the significance of recurring revenue and intangible assets, and asset-based ones are favored by industries that have a significant number of assets.

Errors are made when analysts use methods that are not strategic but are done by default. Subsequently, it can have extreme valuations that are not in line with the market reality.

2.2 Unability to Integrate more than one approach.

By using just one method we may develop blindness. A combination of a blended approach (DCF, market comparables and asset-based methods) is a common source of professional valuation as it can be used to create a balanced estimate. By using a single strategy, business owners are likely to look at particular competitive advantages underestimated, or they are likely to overestimate financial power.

An example is a regional logistics company that experienced a 25 percent gap between the value of the company as per the market and the value of the company as per its assets. A mixed view contributed towards resolving the disagreements and giving investors a more realistic figure.

3. Wrong Discount Rates and Growth Assumptions.

3.1 Misjudging Risk Profiles

The rate applied to the discount should be based on the operating risks, market volatility, capital structure, and the industry standards. The inaccuracy of the computation of the Weighted Average Cost of Capital (WACC) can greatly influence the valuation.

In Singapore, one of the healthcare startups had miscalculated regulatory risks and had used a discount rate that would have been utilized in more stable and mature business. This overpriced valuation resulted in conflicts with likely investors who doubted the validity of the assumptions.

Due to overoptimistic projections, the company may schedule its products to be sold a month before they become available.

3.2 Overoptimistic Projections

The company can plan to sell its products a month prior to their availability as a result of overoptimistic projections.

The income approach is driven by future cash flows. Valuations are unrealistic when founders or analysts forecast aggressive growth, which cannot be backed up by market data.

This overestimation may be found in those businesses that enter the new markets without effective testing, or those that use customer acquisition methods that are not tested. Projections made must be accurate, and a balance made between ambition and evidence so that they are credible when negotiating.

4. Negligence in Recording Intangible Assets.

4.1 The underestimation of Brand and Intellectual Property

A lot of SMEs do not recognize or measure those intangible assets like trademarks, proprietary technology, or customer loyalty. This tends to cause severe underestimation particularly in the present day knowledge-driven industries.

An illustrative case is a drink production firm whose general brand awareness in the entire southeast Asian region has been quite substantial in brand equity than in hardware. These intangibles may cost millions of dollars not to consider when making acquisition deals.

4.2 The misclassification of Customer Relationships.

The customer agreements, retention behavior, and recurrent payment sources are significant economic assets. The incomplete valuation of companies comes about when they consider these assets as routine operations data rather than long-term drivers of value.

One e-learning website that relied on subscription business model discovered that an efficient valuation of its customer lifetime value led to an enhancement in its enterprise value by over 40 percent.

5. Ineffective Quality Financial Records.

5.1 The audit team discovered that the company lacked audit ready documentation.

Wrong book keeping or failure to record audit trails compromises integrity. Investors and purchasers rely on clean and transparent financial books. Late invoices, irregular depreciation, or unrecorded debt liabilities may bring derail the valuation and initiate an increase in discount rates to represent the uncertainty.

5.2 Missing or Untrustworthy Information.

Other businesses do not separate the business and personal expenses in financial records, and it makes it harder to categorize cost or even to record contingent liabilities. These problems cause miscalculations and generate the skepticism of investors lowering the multiples of valuation.

6. Ignoring Market Conditions

6.1 Outdated Comparables

A market-based valuation can be invalidated by the use of outdated transaction data. As an illustration, the use of pre-pandemic deal multiples when estimating post-pandemic markets could give a false impression. Valuation models need to incorporate external shocks, such as recession or regulatory changes, or inflation.

6.2 Absence of Competitive Landscape Change.

Industries evolve rapidly. Competitive pressure is influenced by new entrants, new technologies and consumer shifts. Failure to capture such dynamics may either inflate market share or underestimate threats to misvalue the result.

7. Failure in Working Capital Requirements.

7.1 The error of estimating liquidity requirements.

Cash working capital is very important in the maintenance of daily activities. Lack of working capital to the business can put the business at a risk of splintering. When analysts do not take into consideration this factor, they usually have projected cash flows that are not real in terms of operations.

7.2 Ignoring Capital Needs in the Seasons.

Companies including distributors or wholesalers might require short-term financing during high seasons. Lack of such reflections in the valuation models creates a partial account of financial resilience.

8. Excessive use of Industry Rules of Thumb.

8.1 Using Generic Multiples

Using broad multiples of valuation (e.g. 5x EBITDA) and not varying them to company-specific conditions results in shallow appraisals. Multiples should be increased in growth rate and margins and positioning based on competitive position and exposure to risk.

8.2 No consideration of Company-Specific Drivers.

A firm that has exclusive technology, a good company management, or strategic alliances could warrant to be sold at a premium. The failure to uphold these attributes will lead to underestimation and less bargaining power.

9. Inability to do Pre-Buyer or Investor Diligence.

9.1 Poorly documented and forecasted documents.

Due diligence reveals vulnerabilities in assumptions, compliance and financial controls. Firms that are not ready to face close ups may experience unpredictable fall in value.

A misalignment between narrative and numbers is present when an author focuses on a story or theory and draws conclusions based on generalizations and assumptions that lack support from actual evidence.<|human|>9.2 Misalignment of Narrative and Numbers Misalignment of narrative and numbers occurs when an author concentrates on a story or theory and makes conclusions on an unsupported basis of generalization and assumptions.

The investors require financial and strategic stories to be consistent. Growth stories that do not align with the underlying assumption of valuation rapidly destroy trust.

10. Not Engaging Professional Valuation Experts

10.1 Limited Internal Expertise

DIY valuation often leads to major business appraisal mistakes. The experienced valuers have market insights, regulatory knowledge and financial modeling skills and objective perspectives that the internal teams might not possess.

10.2 Compliance and Audit Risks

Professional valuations are in accordance with the IFRS, IVS, and financial reporting. In absence of expert validation, businesses will face difficulties in the process of auditing or negotiating with complex investors.

Conclusion to Top 10 Business Valuation Mistakes That Can Cost You Millions

The ten valuation traps should be avoided to preserve the business value and negotiating power. In competitive financial landscape, precision, transparency and strategic acumen characterize the perception of companies to investors, lenders and even prospective buyers. Understanding and managing these pitfalls listed in this article will enable businesses to go about the valuation process with increased confidence and better preparedness, as well as be more likely to succeed in a business long-term.