Understanding Company Worth Valuation Program

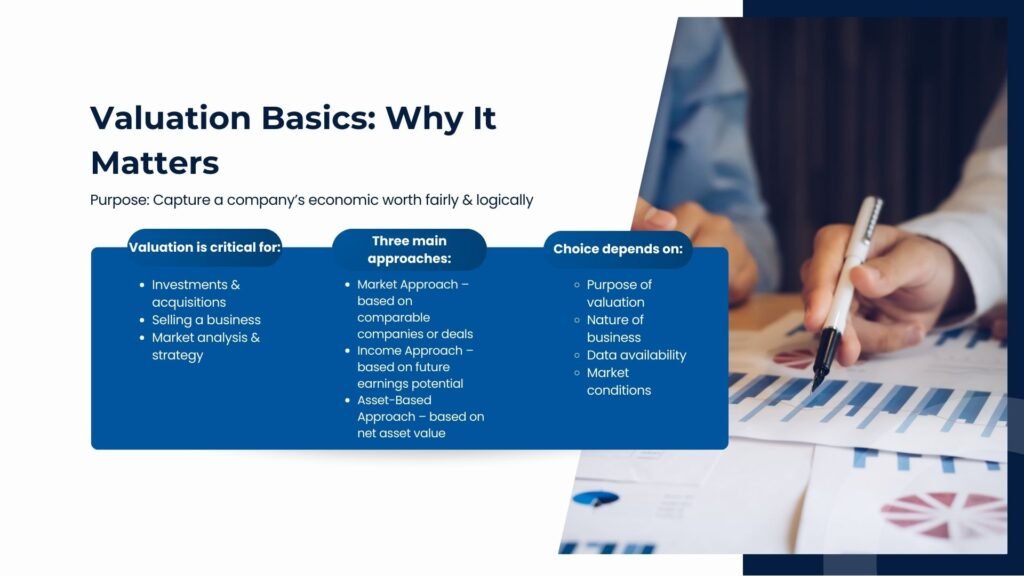

Introduction to Business Valuation: Understanding Company Worth Guide on Understanding Company Worth Valuation Program In the contemporary business world characterized by a high level of dynamism, it is important that investors, entrepreneurs and corporate leaders understand the true worth of a particular company. Regardless of whether you are intending to sell a business, raise capital […]

Complete Guide to Company Valuation Methods and Approaches

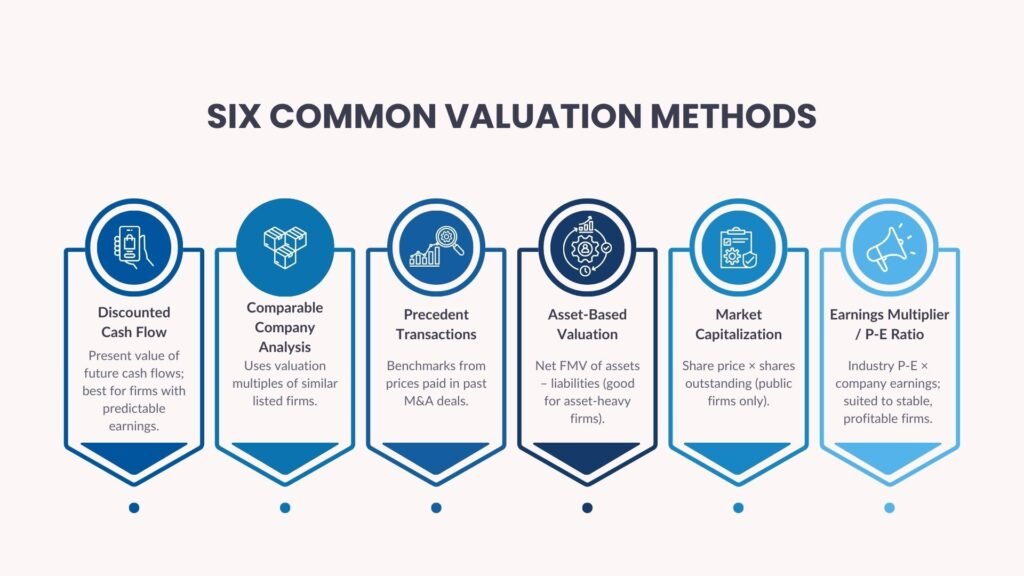

Learn the Complete Guide to Company Valuation Methods and Approaches Financial decision-making, investment strategies and valuation of corporate transactions are based on it. The valuation process can be concerned with arriving at a value-ascertainment of a start-up or an intentional acquisition transaction or approximating the value of a shareholder equity. Valuation means are essential. The […]

What is Company Valuation and Why it Matters

Learn What is Company Valuation and Why it Matters This knowledge of the value of a company has become essential to many stakeholders; including the investors and acquirers as well as the internal managers and regulators of the economy. Valuation of companies is the analysis of economic value of a company or unit within the […]

Company Valuation with 6 Key Approaches

Understand Company Valuation with 6 Key Approaches Valuation of a company is an imperative aspect when making a sound direction on mergers and acquisitions, investment analysis and financial reporting. Being a buyer, seller, or investor, or owning a business comes with the potential knowledge of how to evaluate the worth of a company to help […]

How to Value a Private Company Using Income Approach in Singapore

Learn How to Value a Private Company Using Income Approach in Singapore The calculation of the value of a privately owned company is much different than that of a publicly owned. It seldom happens that a business trade is publicly sold on the market, and it is also not easy to know the real value […]

How to Calculate Company Value

Understanding How to Calculate Company Value One of the core aspects of finance involves determining the value of a company, in a M&A transaction, raising funds, in all strategic planning efforts, and investor due diligence. The appropriate valuation can make a difference in the prices negotiated, the amount of capital, and even growth of the […]

Importance of Valuation Before Selling Company

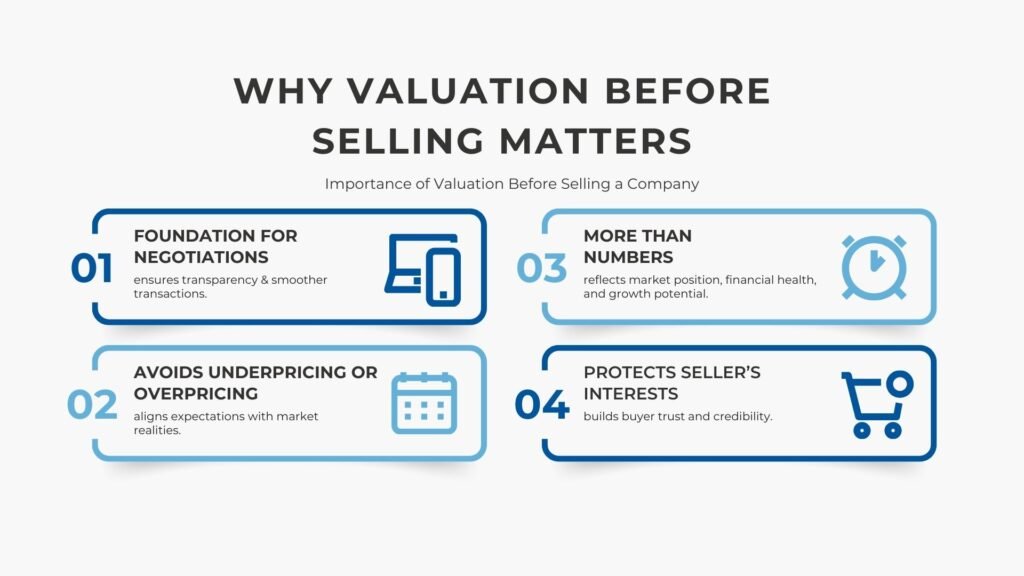

Importance of Valuation Before Selling Company Selling a company is one of the most significant decisions a business owner can make. Whether it is a small family-owned enterprise or a large corporation, the process involves more than finding a buyer and agreeing on a price. One of the most critical steps in this journey is […]

Professional Company Valuation Services Explained

Learn Professional Company Valuation Services Explained In the modern business environment, understanding the value of a company has never been more important. Whether a business owner is preparing for a sale, seeking investors, complying with regulatory requirements, or making strategic decisions, company valuation forms the foundation for informed choices. Professional company valuation services offer expertise, […]

How 3 Key Company Valuation Approaches Are Applied in Practice

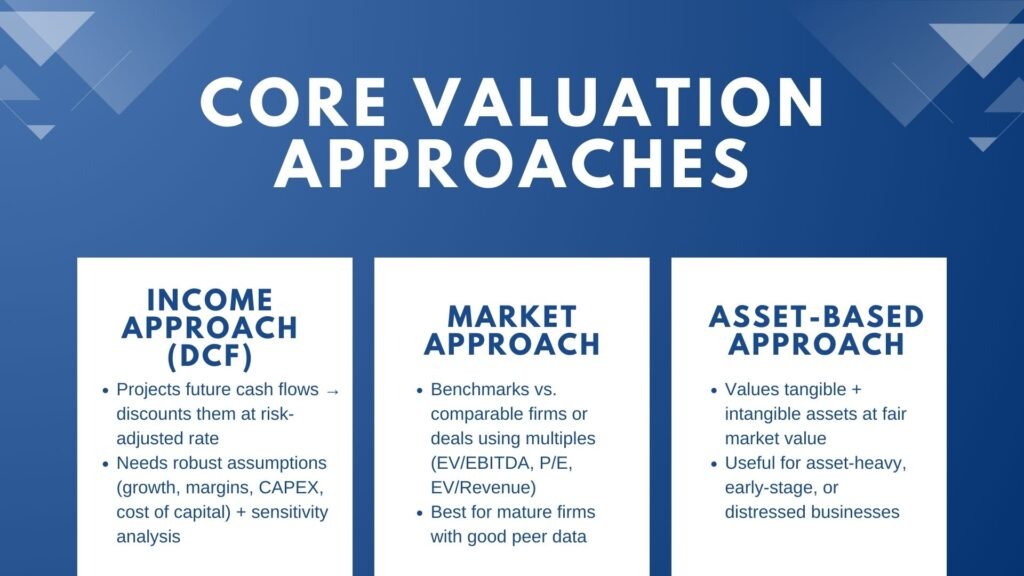

Learn How 3 Key Company Valuation Approaches Are Applied in Practice Valuation is one of the most critical processes in finance, mergers and acquisitions, and strategic decision-making. Whether you are an investor deciding whether to acquire a company, a business owner preparing for a sale, or a financial analyst evaluating market potential, understanding how a […]

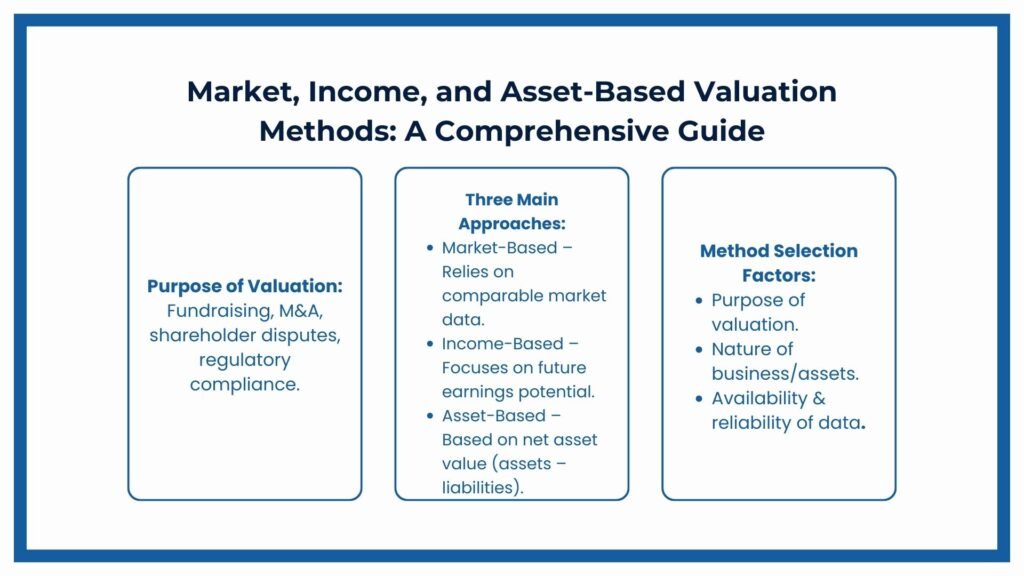

How Market Income and Asset Based Valuation Methods Differ

Learn How Market Income and Asset Based Valuation Methods Differ One of the pillars of informed decision-making in business is valuation. The fair value of a company or asset is needed to fundraise, to merge and acquire, in terms of shareholder disagreement, and in the case of regulatory compliance. Out of the numerous valuation models […]