Top Business Valuation Services for Entrepreneur

Top Business Valuation Services Every Entrepreneur Should Know

Learn Top Business Valuation Services for Entrepreneur

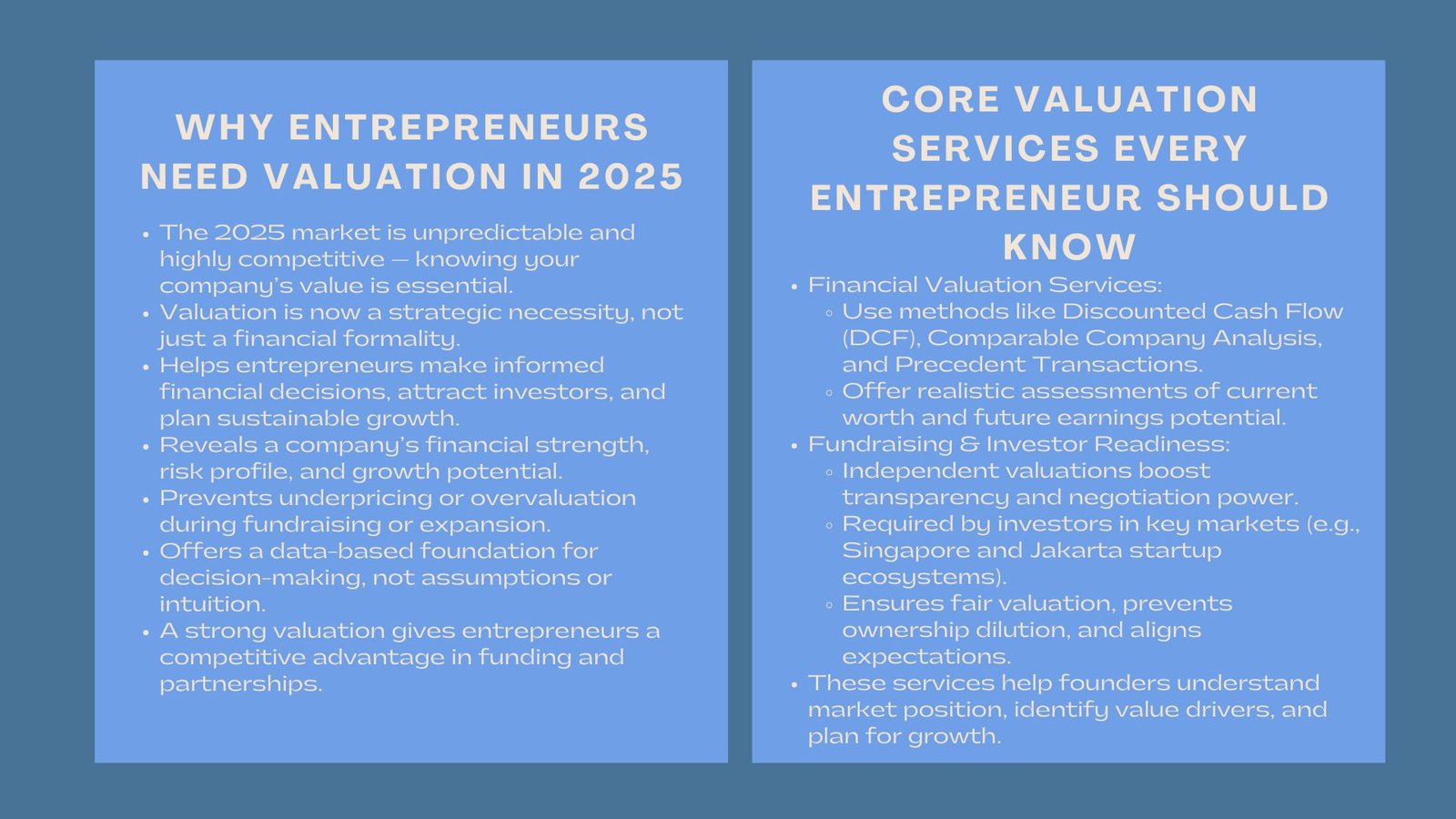

The high-pressure and unpredictable business environment of the future in 2025 makes it not only necessary but a fact that you know the true value of your company. The task of entrepreneurs is even more challenging as they are being pressed to make knowledgeable financial choices, draw in investors, and prepare their companies to be spread in a way that helps them to sustain their growth. Once regarded as an elaborate financial activity, business valuation has become a necessary strategic service to which any founder needs to have a good command of and make use of.

Since startups who need funding options and established businesses that are considering expansion or exit need to prepare to understand their financial strength, risk profile, and future prospects, valuation services can be used to demystify their financial state. Being aware of the valuation services to contract can provide the entrepreneur with a competitive advantage because all strategic decisions can now be made on the basis of real economic value and not assumptions and guesses.

1. The Growing Demand of Business Evaluation.

1.1 The Importance of Valuation More Than Ever.

Entrepreneurs do not think much about the role of central valuation in making daily decisions. It has an impact on the negotiations of fundraising, partnership conditions, employee stock options, and even marketing strategies. As digital and intangible assets continue to take over the business models in 2025, having a basic idea about the principles of valuation is the key to keeping the investor confident and sustainable.

Take a fintech start up intending to raise Series A capital. A believable valuation is missing and the company can either undervalue itself or overprice itself out of the market. Valuation services would be useful in bridging this gap by offering data informed insights into growth potential, market share and future profitability, which are critical areas that investors scrutinize keenly.

1.2 The alignment of Strategy and Valuation

Other than figures, valuation can also be considered as a strategic tool. It helps founders to understand what aspects of their business provide the greatest value and what areas require reorganization. As an example, a retail brand can find that its online sales operations are adding much more to the enterprise value than its brick and mortar locations. This understanding can inform the digital investment decisions, marketing, and long-term capitals.

2. The Fundamentals of Business Appraisal Amongst the Entrepreneurs.

2.1 Financial Valuation Services.

Corporate finance is based on the financial valuation services. The methodologies that they use include discounted cash flow (DCF), similar company analysis, and precedent transactions. Both methods offer a new perspective on the value of business.

To illustrate, DCF method can determine the value of future cash flows in the present, which assists entrepreneurs to determine the value of the future earnings in the company based on the projected earnings. Similar company analysis, in its turn, compares one business with other companies within this industry, providing information about its position in the market and expectations of investors. Firms offering professional business valuation services often use a combination of these methods to provide a balanced, realistic assessment.

2.2 Valuation for Fundraising and Investor Readiness

Investor engagement is one of the most usual applications of valuation. An independent valuation report improves the level of transparency in fundraising rounds and bargaining leverage. Today, the investors insist on financial forecasts, articulate descriptions of the assumptions used in valuation, and market data.

This is illustrated by the startup ecosystems of Singapore and Jakarta wherein investors now demand founders to present independently verified valuations before they invest capital. This will create fairness, avoid dilution mistakes, and the expectations on future returns will be aligned.

3. Entrepreneur-Specialized Valuation Services.

The valuation of Intellectual Property (IP) is performed to estimate the value of the intangible asset (Intellectual Asset) present in the business entity, encompassing patents, trademarks, copyrights, and trade secrets.

3.1 Intellectual Property (IP) Valuation

Intellectual Property (IP) valuation is carried out to determine the value of the intangible asset (Intellectual Asset) that exists in the business entity including patents, trademarks, copyrights and trade secrets.

The knowledge economy has a high proportion of enterprise value contained in intangible assets such as patents, trademarks, and proprietary technology. IP valuation assists in the measurement of economic value of innovation and brand ownership.

As an example, an IP valuation can be used in a situation where a biotechnological firm producing new therapies can calculate the fees to license their therapy or the price to purchase a company. This is done to ensure that the intellectual assets receive proper valuation in the financial statements and discussions of deals.

In 2025, IP valuation also overlaps with the digital transformation – not software codebases but AI algorithms – which would help entrepreneurs better understand the way innovation can create value over the long term.

3.2 The startup and early-stage valuation are the following items.

Startups can be a difficult case in valuation, particularly in the initial days of existence. Startup-specific valuation services take into account non-financial metrics such as user traction, maturity of technology and expertise of the team. Those companies that provide consulting services on valuation of startups usually employ hybrid approaches which amalgamate quantitative and qualitative analyses to come up with believable findings.

An example that can be used in practice is the adjustment of valuation on a milestone basis by venture capital firms in the U.S. and Asia. Such models are connected to certain performance metrics, e.g. to reach 10,000 active users or to attain a certain revenue goal. This practice will be used to get valuation expectations and performance to match.

4. Transaction-based Valuation Services.

4.1 Mergers and Acquisitions (M&A)

Valuation is a decisive factor in structure of deals in M&A transactions, pricing and integration after the transactions. Valuations are used by sellers to provide a valid basis to ask price whereas buyers use them to estimate synergies and prevent overpayment.

As an illustration, in case a regional logistics company buys a smaller company, both parties have to reach an agreement on the prices of both tangible and intangible resources, such as brand recognition and contracts with customers. Properly drafted valuation report forms a basis of successful negotiation and regulation.

Valuation firms specializing in M&A advisory services also assist in purchase price allocation, helping acquirers record fair asset values and goodwill accurately after the transaction closes.

4.2 Exit and Succession Planning

In case an entrepreneur is ready to leave the business, proper valuation is a guarantee of appropriate payment and a less distressing transition. Regardless of the sale to an individual buyer, a takeover by a bigger company, or a sale to relatives, a justifiable valuation report can reduce conflicts and earn the best possible returns.

As an illustration, a family owned manufacturing company may seek the services of an independent valuation prior to relinquishing the control to the other generation. This brings in honesty and does not create any emotional bias, so that the decisions made regarding succession are not based on emotion, but the actual market value.

5. Modern Valuation and Technology and Data.

5.1. The Emergence of Digital Valuation Tools.

The development of artificial intelligence and cloud analytics has transformed the process of issuing valuation services. Digital valuation platforms have now made the aggregation of financial information, industry standards, and risk signals accessible to entrepreneurs in an automatic manner. These tools help to improve accuracy, lessen turnaround time and increase comparability across industries.

5.2 Predictive Insights and Real-Time Valuation.

In the current turbulent markets, stagnant valuation reports do not stand much shelf life. Real-time systems of valuation enable business to monitor the impact of market changes, regulatory developments or the activities of competitors on enterprise value. Predictive analytics also allows entrepreneurs to experiment with the future, e.g. price changes, market entry, or restructuring capital, before making a real choice.

As an example, a SaaS startup may model the effects of various subscription pricing models on the valuation in five years. This understanding assists founders to make informed choices based on data that are relevant to the expectations and profitability objectives of investors.

6. Selecting the appropriate Valuation Partner.

6.1 knowledge and experiences in the industry.

Valuation firms are not all created equal. Entrepreneurs are supposed to find professionals who are conversant with dynamics and growth challenges in their line of business. A specialist consultant who is an expert in the sector, i.e. technology, manufacturing, or real estate, may have more detailed information than a generalist consultant.

6.2 Transparency and Compliance.

Transparency is a source of credibility in valuation. The finest companies are using international standards of valuation like IVS or IFRS thus consistency and regulation. This improves the confidence of investors as well as safeguarding the entrepreneurs against possible disagreements or insincere reporting.

Conclusion

In 2025, business valuation is much more than a financial indicator – it is a strategic roadmap of entrepreneurs in their growth, investment and exit decisions. Valuation services offer a sense of clarity and credibility in an otherwise competitive world between knowing the value of intellectual property and gearing up to raise funds or a merger.

Experienced entrepreneurs that invest in professional valuation practices acquire knowledge that will enable attracting investors, strategy optimization, and risk management. With the business environment becoming more data-driven and globalized, valuation will be one of the most potent instruments of creating a sustainable success.