Legal Considerations for Business Valuation in Mergers and Share Sales

Legal Considerations for Business Valuation in Mergers and Share Sales

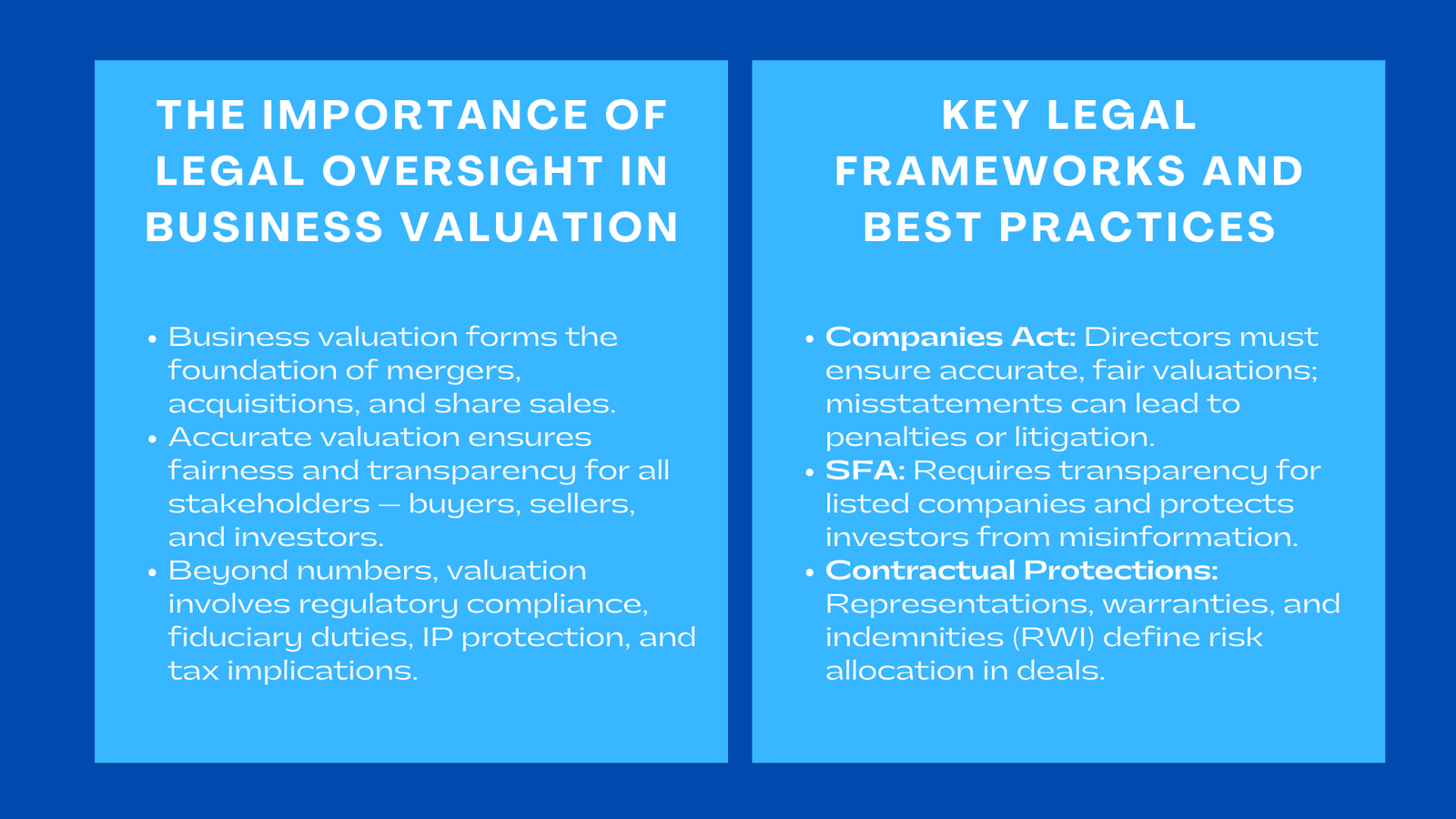

Business valuation is a cornerstone of corporate finance, serving as the backbone of mergers, acquisitions, and share sales. Accurate valuation ensures that all parties—buyers, sellers, shareholders, and investors—have a clear and defensible understanding of the true economic value of a company. However, valuation is not solely a technical or financial exercise. It also involves complex legal considerations, including regulatory compliance, contractual obligations, fiduciary duties, intellectual property protection, and tax implications. Neglecting these legal dimensions can result in disputes, litigation, or even regulatory penalties, potentially derailing transactions that were otherwise financially sound.

In Singapore, a robust legal and regulatory framework governs corporate transactions. The combination of the Companies Act, the Securities and Futures Act (SFA), tax regulations, intellectual property laws, and disclosure requirements ensures that mergers and share sales are executed with fairness, transparency, and accountability. Understanding how these legal considerations in business valuation Singapore elements intersect with valuation standards is essential for professionals navigating high-stakes transactions. Legal oversight, therefore, is not just a safeguard against risk but also an enabler of value creation, facilitating smoother negotiations, enforceable agreements, and investor confidence.

This article examines the key legal considerations in business valuation for mergers and share sales, exploring the regulatory environment, contractual mechanisms, intellectual property issues, taxation, emerging trends, and best practices for ensuring legally compliant and defensible valuations.

Regulatory Framework Affecting Business Valuation

Companies Act and Share Sale Regulations

The Companies Act of Singapore establishes the fundamental legal framework for corporate governance, mergers, acquisitions, and share transfers. Directors of companies are legally obliged to act in the best interests of the company and its shareholders. This includes ensuring that all M&A business valuation Singapore processes for mergers or share sales are accurate, fair, and based on sound methodologies. Misrepresentation, negligence, or the deliberate misstatement of valuation figures can lead to civil or criminal liabilities for directors, including potential fines, disqualification from directorship, and reputational damage. Partnering with ValueTeam, professionals can ensure compliance and credibility throughout the valuation process.

When shares are sold, particularly in private transactions, the Companies Act mandates disclosure of material information. Buyers must be provided with sufficient, accurate, and timely information regarding the assets, liabilities, and financial performance of the company. Failure to meet these obligations could allow buyers to challenge the transaction, seek damages, or even reverse the deal. Valuation reports must, therefore, be meticulously prepared, documented, and consistent with recognized accounting and valuation standards, such as IFRS and International Valuation Standards (IVS), to ensure legal defensibility.

Securities and Futures Act (SFA) and Public Listings

For publicly listed companies in Singapore, the Securities and Futures Act (SFA) imposes strict requirements on disclosure, transparency, and fair dealing. Companies must provide investors with accurate information regarding their financial position, valuation of assets, and business prospects. Share sales, especially those involving related-party transactions or significant equity changes, must comply with SFA provisions to prevent misleading statements or market manipulation.

Regulatory oversight under the SFA ensures that valuations used in share sales reflect actual market conditions and are prepared with integrity. Non-compliance can lead to regulatory enforcement actions by the Monetary Authority of Singapore (MAS), penalties, or suspension of trading. Valuation professionals must be aware of SFA requirements and incorporate these legal obligations into their methodologies, reporting formats, and disclosure documents.

Contractual and Transactional Legal Considerations

Representations, Warranties, and Indemnities (RWI)

In mergers and share sales, contracts often include representations, warranties, and indemnities (RWI), which allocate risk between buyers and sellers. Valuation figures are central to these clauses, forming the basis for buyer expectations and potential post-transaction claims. For example, a seller may represent that the company’s assets have been fairly valued according to recognized standards, while the buyer may secure indemnities in case subsequent audits or events reveal discrepancies.

Legal counsel plays a vital role in ensuring that valuation reports accurately inform these contractual provisions. Detailed documentation of assumptions, methods, and calculations strengthens the enforceability of RWI clauses, reducing the likelihood of disputes. Furthermore, well-structured indemnities can mitigate potential financial losses if post-transaction valuations deviate materially from expectations, balancing the risk allocation fairly between parties.

Due Diligence and Risk Mitigation

Due diligence serves both financial and legal purposes. Valuation reports are scrutinized to verify methodologies, confirm asset ownership, assess potential liabilities, and ensure that all information provided is accurate and comprehensive. Legal advisors examine whether contracts, regulatory licenses, intellectual property rights, or pending litigation could impact asset values or share pricing.

This process mitigates risks associated with claims of misrepresentation, breach of fiduciary duty, or negligence. By integrating legal review into the valuation process, companies can anticipate potential disputes, adjust valuation assumptions, and ensure that the deal structure complies with statutory and contractual requirements.

Intellectual Property and Intangible Asset Considerations

Legal Protection of Intellectual Property

Intangible assets, including intellectual property (IP), software, brand value, and proprietary data, increasingly constitute a large portion of corporate value. Legal considerations include verifying IP ownership, registration, licensing agreements, and potential infringement risks. Any oversight in these areas can materially affect the accuracy of the valuation and expose the company to legal challenges.

Valuers must collaborate closely with legal counsel to confirm that IP rights are enforceable, valid, and free of encumbrances. Proper legal review ensures that assumptions regarding IP are realistic, defensible, and aligned with Singapore’s intellectual property laws and international treaties.

Brand Value, Goodwill, and Contractual Protections

Brands, customer relationships, and goodwill are significant intangible assets in many industries. Legal review ensures that these assets are supported by enforceable contracts, non-compete agreements, and intellectual property protections. Failure to consider contractual and legal dimensions in the valuation process could lead to overstatement of value, disputes, or reputational damage post-transaction. Valuation assumptions must therefore be grounded in legally enforceable rights rather than speculative estimates.

Taxation and Regulatory Compliance

Transfer Pricing and Tax Risks

Valuations underpin tax reporting, particularly in transactions between related parties. Under Singapore law, the Inland Revenue Authority of Singapore (IRAS) monitors compliance with transfer pricing rules and other tax regulations. Valuation reports must be transparent, well-supported, and compliant with local tax legislation to justify transaction prices and avoid disputes.

Non-compliance can result in additional tax assessments, fines, or litigation. Legal oversight ensures that valuations are defensible, and tax implications are accurately incorporated into deal structuring, reducing potential exposure.

Cross-Border Transactions

Mergers and share sales often involve foreign investors or subsidiaries, introducing additional legal considerations. These include compliance with foreign investment regulations, bilateral tax treaties, and reporting requirements in multiple jurisdictions. Legal counsel coordinates with local and international authorities to secure approvals, ensure compliance, and manage potential conflicts of law, ensuring that valuations are recognized and enforceable globally.

Emerging Legal Challenges

Litigation Risks

Disputes over valuation are common in high-stakes mergers and share sales. Buyers or shareholders may challenge reported asset values or assumptions underlying intangible asset valuations. Legal review, detailed documentation, and adherence to recognized valuation standards provide a defensible position if litigation arises, reducing risk exposure and ensuring transaction stability.

Regulatory Developments

Changes in corporate governance laws, financial reporting standards, or ESG disclosure requirements create evolving obligations for valuations. Organizations must stay informed of these developments and integrate legal interpretations into valuation methodologies. Legal guidance ensures that valuations remain compliant with both current regulations and anticipated changes.

ESG and Sustainability Considerations

Environmental, Social, and Governance (ESG) factors are increasingly affecting corporate value. Legal review ensures that ESG assumptions incorporated into valuations are transparent, defensible, and consistent with regulatory expectations. Proper disclosure mitigates legal exposure and aligns valuation practices with emerging sustainability requirements.

Best Practices for Legally Compliant Valuation

To ensure legally compliant, defensible, and credible valuations, organizations should integrate financial, accounting, and legal expertise from the outset. Valuation assumptions must be well-documented, transparent, and aligned with IFRS, IVS, and Singapore-specific standards. Legal advisors should review all reports, contracts, and disclosures to confirm statutory and fiduciary compliance.

Collaborative practices between finance and legal teams, comprehensive due diligence, and robust documentation reduce litigation risk, enhance corporate governance, and improve stakeholder confidence. Recognized professional standards, such as the Chartered Valuer and Appraiser (CVA) program, further strengthen credibility, supporting both domestic and cross-border transactions.

Case Study: Legal Oversight in a Share Sale Transaction

Consider a hypothetical scenario in Singapore where a technology company is undergoing a share sale to a private equity investor. The company’s valuation includes significant intangible assets, such as proprietary software and customer contracts. Legal counsel reviews the intellectual property registration, licensing agreements, and non-compete clauses to ensure enforceability. Simultaneously, valuation professionals apply IFRS and IVS standards to measure fair value of intangible assets using Level 3 inputs in a discounted cash flow model.

During due diligence, legal advisors identify a pending patent litigation that could impact asset value. The transaction terms are revised to include indemnities, and the share sale agreement explicitly documents assumptions about potential liabilities. The integration of legal oversight and rigorous valuation ensures that the transaction proceeds smoothly, with both parties protected against unforeseen legal and financial risks.

Conclusion to Legal Considerations for Business Valuation in Mergers and Share Sales

Legal considerations are a critical component of business valuation in mergers and share sales. Compliance with corporate valuation for mergers and share sales Singapore laws, securities regulations, tax rules, intellectual property protections, and ESG requirements ensures that valuations are accurate, defensible, and enforceable.

By integrating legal oversight with robust financial and accounting standards, companies can mitigate risks, safeguard stakeholder interests, and facilitate transparent, fair, and strategically sound transactions. Properly executed valuations not only support fair pricing and informed decision-making but also reinforce corporate governance, regulatory compliance, and investor confidence, establishing a foundation for long-term business success.