Common Pitfalls in the Business Valuation Process and How to Avoid Them

Common Pitfalls in the Business Valuation Process and How to Avoid Them

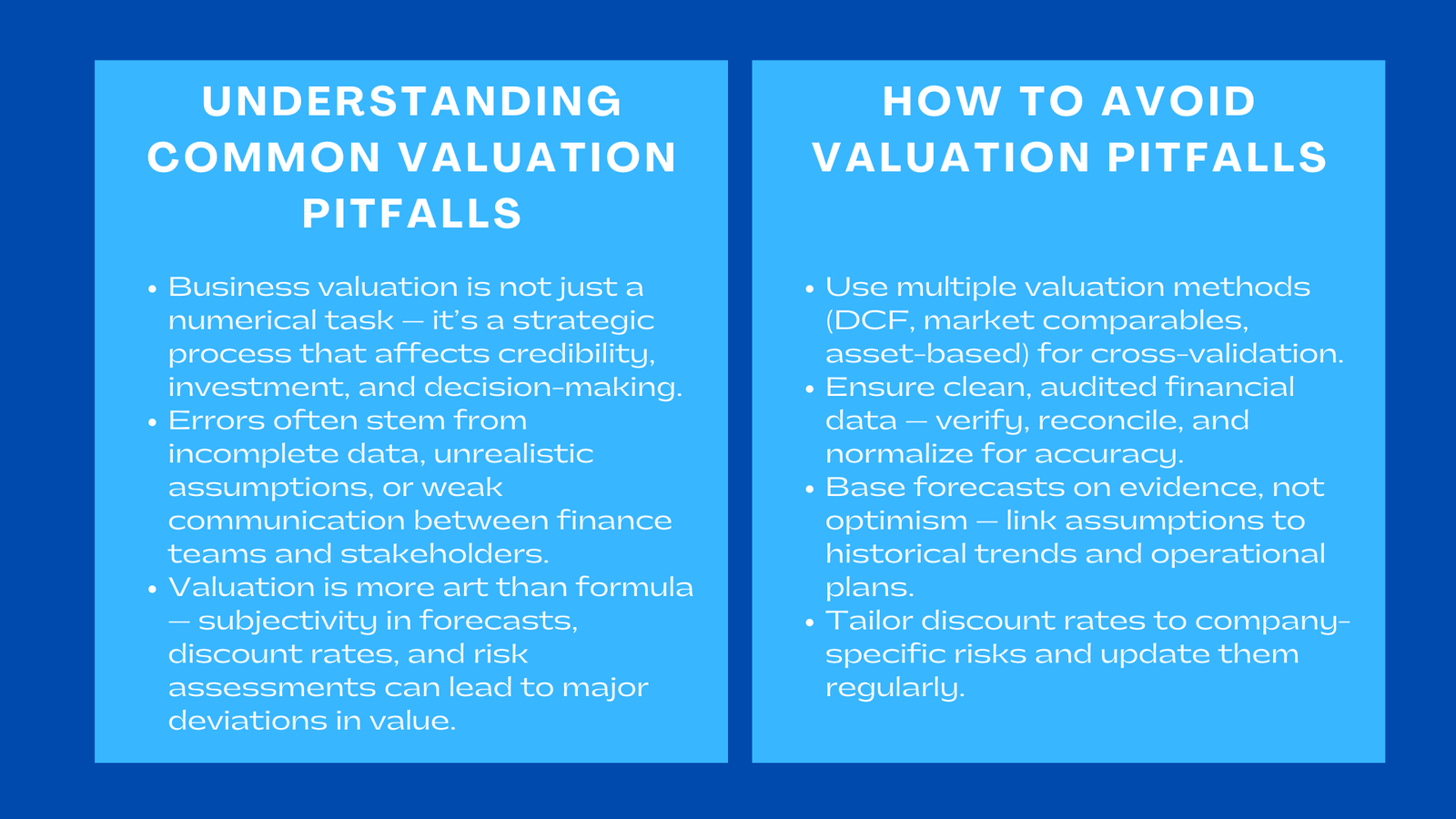

A business valuation represents one of the most complex and consequential exercises in corporate finance. Whether performed for mergers and acquisitions, investment rounds, shareholder restructuring, or financial reporting, the outcome directly influences strategic decisions and financial credibility. Yet despite advances in modeling and data availability, valuation errors remain surprisingly common. These pitfalls often arise not from lack of technical skill but from incomplete data, flawed assumptions, or poor communication between finance leaders and stakeholders.

For CFOs and valuation professionals, understanding these common pitfalls is essential to safeguarding both analytical integrity and stakeholder confidence. The valuation process is not simply about arriving at a number; it is about ensuring that number reflects common business valuation mistakes and pitfalls economic reality, withstands scrutiny, and aligns with the company’s strategic trajectory. By identifying where most valuations go wrong and establishing preventive measures, organizations can elevate their financial decision-making from reactive to proactive.

The Complexity and Subjectivity of Valuation

Why Valuation Is More Art than Formula

Valuation is often perceived as a mathematical exercise, but in practice it is an interpretive art grounded in both analysis and judgment. Financial models can quantify the mechanics of value — revenues, margins, and discount rates — yet the real challenge lies in selecting appropriate assumptions and understanding their implications. Two analysts can use identical models and arrive at vastly different results depending on their outlook on growth, risk, or market conditions. This is why engaging professional business valuation services Singapore is essential, especially for identifying and avoiding common pitfalls that can impact accuracy and strategic outcomes.

This inherent subjectivity makes valuation vulnerable to bias and misinterpretation. Over-optimistic assumptions can inflate value unrealistically, while excessive conservatism can lead to undervaluation that hampers strategic opportunities. A disciplined valuation process requires balancing analytical precision with the ability to question and validate every underlying assumption.

The Stakes of Getting It Wrong

The consequences of valuation mistakes can be severe. Overvaluation may result in overpayment for acquisitions, mispriced equity issuances, or unrealistic investor expectations. Undervaluation, on the other hand, can lead to lost funding opportunities, undervalued employee stock options, or weakened negotiating power. In both cases, credibility suffers.

For CFOs, ensuring valuation accuracy is therefore not merely a compliance exercise — it is a strategic responsibility that affects capital efficiency, stakeholder trust, and long-term corporate reputation.

Pitfall One: Using Incomplete or Inaccurate Financial Data

The Dangers of Poor Data Integrity

The most fundamental error in any valuation process begins with unreliable financial data. Missing documentation, outdated numbers, or inconsistent accounting treatments can lead to distorted conclusions. If revenue recognition policies differ across periods or expenses are misclassified, even the most sophisticated valuation model will produce unreliable results.

For example, a company that capitalizes certain costs one year and expenses them the next may appear more profitable in one period and less in another, creating an illusion of volatility. Without normalization, these inconsistencies mislead analysts into misjudging sustainable earnings.

Ensuring Data Validation and Consistency

CFOs must implement robust data validation procedures before initiating any valuation. This includes reconciling all financial statements, reviewing audit adjustments, and cross-checking figures with management reports. It is equally important to ensure that financial data aligns with operational metrics such as sales volumes or production output. When discrepancies arise, they should be investigated and explained transparently.

Accurate data does not just support valuation credibility — it signals organizational discipline and financial maturity to investors and external reviewers.

Pitfall Two: Overreliance on a Single Valuation Method

The Risk of One-Dimensional Analysis

Relying solely on one valuation approach — whether discounted cash flow (DCF), market multiples, or asset-based valuation — can yield misleading conclusions. Each method captures value from a different perspective, and none is universally applicable. A DCF model might overstate value if forecasts are overly optimistic, while a market-based approach might undervalue a company during sector downturns.

A one-dimensional analysis ignores the broader context and increases the risk of anchoring bias, where decision-makers become fixated on a single figure rather than considering a range of possible values.

Integrating Multiple Methods for Cross-Validation

The best practice is to triangulate results using multiple valuation approaches. For instance, comparing a DCF outcome with market comparables and precedent transaction multiples helps reveal inconsistencies or confirm reliability. Large discrepancies between methods should trigger a re-examination of assumptions rather than a forced average.

Cross-validation not only strengthens analytical robustness but also enhances stakeholder confidence that the valuation reflects both intrinsic fundamentals and external market realities.

Pitfall Three: Unrealistic Financial Forecasts

Optimism Bias and Forecast Inflation

One of the most common valuation pitfalls stems from over-optimistic forecasts. Management teams often project aggressive revenue growth or margin expansion without sufficient evidence, driven by ambition, investor pressure, or simple optimism bias. These inflated forecasts inflate valuation results, which later prove unsustainable when actual performance falls short.

This bias is particularly prevalent in startups or high-growth industries, where narratives of disruption often overshadow grounded financial analysis. Even established companies may fall into the trap of assuming past success guarantees future stability.

Building Credible, Evidence-Based Forecasts

Avoiding this pitfall requires rigorous validation of forecast assumptions. CFOs should base growth projections on tangible drivers — such as historical performance, market share trends, pricing strategies, or new product pipelines. Each assumption must be documented, benchmarked against industry data, and stress-tested under alternative scenarios.

By demonstrating that forecasts are both achievable and evidence-based, CFOs create valuations that withstand scrutiny from auditors, investors, and potential buyers.

Pitfall Four: Misestimating the Discount Rate

The Discount Rate’s Critical Role in Valuation

In a discounted cash flow analysis, the discount rate serves as the bridge between future value and present worth. Small changes in this rate can dramatically affect the final valuation outcome. Yet many analysts miscalculate it by relying on generic or outdated assumptions.

Common mistakes include using an industry-average weighted average cost of capital (WACC) without adjusting for company-specific risk, or applying the same discount rate across business units with different risk profiles. Inaccurate discount rates either overstate or understate value, undermining the credibility of the entire analysis.

Tailoring the Discount Rate to Risk Profile

The correct approach is to calculate the discount rate based on the company’s actual cost of capital and risk factors. This involves estimating the cost of equity using the capital asset pricing model (CAPM), adjusting beta for industry and leverage, and incorporating risk premiums for factors such as country exposure, size, or illiquidity.

Regularly updating these parameters to reflect current market conditions ensures that valuation outcomes remain realistic and defensible. Transparency in how the discount rate is derived further enhances stakeholder trust.

Pitfall Five: Ignoring Non-Financial and Intangible Factors

The Invisible Drivers of Value

Traditional valuation models often focus narrowly on financial metrics, overlooking intangible assets such as brand equity, intellectual property, customer loyalty, and human capital. In today’s economy, these assets frequently account for the majority of enterprise value.

Ignoring them leads to significant undervaluation, especially in industries driven by innovation, digital presence, or customer experience. For example, a software firm’s patents or a luxury brand’s reputation may be far more valuable than their tangible assets, yet they often remain underrepresented in valuation models.

Quantifying Intangibles with Modern Methods

CFOs can avoid this oversight by incorporating intangible asset valuation techniques such as the relief-from-royalty, multi-period excess earnings, or cost-replacement approaches. These methods translate intangible benefits into quantifiable financial terms.

Beyond measurement, intangibles must also be integrated into strategic discussions. Demonstrating how intangible assets contribute to sustainable growth strengthens both valuation accuracy and investor confidence.

Pitfall Six: Overlooking Working Capital and Cash Flow Dynamics

The Misinterpretation of Profitability

A common analytical error arises when profitability is mistaken for liquidity. Many valuations focus heavily on earnings metrics like EBITDA while neglecting the impact of working capital and cash conversion cycles. A company may report strong profits but experience poor cash flow due to rising receivables or inventory buildup.

If these dynamics are not incorporated into the valuation model, the resulting enterprise value can be overstated. Investors and buyers ultimately value cash flows, not accounting profits.

Embedding Realistic Cash Flow Assumptions

CFOs should conduct detailed working capital analysis to ensure forecasts reflect realistic cash generation patterns. Historical trends in receivable days, payable terms, and inventory turnover provide critical insight into liquidity. Including these factors in cash flow projections ensures that valuation outcomes mirror economic, not just accounting, performance.

Pitfall Seven: Ignoring Market Context and External Benchmarks

Valuation in Isolation

Another major pitfall occurs when valuations are conducted without considering broader market dynamics. A model may produce an internally consistent value that nonetheless deviates drastically from prevailing market multiples or transaction benchmarks. When presented to investors, such outlier valuations invite skepticism.

Failing to reconcile intrinsic valuation with market evidence can also result in missed opportunities — for instance, undervaluing a business during periods of high investor appetite or overvaluing it in a bearish environment.

Benchmarking and Market Reconciliation

To avoid this error, CFOs should always compare intrinsic results to external references such as peer company multiples or recent industry transactions. Any deviations should be analyzed and explained logically. This reconciliation process not only validates the valuation but also ensures alignment with investor expectations and market sentiment.

Pitfall Eight: Poor Documentation and Transparency

The Cost of Insufficient Disclosure

Even when a valuation is technically sound, lack of documentation can undermine its credibility. Without clear records explaining assumptions, methodologies, and data sources, reviewers cannot verify the reasoning behind results. This lack of transparency breeds mistrust and weakens the valuation’s defensibility in audits, negotiations, or litigation.

Incomplete documentation also impedes future updates or internal reviews. If key assumptions are undocumented, the company must recreate the logic from scratch each time the valuation is revisited.

Best Practices for Documentation and Review

Every valuation should include a transparent report outlining purpose, scope, methodologies, assumptions, sensitivity analyses, and limitations. Supporting data — such as financial statements, market comparables, and risk calculations — should be referenced and archived systematically.

Periodic peer reviews or external validations further strengthen the reliability of valuation reports. Transparency transforms valuation from a static deliverable into a continuous learning tool for both finance teams and executive leadership.

Pitfall Nine: Communication Gaps with Stakeholders

Misalignment Between Finance and Management

Valuation errors frequently arise not from faulty calculations but from miscommunication. CFOs may conduct analyses in isolation, failing to align assumptions with operational realities or strategic plans. Likewise, management teams may provide forecasts without understanding how valuation models interpret them.

This misalignment results in inconsistencies that erode credibility during review. For example, a CFO may assume stable margins while operations anticipates rising input costs, leading to projections that fail to reflect reality.

Establishing Collaborative Valuation Governance

To prevent such disconnects, CFOs should establish cross-functional valuation committees involving finance, operations, and strategy leaders. Regular communication ensures that assumptions are aligned, validated, and updated as conditions change. Collaborative valuation governance turns valuation from a technical exercise into a shared strategic discipline.

Conclusion to Common Pitfalls in the Business Valuation Process and How to Avoid Them

Business valuation is a delicate balance between quantitative rigor and qualitative judgment. Each stage — from data collection to assumption setting and communication — presents potential pitfalls that can distort outcomes or erode trust. Recognizing these risks is the first step toward mastering them.

For CFOs and valuation professionals, the path to accuracy lies in disciplined processes: ensuring clean financial data, validating assumptions, using multiple how to ensure accurate company valuation methods for cross-checking, and integrating both tangible and intangible drivers of value. Equally important is transparent communication and documentation, which transform valuation from a black-box exercise into a credible strategic tool.

Avoiding these common pitfalls does more than improve valuation accuracy; it strengthens organizational integrity. In an era where investors demand accountability and markets reward transparency, the CFO’s ability to conduct precise, defensible valuations stands as a defining hallmark of financial leadership