Key Considerations Before Selling Your Business

Key Considerations Before Selling Your Business: Valuation Insights

Understanding to Key Considerations Before Selling Your Business

One of the most great financial events of an entrepreneur is the selling of a business. It is the ultimate phase of years of work, investment and growth strategies. Nevertheless, to maximize on a sale, much more than a buyer is needed, one would need to have a thorough knowledge in business valuation, market situations and structuring of a deal.

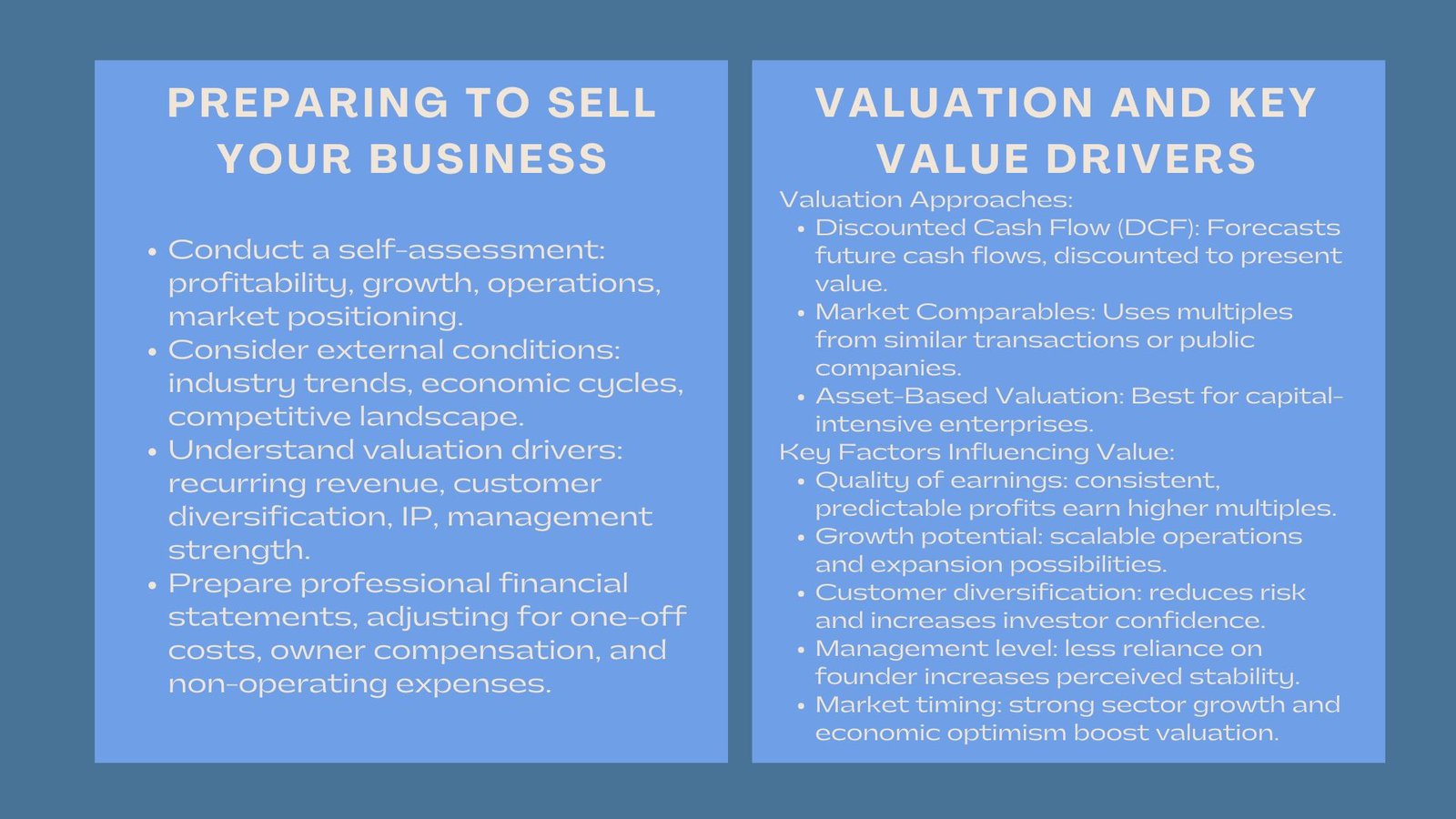

Business owners should put considerable thought before making the decision of selling whether or not they are in the best position to create optimal value. The knowledge of the major valuation drivers will also help the sellers to negotiate at an advantage, avoiding the underpricing and disadvantageous terms of the deal. Before proceeding with a sale, business owners should conduct a thorough self-assessment to determine whether they are in the optimal position to maximize the company’s value.

This involves analyzing internal factors such as profitability, growth trajectory, operational efficiency, and market positioning, as well as external conditions including industry trends, economic cycles, and competitive landscape. Awareness of key valuation drivers—such as recurring revenue, customer diversification, intellectual property, and management strength—enables sellers to negotiate from a position of strength.

Preparing for Valuation

To make a sale, it will commence with a professional objective estimation. It is done by examining the past financial performance, making future cash flow predictions, and the non-financial areas of the company like brand equity and customer relationship.

Triangulation of fair value in valuation is usually done through various approaches by the valuation professionals:

- Discounted Cash Flow (DCF): it forecasts future free cash flows of the project, and discounts them back in value.

- Market Comparables: same portrait valuation multiples of other similar transactions or public companies.

- Asset-Based valuation: this method is especially applicable when dealing with capital intensive enterprises.

In the case of privately owned businesses, normal financial reports are essential. When adjusted to one-off cost, compensation to the owner and non-operating costs, this will give a better picture of sustainable profitability. For privately owned companies, adjustments for one-off expenses, owner compensation, and non-operating costs provide a clearer picture of sustainable profitability. This preparation not only strengthens the credibility of the asking price but also ensures the seller is positioned to respond confidently to buyer queries or challenges during negotiations.

Key Factors Influencing Business Value

The value that your business is being accorded by potential buyers depends on a number of factors:

- Quality of Earnings: high valuation multiples are given to consistent and predictable earnings.

- Growth Potential This is because markets reward companies that have scalable operations and expansion possibilities.

- Diversification to customers: the lack of diversification to a small number of customers can diminish the perceived stability.

- Managerial Level: those companies that are not anchored on the founder pay higher prices.

- Market Timing: multiples can be increased greatly by good sector growth and economic optimism.

All these factors define investor confidence and bargaining power. Understanding these key considerations before selling a private business in Singapore factors helps sellers anticipate buyer priorities and strengthen their negotiation position, ensuring that valuation discussions are grounded in objective, value-driven insights rather than subjective assumptions.

Structuring the Deal

In addition to price, deal structure is another important consideration by the sellers. Ordinary alternatives are complete acquisitions, leave-out in which payments will be made based on performance thresholds. The structure selected influences the taxability, level of risk and long-term participation in the business.

This should be done through a tax efficient structure of transaction business valuation insights for maximizing sale price that is usually recommended by corporate accountants as a means of maximising net proceeds without contravening the guidelines of the Inland Revenue Authority (IRAS) in Singapore. Effective deal structuring also involves careful tax planning. Corporate accountants typically design the transaction to maximize after-tax proceeds while ensuring compliance with Inland Revenue Authority of Singapore (IRAS)regulations. Structuring considerations extend to payment schedules, asset versus share sale implications, and risk allocation, all of which can materially affect the financial and strategic outcomes for the seller.

Conclusion

The art and science of selling your business. The preparation, timing, and clarity of the valuation are the keys to success. The knowledge of what drives enterprise value will ensure that business owners negotiate firmly to have a price that will be very fair to its worth. Sellers who understand the drivers of enterprise value—financial performance, growth prospects, operational stability, and market conditions—can negotiate confidently to achieve a price that truly reflects the company’s worth.

A knowledgeable attitude will make the sale more of a planned change, rather than a reactive one. When valuations are properly established, there is a clear record and qualified guidance, sellers can be assured of achieving their highest financial gains and their legacy will go on to new hands that will help it prosper. Knowledgeable preparation ultimately allows sellers to approach the transaction with clarity, confidence, and strategic foresight, turning years of entrepreneurial effort into a successful and rewarding exit.