Learn PPA for Business Acquisitions

Purchase Price Allocation (PPA) Explained for M&A Transactions

Learn PPA for Business Acquisitions

M&As are such transformational events in corporate life that they change the market, unite competitive advantages, and form new value chains. However behind all transactions that involve success is a complicated process of financial accounting that defines how the purchase price is to be recorded and reported: the Purchase Price Allocation (PPA). To investors, CFOs and valuation experts, PPA is not a regulatory mandate per se, but it is the financial map that determines how the assets, liabilities, and goodwill of an acquired business are going to be measured and recognized.

This article explores PPA from a valuation perspective, detailing its conceptual foundation, practical execution, and strategic implications for deal structuring and post-acquisition reporting. In doing so, it clarifies how to apply purchase price allocation in mergers and acquisitions effectively and accurately in compliance with accounting standards while maximizing value transparency.

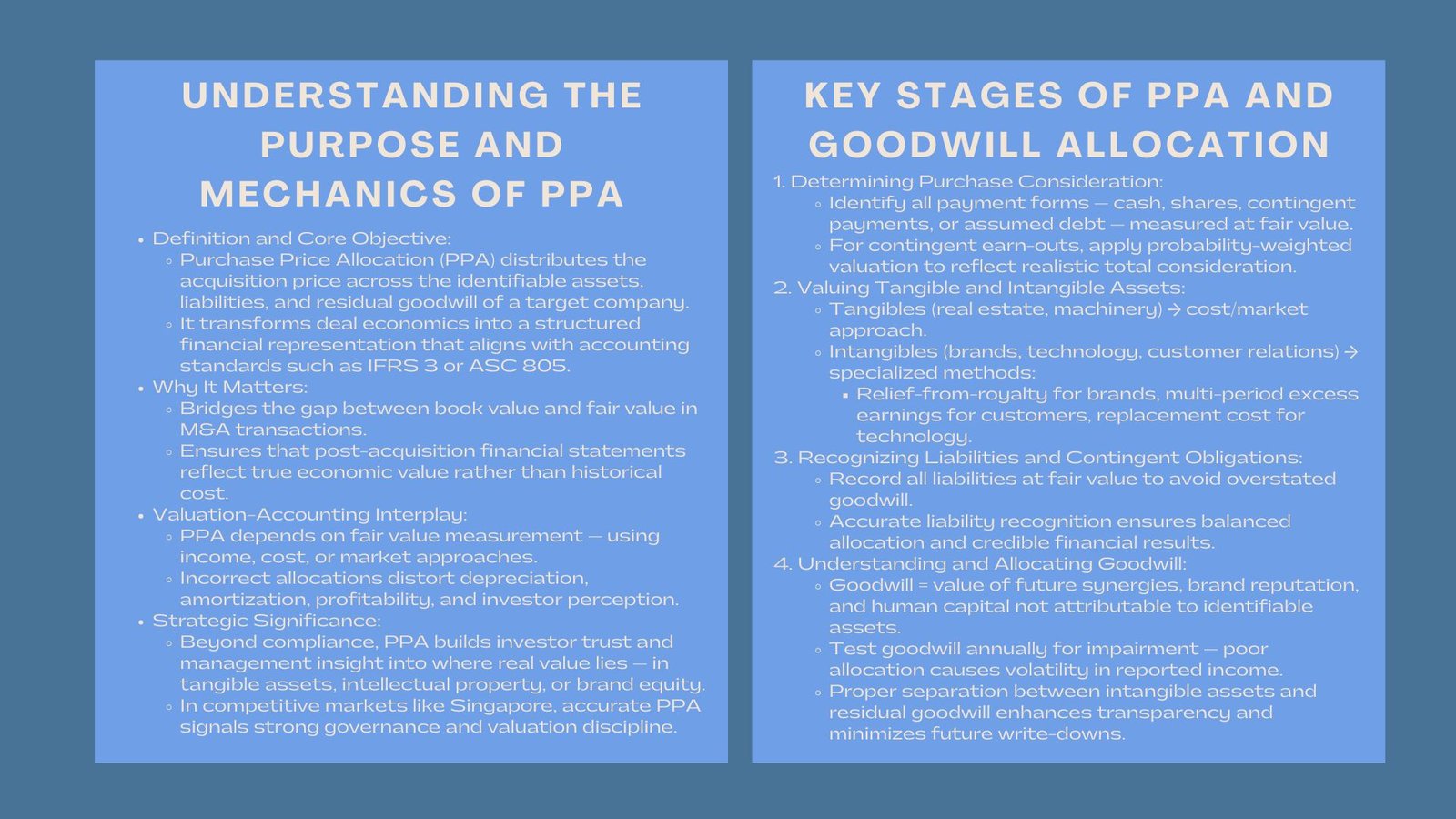

Understanding the Purpose and Mechanics of PPA

The Rationale Behind Purchase Price Allocation

In the case of a business acquiring another business, the price of the transaction is never close to the book value of the target. The reason behind this difference is that the acquisition price represents fair value with what the buyer thinks the business is worth and not historical cost. PPA attempts to fill this gap by apportioning the entire purchase price between identifiable tangible and intangible assets, liabilities and residual goodwill.

Under the business combinations under IFRS 3 (and other similar rules such as ASC 805 in the U.S.) all identifiable assets and liabilities should be recognized by the acquirer at fair value on the date of acquisition. This will make sure that the consolidated financial statements are made to represent the reality of the economy and not the legacy of accounting. PPA is therefore an important instrument of financial disclosure and investor trust which alters the economics of deals into a systematic system of valuations.

The Interplay Between Valuation and Accounting Standards

Practically, PPA demands the estimation of the fair values of identifiable assets like property, equipment, customer contracts, brands, patents, and technology that valuation specialists should perform. The assets of each class will require a specific approach, that is, either an income method, a market method, or cost method, depending on its nature and observability in the market.

Nevertheless, PPA is not a mere accounting exercise, but it is a valuation process based on strategic interpretation. These values affect depreciation, amortization and eventually post acquisition profits. The allocation of funds can be misplaced and this may skew the profitability, the tax payable and even the perception of investors. PPA is therefore the interface connecting financial reporting integrity and valuation accuracy.

The Strategic Significance for Acquirers

Other than compliance, PPA has strategic implications. A properly implemented allocation may promote transparency, investor confidence and post-deal integration. It enables the management to know where the real value lies, be it in any tangible assets, intellectual property or brand equity and match the resources.

To the competitive markets in Singapore, such as the private equity and corporate acquirers, efficient PPA analysis emerges as a source of competitive advantage, facilitating the communication of investment thesis and acquisition pricing decisions to the boards and regulators.

Key Stages of the Purchase Price Allocation Process

Determining the Purchase Consideration

Identification of total purchase consideration is the first step in PPA which is the sum paid to acquire the purchase. This could be in the form of cash, stock, contingent payment or assumed debt. All the components should be determined at fair value on the date of acquisition.

In complicated transactions, contingent or earn-out can be a source of uncertainty. To determine the present value of a contingent consideration, probability-weighted scenarios have to be evaluated by the valuation teams in such a manner that the total consideration reflects the number of times the valuation is likely to come into being.

Identifying and Valuing Tangible and Intangible Assets

After identifying and defining the consideration, an acquirer is to identify and measure all tangible and intangible assets acquired. Cost or market method is normally used to value tangible assets, including real estate, machinery, and inventory. Brands, customer relationships, technology, and trademarks are intangible assets that need a closer analysis.

The relief-from-royalty approach to brands, The multi-period excess earnings approach to customer relationships, and the replacement cost approach to technology are some of the approaches used by valuers. Such methods transform the future economic benefits to present value estimates, which enables the purchase price to be accurately allocated.

Recognizing Liabilities and Contingent Obligations

Liabilities should also be recorded at fair value such as debt, litigation provisions or the contractual obligations. The contingent liabilities are evaluated depending on the probability of occurrence of the outflows in the future and the uncertain items are disclosed based on this.

The relationship that exists between the asset valuation and liability recognition will define the remaining amount allocated to goodwill. This is an important step because the liabilities are misestimated and hence the overestimation of goodwill and subsequent impairment risks.

Goodwill and Intangible Asset Allocation

Understanding Goodwill in PPA

Goodwill is the value that is paid as future synergies are anticipated, reputation, human resources expertise, and future expansion which cannot be ascribed to measurable assets. It shows the confidence of the acquirer in the value creation that cannot be determined at the date at which the transaction was made.

Goodwill is however not amortized but is tested on an annual impairment basis. This implies that goodwill is overvalued and this can bring volatility in future incomes. The appropriate calculation of the amount of residual goodwill will make post-acquisition reporting realistic and defensible.

How to Allocate Goodwill and Intangible Assets in PPA

The process of determining how to allocate goodwill and intangible assets in PPA requires both art and science. Valuers must separate identifiable intangibles—such as brands or patents—from residual goodwill, avoiding overlap that could distort financial outcomes.

As an example, in case the customer relationships or proprietary software of the target have a material contribution to future cash flows, they must be specifically valued and classified as unique intangibles. The only goodwill that is left is the unquantifiable potential synergy. Such rigor brings in greater transparency and minimizes the risk of impairments in the long run.

Challenges in Measuring Intangible Assets

The intangible presents special valuation difficulties since the market lacks comparable full and dynamism of business model. Intellectual property, reputation, or digital platforms, which are often inimitable to measure but provide most of the value to the deal, are common to brand-driven companies, technology firms, and service providers.

Valuation of intangible assets is done using sophisticated modeling, sensitivity analysis and benchmarking in order to ensure that the certain values are an economic, as well as a market reality. This degree of precision has become a requirement of compliance and investor confidence in the Singapore economy which is increasingly innovation-led.

The Connection Between PPA and Post-Acquisition Financial Performance

Impact on Financial Statements

The results of the PPA flow are directly involved in financial reporting. The allocation forms the foundation to the future depreciation and amortization, which affect the profit margins and the tax planning. As an example, the increase in the recognition of more intangible assets leads to a higher expense of amortization, which makes profits less in the short-term but enhances transparency regarding economic asset life.

These post-acquisition effects are well observed by investors and analysts because they give insight on the valuation discipline as well as the performance of the management to execute the deal. Credibility and perception by the capital market can therefore be enhanced by providing transparent PPA reporting.

Tax and Regulatory Implications

Tax authorities tend to examine the results of the PPA particularly in terms of the depreciability and non-depreciability of the property. The discrepancies between accounting and tax valuation may have an impact on the deferred tax liabilities and deductions in future taxes.

In countries such as Singapore where regulatory systems promote transparency and adherence, it is highly important to have accurate documentation of PPA assumptions. To avoid any dispute or restatements in the future, cross-border acquirers should make sure that there is no mismatch between IFRS reporting and local taxes.

Linking PPA with Synergy Realization

PPA is never completed at accounting, but it tells post-merger integration. Identifying where value lies, be it in technology, relating to customers or in operational synergies, the management could therefore put a priority on integration efforts.

To illustrate, when customer relationships make a significant percentage of value allocated, taking retention strategies to the forefront of expected returns delivery becomes the order of the day. Through this, PPA becomes more of a forward-looking management tool rather than a backward-looking book keeping activity.

Advanced Considerations in Purchase Price Allocation

The Role of Fair Value Measurement

The essence of PPA is fair value estimation. The technical expertise and professional judgment is required to determine the market-consistent assumptions with regard to discount rates, growth expectations, and lives of assets. The independent valuation specialists are important in promoting objectivity and adherence to regulations.

The fair value measurement also enables the investor to know the way the management views the risk in assets and return potential. Honesty in approach instills confidence in stakeholders and minimizes the chances of impairment in the future or audit difficulties.

Integrating Brand and ESG Valuation in Modern PPA

The current M&A landscape is becoming more aware of the financial importance of the brand strength and environmental, social, and governance (ESG) issues. By integrating brand valuation and ESG within PPA, we will have a more comprehensive understanding of enterprise value.

An example is that a good brand name would support high prices and reduce customer acquisition expenditures, both of which can be measured and would benefit the intangible assets valuation. In like manner, firms that have strong ESG policies can have reduced risks of regulatory actions and are more resilient in the long run, which impacts valuation returns.

Technology and Data in PPA Execution

Valuation models that are technology-enabled have increased the accuracy of PPA. Real-time validation of assumptions and sensitivity analysis are possible due to advanced analytics, AI-driven forecasting and data visualization. By automating the PPA process, minimizing bias, and evidence trails, these tools give auditors transparent evidence trails.

Dynamic modeling can include fluctuations in customer behaviour, subscription data and scalability of the platform in a fast changing industry, which are essential inputs of digital intangibles.

The Evolving Landscape of PPA in Singapore

With the move to make Singapore a centre of regional M&A business, transparency and fair value reporting requirements as a regulator are increasingly becoming important. Businesses that use IFRS have to make sure that their PPA systems are of international standard coupled with the local market realities.

In this type of environment, independent valuation advisors are very instrumental to assist firms through a challenging accounting interpretation process, aligning expectations of various stakeholders, and justifying valuation procedures as a part of audit reviews. To cross-border investors, best practices in allocation of purchase price in mergers and acquisitions are now a competitive requirement, rather than a compliance requirement.

Conclusion

Purchase Price Allocation is not merely a mere accounting activity but it is a pillar of value management of post-acquisition. PPA influences the perceptions of investors, regulators, and the management about the success of any particular deal as they translate the acquisition prices into fair value insights.

A good PPA process identifies the intangibles, both tangible and identifiable, but also the strategic basis of goodwill. It combines financial accuracy and business rationality and aligns reporting results with the long-term strategic purpose.

In the case of organizations that are involved in M&A, especially in a volatile market such as Singapore, having a perfect mastery of the PPA process would not only guarantee compliance but also credibility. When managed with discipline and disclosure, PPA makes a transaction appear as an unequivocal, justifiable narration of value creation and strategic development.