Learn How To Value Companies Using AI

AI-Driven Transformation in Modern Company Valuation: Understanding Company Valuation What Is and the Future of Digital Valuation Models

Introduction to Learn How To Value Companies Using AI

In the current fast changing financial environment, what is company valuation has grown in importance as organisations, investors and analysts make strategic decisions based on the right valuation. The business executives no longer have the choice to stick to the old-fashioned methods of financial modelling, particularly the technology is already taking a new form in the way value is evaluated and estimated.

Valuation has entered a new wave of precision and efficiency with the development of business valuation using AI, which is enabled through the development of automation, machine learning, and predictive analytics. Firms are also investigating the use of AI in valuing companies as a complement or addition to the traditional approaches, as analysts test the use of hybrid models combining past financial metrics, real-time operational data and industry-specific risk factors.

With the world going digital, the use of company valuation based on AI is rapidly increasing, allowing the decision-makers to operate the valuation models that are not only faster, more flexible, and transparent than the valuation models used in the past decades. Knowing the history of the company valuation and the role of artificial intelligence to redefine it is something one must know when working in the field of finance, investment, and company strategy.

Understanding Company Valuation: What It Really Means

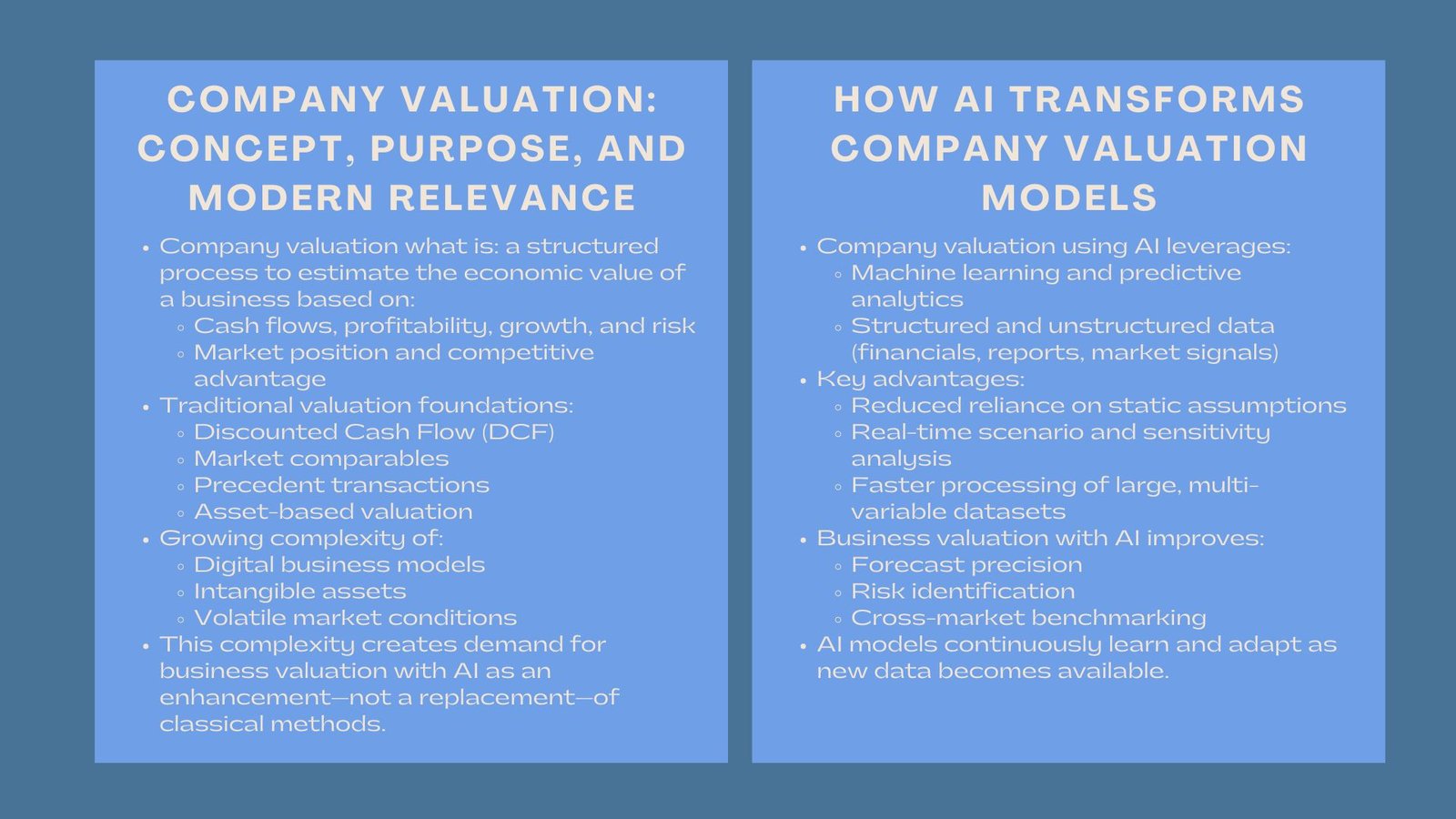

Financial decision-making is based on the underlying question of company valuation what is. Company valuation is an organised procedure to arrive at the reasonable economic worth of an organisation through evaluating assets, revenues, profitability, market status, growth opportunities and risk exposure. Conventionally, valuation deals with accepted procedures which include discounted cash flows analysis, market comparables, precedent transactions, and asset based valuation. Such methods are still fundamental, yet they are more and more being supplemented by technology-based valuation techniques which are more informative and more accurate.

The old principles of valuation continue to be important- cash flow, earnings stability, competitive advantage, and capital structure continue to play a major part. The intricacies of the contemporary markets, digital business models, and intangible assets, however, have rendered the traditional models inefficient unto themselves. Here, the next-generation tools, such as business valuation with AI, provide the significant benefit of allowing the analyst to work with large and multidimensional datasets that were previously hard to include in the forecast of valuations.

The Role of Artificial Intelligence in Modern Valuation

The introduction of artificial intelligence into valuation procedures has completely transformed the manner in which organizations are observed. In the framework of company valuation using AI, organisations can get models that can assess thousands of variables at a time and find correlations and risk indicators, which can be overlooked by human analysts. AI based valuation tools consume both structured and unstructured data, including financial reports and market standards, customer perception, supply chain, macroeconomic trends, and industry-specific performance indicators.

Machine learning algorithms are continually enhanced, as new data patterns are used to increase predictions. This renders business valuation using AI a potent complement to conventional valuation expertise, particularly in markets where volatility, technological dislocation or sectoral innovation have an impact on price behaviour. The value assignments to companies are dynamic, not static, and thus it is dynamic as the market conditions change in real time.

How AI Enhances Accuracy and Efficiency in Valuation

Another major benefit of company valuation using AI is the increased accuracy of analysis. The conventional models are significantly based on assumptions- growth rates, discount rates, profitability projections and risk factors. The AI-controlled valuation makes fewer general assumptions since it rather leverages the real market signals and the past trends to make predictions. This will enable more based and evidence-based valuation conclusions.

AI also delivers efficiency. There is no need to take weeks of manual data collection, reconciliation, and scenario modelling to do tasks that can now be accomplished in minutes. Natural language processing (NLP) systems have the ability of reviewing annual reports, regulatory filings, competitor disclosures, and market reports in order to extract information. Machine learning models are capable of calculating thousands of valuation cases at once and provide analysts with a better understanding of sensitivity and risk correlations.

The pull of AI-driven company valuation is particularly high in the case of industries that have a complicated data environment, including technology, energy, real estate, and financial services. AI enables analysts to manage high amounts of intangible asset data, business metrics, and industry standards in a better manner.

AI and the Evolution of Intangible Asset Valuation

To know the value of companies today, it is necessary to realize that much value today has been placed in intangibles. The contribution of intellectual property, patents, software platforms, brand equity and customer information to modern enterprise value is greater than the value of physical assets. Conventional valuation models find it difficult to represent this value.

The intangible analysis of assets is more dependable with AI business valuation. Digital engagement metrics, brand visibility, customer behaviour, proprietary technology performance, and innovation pipelines can be analyzed with AI algorithms to determine what role they played in the creation of long-term value. Predictive analytics are more efficient in identifying the future income potential of intangible assets compared to the manual technique.

This change is particularly applicable in the case of technology, biotechnology, digital services and e-commerce where value is more and more based on non-physical capabilities. AI assists in measuring the interaction of these assets, competitive advantage building, and value creation over time.

Real-World Applications of AI in Company Valuation

There is use of AI-driven valuation tools in industries in mergers and acquisitions, financial reporting, strategic planning, investment, and due diligence. Companies based on AI to test company valuation can promptly calculate the prospective acquisition targets, uncover concealed dangers, and compare corporate performance more efficiently.

AI-based valuation models are applied in investment firms to forecast market cycles and undervalued or high growth companies. The corporate finance departments use AI to automatize their business planning and budgeting processes and align their valuation models with real-time operation data. In the meantime, AI is incorporated into valuation services offered by consulting firms to enhance analytical services and make better decisions.

The infinite valuation of companies with AI indicates a wider innovation to digital finance where a constantly growing number of strategic decisions are made based on data.

Challenges and Considerations in AI-Driven Valuation

Although it has its benefits, AI-enhanced valuation has new challenges. The concept of valuation of the company nowadays implies the awareness of both the benefits and the drawbacks of the new digital tools. The availability of AI models is as good as the information they hold. Unfinished, partisan or unreliable data will lead to a poor outcome. There is also a question of transparency since certain machine learning models are black boxes and there is little insight about how they arrive at calculations.

AI-based financial analysis regulatory structures are a developing phenomenon. Businesses embracing the use of AI in business valuation should ensure that they meet the standards of reporting, audits, and ethical provisions. To analyze, machine analysis still needs human judgment; it is a question of professional experience to read between the lines, to question assumptions and to make sure that results are in line with the strategic goals.

The Future of AI in Corporate Valuation

Over the next decade, company valuation using AI is expected to become a mainstream component of corporate finance. With the development of AI models, valuation information will be more predictive, adaptive, and connected to financial reporting mechanisms. The automated scenario simulations, multi-factor forecasting of risks, and cross-market benchmarking will be made available to analysts at a speed and scale never before seen.

Innovations in the future can involve self-valuation systems, ongoing valuation dashboard and industry-specific AI, which will be trained on dynamic global information. Early adopters of AI-enhanced valuation will have a vast competitive edge in their opportunities analysis, risk management, and value creation on a long-term basis.

Conclusion

In a data-driven, digital transformation, and competitive complexity era, to know what company valuation needs, one must have a wider outlook that utilizes the traditional financial approach alongside the new AI-based technologies. The increasing use of business valuation using AI, along with the practical uses of company valuation using AI, is an example of how machine learning and predictive analytics are transforming the future of financial decision making.

With organisations further enjoying the development of advanced tools and approaches, the task of company valuation with the help of AI will play the key role in the strategic planning process, the analysis of investments, and the positioning in the market. Those companies that adopt AI-powered valuation will be in a better position to sail through uncertainty and open new opportunities, as well as create sustainable value in the future.