How Intangible Assets Affect Business Valuation and Growth Potential

How Intangible Assets Affect Business Valuation and Growth Potential

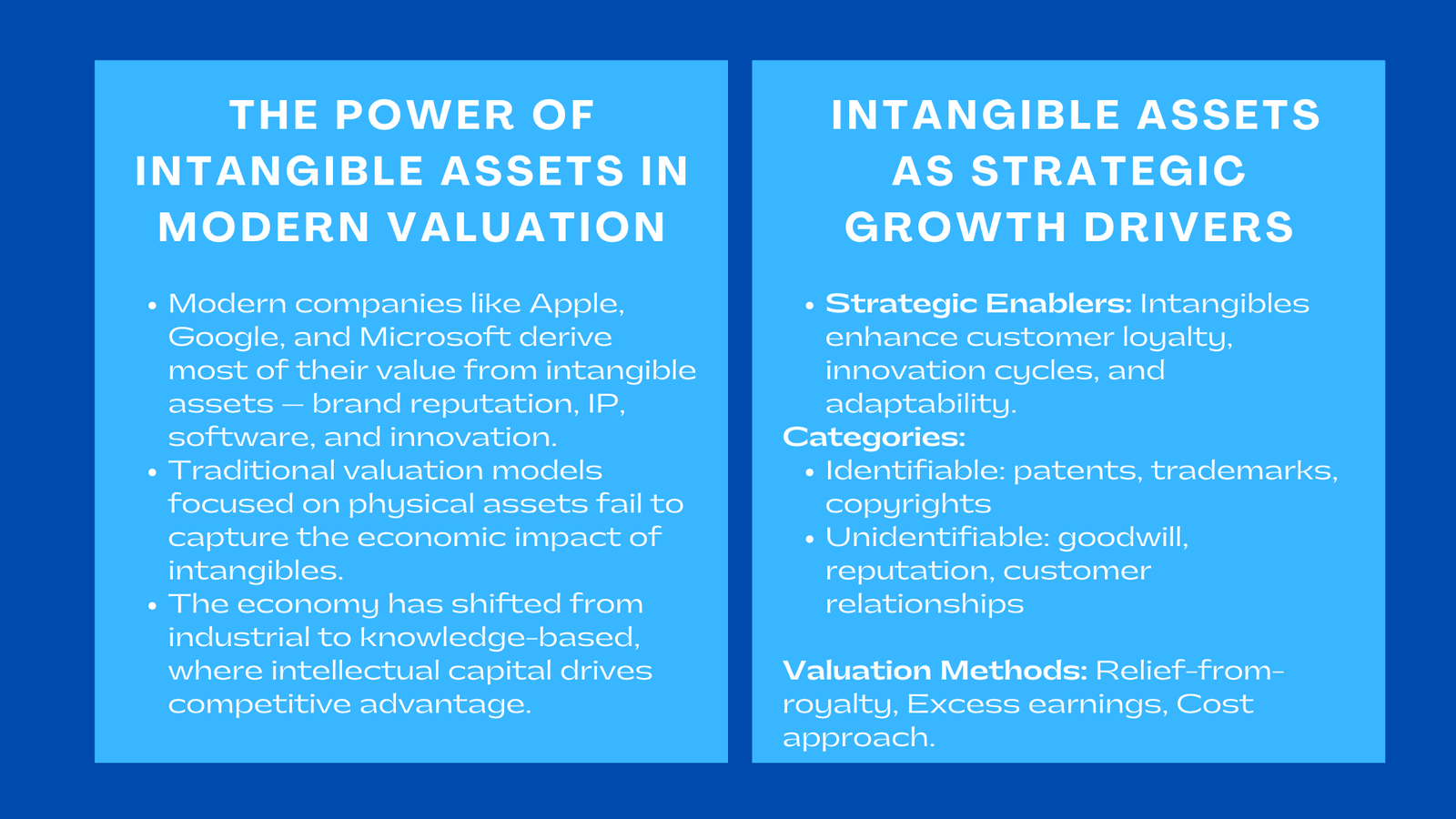

In the modern economy, the concept of value has evolved far beyond tangible assets like buildings, machinery, or inventory. Today, some of the world’s most valuable companies—such as Apple, Google, and Microsoft—derive the majority of their worth from intangible assets: brand reputation, intellectual property, software, customer loyalty, and innovation. As technology and globalization reshape competitive landscapes, intangible assets have emerged as the primary drivers of both business valuation and sustainable growth.

Traditional valuation models, once centered on physical capital, now struggle to capture the economic reality of intangible value creation. Businesses that overlook or undervalue these assets risk misrepresenting their true market position, underestimating their strategic potential, and making flawed investment or pricing decisions. Therefore, the impact of intangible assets on business valuation and growth understanding how intangible assets influence valuation and growth is essential not only for investors and CFOs but also for entrepreneurs navigating knowledge-driven markets.

The Rise of Intangible Assets in the Modern Economy

From Industrial Capital to Intellectual Capital

The global economy has transitioned from an industrial model driven by physical capital to a knowledge-based model dominated by intellectual capital. In the past, the value of a company could be measured largely by its physical resources—factories, land, and equipment. Today, however, competitive advantage often stems from intangible qualities such as innovation, customer trust, data analytics, and organizational culture. In the context of growth equity valuation Singapore ValueTeam services, understanding how intellectual capital contributes to business value has become increasingly essential for companies seeking to attract investors and sustain long-term growth.

This transformation is visible in the market capitalization of technology and service-oriented companies. For example, while physical assets account for less than 10% of total value in some leading corporations, intangible assets like patents, software, and customer networks constitute more than 80%. This shift reflects a broader structural change in how businesses generate wealth: through ideas, innovation, and brand relationships rather than physical production capacity.

Intangible Assets as Strategic Drivers of Growth

Intangible assets are not just accounting entries; they are strategic growth enablers. They influence customer perception, operational efficiency, and the company’s ability to adapt to changing market conditions. A strong brand, for instance, creates customer loyalty and pricing power. Proprietary technology accelerates innovation cycles, while intellectual property rights safeguard competitive advantages. Collectively, these assets enhance profitability and ensure that businesses remain resilient against market volatility.

Companies that actively invest in developing their intangible base—through research and development, employee training, and brand marketing—consistently outperform competitors who rely solely on tangible resources. Thus, intangible assets are not supplementary components of value but the cornerstone of long-term financial performance.

Categories and Nature of Intangible Assets

Identifiable and Unidentifiable Intangibles

Intangible assets can be broadly classified into identifiable and unidentifiable categories. Identifiable intangibles, such as patents, trademarks, copyrights, and licenses, have legal recognition and can often be separately sold or transferred. Unidentifiable intangibles, on the other hand, include elements like goodwill, corporate reputation, and customer relationships, which cannot be easily separated from the overall business.

This distinction matters greatly for valuation. Identifiable assets can typically be measured using financial models such as the relief-from-royalty or cost approach. Unidentifiable intangibles, by contrast, are more subjective and often require valuation through residual methods—estimating their contribution to overall business value after accounting for all tangible and identifiable elements.

The Economic Substance of Intangibles

What makes intangible assets complex is that they do not generate direct financial returns on their own. Instead, they contribute indirectly by enhancing productivity, brand equity, or customer retention. For example, a patented technology may not immediately yield cash flows, but it strengthens the company’s market position, making future revenue streams more predictable. Similarly, strong corporate culture enhances innovation and employee retention, which in turn supports sustainable growth.

Understanding the economic substance of intangibles allows analysts to connect qualitative factors with quantitative outcomes—a necessary skill for accurate valuation.

Valuing Intangible Assets in Business

The Limitations of Traditional Valuation Methods

Traditional valuation frameworks—especially asset-based models—were designed in an era when tangible assets dominated balance sheets. These methods often fail to capture the contribution of intangible resources. As a result, companies rich in intellectual property or brand value may appear undervalued when assessed purely by book value or asset replacement cost.

For instance, a startup that has developed innovative AI software might have minimal tangible assets yet hold enormous future potential. Applying a conventional asset-based valuation would overlook this potential entirely. Similarly, a well-known luxury brand’s intangible appeal cannot be quantified simply by the cost of its inventory or production facilities.

The challenge, therefore, lies in adapting valuation methodologies to measure the unseen but substantial economic impact of intangible assets.

Modern Approaches to Intangible Valuation

To address these challenges, several modern valuation methods have been developed to measure intangible assets more effectively. The relief-from-royalty method estimates the value of an asset by determining the royalties the company would have to pay if it did not own the intellectual property. The excess earnings approach isolates the income attributable to intangible assets after accounting for returns on tangible assets. Meanwhile, the cost approach calculates the replacement cost of recreating a similar intangible asset.

These methods, when applied appropriately, allow analysts to translate intangible contributions into monetary terms. They are particularly relevant in mergers and acquisitions, where intangible assets often account for a significant portion of the purchase price.

Integrating Intangibles into Comprehensive Valuation

A comprehensive valuation incorporates intangible asset measurement within broader income or market-based approaches. For example, in a discounted cash flow (DCF) model, intangibles influence future cash flow projections and risk-adjusted discount rates. In market-based valuations, companies with strong brand equity or patents often trade at higher multiples than their industry peers.

The key lies in transparency—clearly documenting the assumptions used to estimate intangible impact and explaining how they translate into overall enterprise value. This integration ensures that intangible value is neither overlooked nor overstated, resulting in a balanced and defensible valuation outcome.

How Intangible Assets Drive Business Growth Potential

Innovation and Competitive Advantage

Innovation is one of the most powerful outcomes of intangible investment. Companies that continuously develop intellectual property, proprietary systems, or data-driven insights can maintain a sustainable competitive edge. These assets create barriers to entry for competitors, enabling premium pricing and higher margins.

In sectors like pharmaceuticals or technology, patents and R&D pipelines define corporate value more than physical infrastructure. The capacity to innovate determines not only current profitability but also future market relevance. Therefore, a company’s valuation must consider the depth, quality, and defensibility of its innovation portfolio.

Brand Equity and Market Perception

A strong brand is perhaps the most recognizable form of intangible value. It builds trust, attracts loyal customers, and allows businesses to command higher prices. Companies like Coca-Cola or Apple demonstrate how brand equity can sustain profitability even in saturated markets.

From a valuation standpoint, brand strength reduces risk, stabilizes cash flows, and enhances future revenue predictability. It also increases investor confidence, as brands with enduring consumer loyalty tend to outperform market averages during economic downturns. Thus, brand equity is not merely a marketing asset—it is a financial asset that underpins long-term business resilience.

Customer Relationships and Data Assets

Customer relationships, loyalty programs, and proprietary data represent another form of intangible capital. In the digital age, data is often called “the new oil,” and for good reason—it enables personalized marketing, predictive analytics, and operational optimization. Companies that harness data effectively create self-reinforcing growth cycles, where customer insights drive innovation and innovation strengthens customer engagement.

Valuation models increasingly incorporate customer-related intangibles by analyzing retention rates, lifetime value, and acquisition costs. These metrics help quantify the financial benefit of sustained customer relationships and data-driven strategies.

Human Capital and Organizational Culture

Behind every successful company is a foundation of human capital—the skills, creativity, and experience of its workforce. Organizational culture, leadership, and employee engagement are intangible assets that directly influence productivity and innovation.

While these assets may not appear on balance sheets, their absence can lead to significant value erosion. Companies with strong cultures attract top talent, reduce turnover costs, and maintain consistent operational excellence. During valuation, analysts may assess human capital indirectly through metrics such as productivity ratios, employee retention rates, and innovation output.

Challenges in Measuring and Reporting Intangibles

Accounting Limitations

Despite their importance, intangible assets remain inadequately represented in traditional financial reporting. Accounting standards often recognize intangibles only when acquired externally, such as through mergers or licenses, but not when developed internally. This leads to discrepancies between a company’s book value and its true economic value.

As a result, investors increasingly rely on supplemental disclosures, management commentary, and non-financial indicators to assess intangible strength. The evolution of reporting standards toward more transparent disclosure of intangible performance will be essential for aligning accounting measures with market realities.

Valuation Subjectivity and Risk

The valuation of intangibles inherently involves judgment and assumptions. Estimating brand value, for instance, depends on subjective factors like customer sentiment or competitive positioning. Similarly, projecting returns from intellectual property involves forecasting uncertain future market conditions.

To manage these challenges, analysts must combine quantitative modeling with qualitative assessment. Sensitivity analyses, scenario testing, and independent verification help mitigate biases and ensure that valuations remain credible under different assumptions.

Strategic Implications for Business Leaders

Integrating Intangible Management into Strategy

For executives, managing intangible assets strategically is as important as optimizing tangible resources. This involves continuous investment in R&D, employee development, brand building, and data analytics. Companies that treat intangibles as strategic levers rather than residual assets are better positioned to achieve sustained growth and attract investors.

Linking Intangible Strength to Financial Performance

Effective management of intangibles directly translates into measurable financial performance. Businesses with strong intangible portfolios tend to exhibit higher profit margins, faster growth rates, and lower cost of capital. This linkage reinforces the notion that intangible assets are not abstract concepts—they are measurable drivers of shareholder value.

Conclusion to How Intangible Assets Affect Business Valuation and Growth Potential

The modern business landscape has redefined the meaning of value. As tangible assets lose dominance, intangible assets—innovation, brand, data, and human capital—have become the true engines of growth. Their impact on business valuation is profound: they shape financial performance, influence investor perception, and determine long-term competitiveness.

To accurately reflect economic reality, evaluating how to value intellectual property and brand equity in companies’ frameworks must evolve to incorporate these assets systematically. Businesses that understand, measure, and strategically cultivate their intangible capital will not only command higher valuations but also secure lasting market leadership. In the knowledge-driven economy, the greatest value often lies in what cannot be seen—but what ultimately defines success.