Determining Fair Acquisition Price Workshop

How to Determine the Right Acquisition Price

Introduction to Determining Fair Acquisition Price Workshop

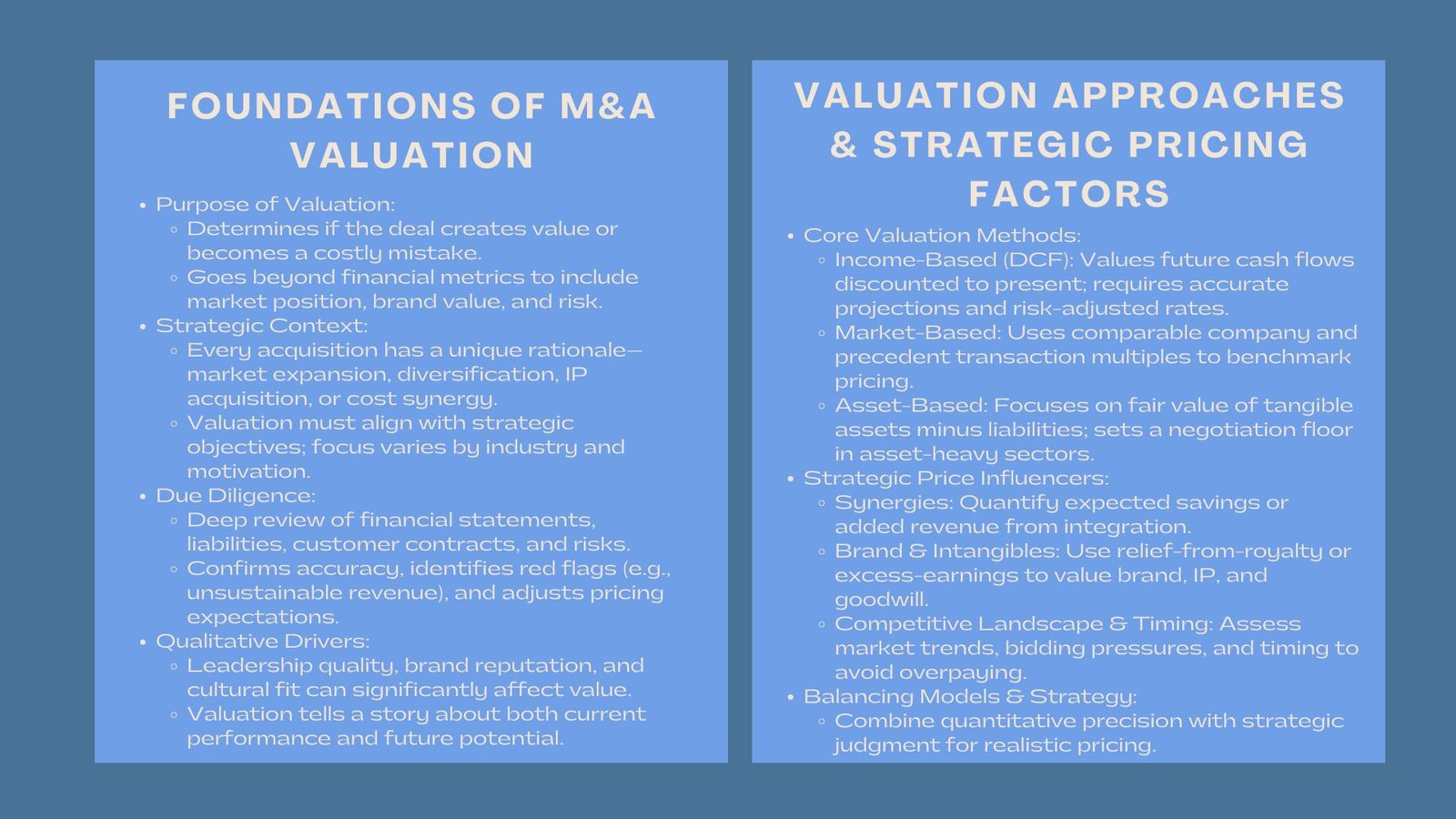

Mergers and acquisitions (M&A) are also among the most radical decisions that a business can make. It is not just a financial exercise as to what to pay the other company, it is a strategic decision of whether or not the acquisition can result in a value-creating milestone or a costly miscalculation. The value that is arrived at during any M&A transaction is not only value based on a balance sheet but also on potential in the future, the market position, brand value, and risk. It is at this point that correct valuation of M&A is very critical to ensure that businesses go through difficult deals with a clear and confident mind.

The Foundations of M&A Valuation

A sound process of valuation integrates financial modeling, market insight and foresight. The essence of the matter is to find a reasonable price of the acquisition that would correspond to the intrinsic value of the target as well as the long-term goals of the buyer.

Understanding the Strategic Context

Each acquisition has a reason behind it which may be expansion of market, diversification, economies of scale, or acquisition of intellectual property and brand. Acquisition buyers need to establish the why of the deal before immersing themselves in spreadsheets. This strategic intent is what determines the way the valuation is carried out and which measurements have the highest weight.

To illustrate, an innovation-driven technologic company that has purchased a software startup will place greater importance on innovation and intellectual property rather than immediate earnings, whereas a manufacturing company that needs to consolidate its operations may place more importance on economies of scale and physical asset prices. The valuation strategy should never be inconsistent with the objective of the acquisition.

The Role of Due Diligence

A complete valuation cannot be made without due diligence. This is done by taking a root-deep into the financial statements of the target company, their customer contracts, their liabilities, and risks in the market. In addition to ensuring that the reported information is accurate, due diligence assists in unraveling red flags concerning reported information that may include unsustainable revenue, legal contingencies, or overvalued assets.

Due diligence enables the acquirers to check the assumptions regarding future cash flows, discover synergies, and revise their pricing expectations regarding the real-life situation. The results of due diligence will most of the time decide whether the purchase will be made as it is or it will be renegotiated or it may not be made at all.

Evaluating the Qualitative Drivers

Although quantitative analysis prevails over M&A valuation, the presence of qualitative considerations can play a big role in determining the final price. These are brand reputation, quality of the leadership, customer loyalty and cultural fit between the two organizations. A firm that has a great brand presence or is innovative might be able to command a high price not easily measured using the traditional financial indicators.

Being a shrewd acquirer, one realizes that a valuation is not merely a calculation, but a story about what the business is and what it can be tomorrow.

Key M&A Valuation Approaches

The process of determining an appropriate valuation methodology is critical in reaching a justifiable price in the process of acquisition. Both approaches offer a differing perspective on the value of a target company, and integrating both will tend to give the most reasonable response, in most cases.

Income-Based Approaches

The income method bases a business on its capacity to bring future cash flows. In this case, the Discounted Cash Flow (DCF) is the key. It is the estimation of future cash flows of the project and its discounting to the present value based on the use of a suitable discount rate incorporating risk and cost of capital.

DCF also provides a comprehensive view of intrinsic value but at the expense of credible estimates and assumptions. Valuation swings of great magnitude could be brought about by any miscalculation of growth rates or terminal value. Thus, sensitivity analyses and scenario modeling are usually performed to provide tests of resilience in valuation findings.

Market-Based Comparisons

In the market approach, valuation is done on the basis of comparisons to the target of similar firms or transactions in the same industry. The two principal techniques are the Comparable Company Analysis (CCA) and the Precedent Transaction Analysis (PTA).

CCA compares valuation to valuation multiples of publicly traded peers; EV/EBITDA, P/E, or other valuation ratios, whereas PTA examines the actual valuation which has been paid in recent acquisitions. Such market based indicators serve to affirm whether or not the expectations of the buyer are in line with the general expectations in the industry.

The weakness of this approach, however, is the accessibility and validity of similar data. There is no single company that is the same and the market mood may create a false charge particularly in the case of.

Asset-Based Valuation

The asset-based approach provides a convenient view of the situation in some sectors, particularly those that are bulky in physical resources such as real estate or manufacturing. In this approach the net assets value of a firm is determined by deduction of the net liabilities to the fair market value of the assets.

Though this strategy is not very applicable in high growth or brand-driven businesses, it offers a necessary floor value in negotiations. In case of troubled acquisitions, it usually becomes the point of origin of price determination.

Strategic Factors Influencing Acquisition Price

Once financial valuation establishes a baseline, strategic considerations help refine the final acquisition price. This involves interpreting what value means beyond numbers.

Synergy Potential and Integration Value

Given that synergy is the value-added by combining the operations of two companies, it is one of the strongest reasons why a company decides to acquire. Cost saving, common technology, or cross-selling prospects may be sources of synergies. It is important to quantify such synergies before determining the extent of additional dollars that a buyer is prepared to pay.

As an example, when operational integration might result in the saving of $10 million/year, it might be worth paying more to purchase it. Acquirers also however, have to consider integration risks, cultural misalignment and one time restructuring costs that can counter the benefits.

Brand and Intangible Assets

In consumer-oriented markets, brands usually constitute a significant portion of enterprise value of a company. Trademarks, patents and proprietary technology are intangibles but they also play a role in customer loyalty as well as cash flow stability in the future. An aggressive M&A valuation should be able to reflect this hidden value in terms of such techniques as relief-from-royalty or multi-period excess earnings.

Having been effectively performed, such analyses can not only direct pricing, but also post-acquisition strategies to sustain or enhance brand equity.

Competitive Landscape and Timing

The valuation of M&As may be strongly dependent on market conditions. These can be the case in competitive bidding situations where the prices can be elevated to surpass intrinsic value as acquirers vie over strategic assets. In the same vein, time is a factor- buying when the market is down usually offers a chance to acquire under-valued firms whereas the boom markets will exaggerate price.

An organized buyer is one who analyses the timing, industry trends, and competitor intentions to conclude whether the price of acquisition can be sustained or it is a speculative momentum.

Applying M&A Valuation in Practice

Knowing how to determine the right acquisition price in M&A requires both technical precision and strategic insight. The process involves more than selecting a valuation model—it demands a holistic understanding of business dynamics and future growth potential.

Negotiating with Valuation Insights

Negotiation is based on valuation. Valuation data helps buyers to justify their offer price and helps sellers to defend their expectations. During such discussions, best practices are clarity of assumptions and documented models.

Valuation gaps in a few situations are bridged with the help of earn-out arrangements or contingent considerations. These mechanisms make the part of the purchase price dependent on future achievements of performance that matches the interest of both, and minimizes chances of overpayment.

Integrating Financial and Strategic Metrics

The best M&A teams incorporate valuation findings into larger strategic scrutiny. This entails the matching of financial projections and the business strategies, synergy objectives as well as the cultures fitting judgments. Combining financial rigor with business strategy will help the decision-makers not only to assess the value of the company, but also to assess the reasons why the company has such value to their own organization.

This data synthesis will make sure that the acquisitions are not ruled by emotions and competition but by pure strategic arguments.

The Role of Technology and Analytics

Digital tools and sophisticated analytics can be used to modernize M&A valuation to make data collection and prediction easier. Predictive modeling and artificial intelligence can be used to simulate the behavior of the market in the future, and automated benchmarking tools can be used to provide insights on similar transactions in real-time.

These innovations have made the M&A valuation method for strategic acquisitions more accurate, data-driven, and adaptive. They allow valuation teams to identify risks early, optimize due diligence, and justify pricing decisions with greater transparency.

The Strategic Imperative of Valuation Alignment

Valuation is not a matter of pricing, but a matter of agreement. Mutual value creation can occur whereby the valuation process is in line with the business strategy of the acquirer and the target. On the other hand, a wrong valuation may result in a case of post acquisition regrets, cultural conflicts, and financial loss.

Effective acquirers view valuation as a continuum of management and not as a discontinuity step in the process of acquisition. The performance tracking after an acquisition, brand monitoring and value realization analysis helps to make sure that the deal is still paying the returns expected.

Also, open dialogue with the stakeholders, including investors and employees, reinforces the belief in the strategic direction of the acquisition and its financial justification.

Challenges and Common Pitfalls

Despite sound methodologies, M&A valuation is associated with uncertainties. The usual pitfalls are excessive reliance on positive projections, failure to estimate integration costs accurately and intangible value overlook. Cognitive biases like overconfidence and confirmation bias may lead to biased decisions particularly during the competitive bidding process.

These risks need discipline and external validation to mitigate them. Hiring independent valuation specialists will bring an objective view and all assumptions will be supported by facts and evidence of the market. In addition, scenario flexibility assists the acquirers to anticipate post-deal realities that might not be as projected.

Conclusion

The determination of the appropriate acquisition price is a fine art/science. The numbers are given meaning through strategic context but structure is given by the financial models. An integrated M&A valuation integrates quantitative accuracy with qualitative opinions- what a business used to be, but what it can be under the control of the acquirer.

Through financial discipline, strategic foresight and hard analysis, the enterprise can make informed decisions regarding acquisitions that will add value to the enterprise and not dilute it. The point of the matter is that valuation is not a one-time computation but a dynamic instrument through which the strategy is strategized, risks are managed, and sustainable growth is established.

Valuation is a skill in the changing environment of mergers and acquisitions that goes beyond being simply a matter of money, but the cornerstone of successful strategy.