Step-by-Step Guide to Choosing the Right Valuation Method for Your Business

Step-by-Step Guide to Choosing the Right Valuation Method for Your Business

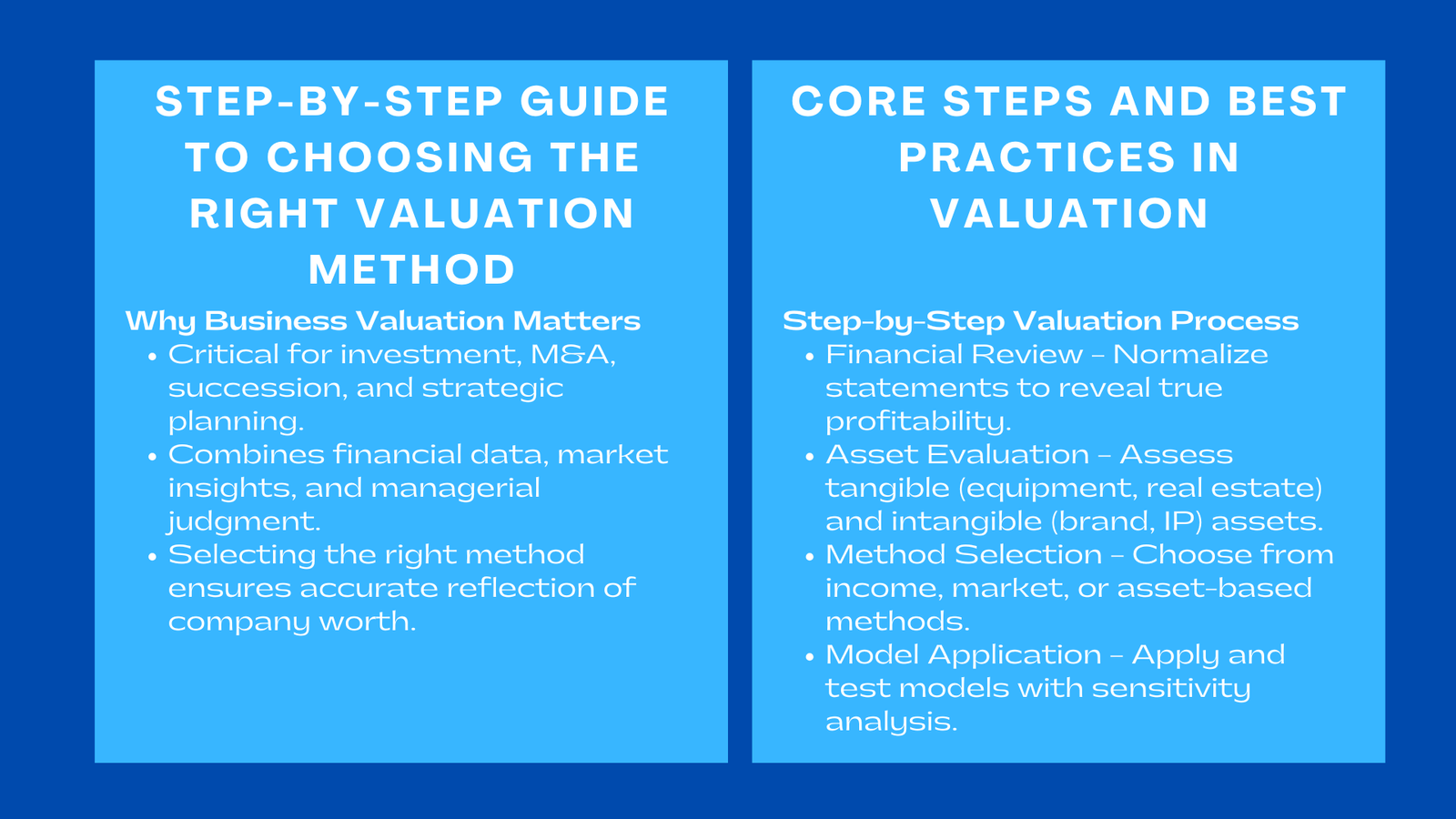

Understanding how to properly value a business is one of the most critical skills in modern financial management. Whether the goal is to attract investors, prepare for a merger or acquisition, plan for succession, or simply understand a company’s financial standing, valuation plays an essential role in informed decision-making. The process, however, is not merely a mathematical exercise—it is a strategic framework that integrates financial data, market insights, and managerial judgment.

Selecting the right valuation method step-by-step business valuation process for SMEs is the foundation of this process. A correct choice ensures that the derived value accurately reflects the company’s true worth, growth potential, and risk exposure. In contrast, applying the wrong approach may distort financial interpretation and lead to costly misjudgments. Therefore, a systematic understanding of how to identify, assess, and apply suitable valuation methodologies is indispensable for every business leader and financial professional.

The Relevance of a Structured Valuation Approach

Clarifying the Purpose of Valuation

Every valuation begins with a purpose. The reason behind conducting a valuation determines not only the scope of analysis but also the methodology that should be applied. A valuation intended for raising venture capital, for instance, differs significantly from one prepared for liquidation or taxation. When the purpose is investment-oriented, analysts tend to focus on forward-looking approaches such as the income or market method, both of which emphasize potential future returns. Conversely, when valuations are used for accounting or compliance purposes, asset-based approaches are more appropriate, as they provide a snapshot of the company’s tangible and intangible resources. In the context of business valuation Singapore ValueTeam services, understanding the purpose ensures that each valuation aligns with regulatory expectations and accurately reflects the company’s financial objectives.

Clarity of purpose brings discipline to the valuation process. It prevents analysts from overemphasizing certain assumptions and ensures that every calculation directly supports the intended business objective. Without defining this purpose, a valuation can easily lose direction and produce results that lack credibility or strategic relevance.

Understanding Business Characteristics and Lifecycle

Just as no two businesses are identical, no single valuation method applies universally. The characteristics of the company—its size, stage of growth, industry, and risk profile—determine which methods are most suitable. Startups, for example, often lack historical financial data, making it difficult to apply traditional income-based valuations. For them, projections and comparable market data become crucial indicators of potential value. Established companies, on the other hand, have stable financial records and operational consistency, allowing analysts to rely more heavily on discounted cash flow (DCF) and asset-based approaches.

Recognizing these distinctions is vital. It allows analysts to balance quantitative precision with contextual understanding, ensuring that valuation outcomes remain both defensible and realistic within the company’s operational framework.

Basic Steps in Business Valuation

Step One: Conducting a Comprehensive Financial Review

The first operational step in any valuation is performing a rigorous financial assessment. Analysts begin by collecting key financial documents, including balance sheets, income statements, and cash flow statements from the previous years. These documents provide the foundation for understanding profitability, liquidity, and long-term financial stability. However, before analysis begins, it is essential to normalize these statements.

Normalization involves adjusting financial data to eliminate anomalies—such as one-time revenues, extraordinary expenses, or owner-specific benefits—that distort a company’s sustainable earnings. Through this process, analysts uncover the core profitability of the business, revealing its true economic performance. A properly normalized financial base enables accurate projections and strengthens the reliability of valuation results.

Step Two: Evaluating Tangible and Intangible Assets

A thorough valuation cannot ignore the dual structure of business assets. Tangible assets, including equipment, real estate, and inventory, are relatively easy to measure because they have observable market prices. Intangible assets, however, are more abstract but often more valuable. These include intellectual property, patents, proprietary software, trademarks, and brand reputation—all of which can significantly influence a company’s long-term profitability.

For companies in innovation-driven industries, intangible assets may represent the majority of enterprise value. Advanced valuation methods such as the relief-from-royalty approach or the excess earnings method are often employed to quantify these assets. By integrating both tangible and intangible evaluations, a more comprehensive and realistic value can be achieved, bridging the gap between balance-sheet figures and market perception.

Step Three: Selecting the Appropriate Valuation Method

Once financial data is validated and assets are clearly understood, the next task is to select the valuation method. The three most widely recognized approaches are the income, market, and asset-based methods.

The income approach, most notably represented by the discounted cash flow (DCF) model, estimates the present value of future cash flows. This method is highly effective for companies with stable and predictable earnings. The market approach determines value by comparing the company to similar businesses that have been sold or are publicly traded, using valuation multiples such as price-to-earnings or enterprise value-to-revenue ratios. The asset-based approach calculates value based on the net worth of a company’s assets after deducting liabilities, making it suitable for asset-intensive businesses or liquidation scenarios.

Selecting among these methods requires critical judgment. Factors such as data availability, industry volatility, and the specific purpose of valuation guide the final choice. In practice, analysts often employ more than one method to cross-verify results and ensure consistency.

Step Four: Applying and Testing the Valuation Model

After selecting a method, analysts proceed to the application stage. Here, accuracy and technical discipline are crucial. Income-based valuations require detailed cash flow projections and an appropriate discount rate that reflects both the company’s cost of capital and industry risk. Market-based valuations demand careful identification of comparable companies and adjustments for scale, growth rate, and geographic differences.

Once calculations are complete, the next critical step is sensitivity analysis. By testing how changes in key variables—such as growth assumptions, discount rates, or cost structures—affect the final outcome, analysts can determine the robustness of their valuation. Sensitivity and scenario analysis provide decision-makers with a range of possible outcomes, rather than a single rigid figure, enabling better risk assessment and strategic planning.

Step Five: Interpreting and Documenting the Results

The interpretation stage transforms numerical output into strategic insight. A valuation figure alone means little without context; it must be supported by a clear understanding of what drives that value. Analysts and executives should examine which components—revenue growth, asset efficiency, or intangible strength—contribute most significantly to valuation outcomes.

Equally important is documentation. A well-documented valuation report outlines the assumptions used, the methodology applied, and the rationale behind each decision. This transparency not only enhances credibility but also allows investors, auditors, or potential buyers to trace the logic behind the valuation. Comprehensive documentation turns a technical report into a persuasive strategic instrument.

Recognizing and Avoiding Common Valuation Errors

Overestimating Growth and Ignoring Risk

One of the most common pitfalls in business valuation is the tendency to overestimate growth potential. Ambitious projections may please stakeholders temporarily but ultimately undermine credibility if they fail to materialize. Similarly, disregarding industry risks or macroeconomic uncertainties can skew valuations significantly. Analysts must ensure that assumptions about future growth remain grounded in market realities, supported by data-driven forecasts and sensitivity testing.

Neglecting Intangible Assets or Liabilities

Another frequent error is focusing exclusively on tangible assets while underestimating intangible contributions such as brand equity or intellectual property. These elements often drive competitive advantage and future profitability. Conversely, ignoring contingent liabilities or hidden operational risks can lead to inflated valuations. A balanced approach that integrates both assets and liabilities—tangible and intangible—ensures a more accurate reflection of overall business worth.

Using a Single Method Without Cross-Validation

No single valuation method provides a complete picture. Solely relying on one approach increases the risk of bias. Best practices recommend using multiple methods to triangulate results, identify discrepancies, and refine assumptions. This cross-validation process not only enhances reliability but also provides a broader strategic understanding of how different factors interact to determine value.

Turning Valuation Insights into Strategy

Valuation is not an end in itself—it is a foundation for strategic decision-making. By interpreting valuation outcomes correctly, business leaders can identify where value is being created or eroded within their organization. For instance, if most of a company’s value derives from brand strength or customer loyalty, management may prioritize marketing and innovation to reinforce these advantages. Alternatively, if valuation reveals inefficiencies in asset utilization, operational improvements or restructuring may be warranted.

Regular valuation exercises also allow businesses to monitor performance over time, benchmark against competitors, and anticipate investor expectations. By embedding valuation practices into ongoing management processes, companies develop a culture of financial awareness that supports sustainable growth.

Advantages of an Effective Valuation Framework

Enhancing Financial Mastery and Decision-Making

Mastering valuation equips professionals with the analytical rigor needed to navigate complex financial decisions. A well-chosen valuation method sharpens the understanding of value drivers, improves negotiation outcomes, and strengthens the ability to justify strategic investments.

Increasing Credibility with Stakeholders

Transparent, well-documented valuations inspire confidence among investors, lenders, and regulatory authorities. They demonstrate professionalism, reduce ambiguity, and build trust—essential factors in high-stakes financial discussions.

Driving Organizational Strategy

At the organizational level, accurate valuation fosters better resource allocation and capital efficiency. It aligns strategic initiatives with measurable financial objectives and enables leadership to make evidence-based decisions grounded in economic reality.

Conclusion to Step-by-Step Guide to Choosing the Right Valuation Method for Your Business

Choosing the right valuation method for your business is both a technical discipline and a strategic art. The process begins with defining purpose, analyzing how to choose the best valuation method for startups and established companies business characteristics, and validating financial data. It continues through careful selection and application of valuation methodologies, followed by interpretation, documentation, and cross-verification.

Ultimately, a sound valuation framework empowers businesses to make informed, confident decisions. It bridges the gap between numbers and strategy—turning financial data into actionable insight. When executed with precision and foresight, valuation becomes more than a financial exercise; it becomes a roadmap for growth, resilience, and long-term success.