Valuation Adjustments for Multinational Acquisitions

Valuation Adjustments in Cross-Border M&A Transactions

Introduction: Valuation Adjustments for Multinational Acquisitions

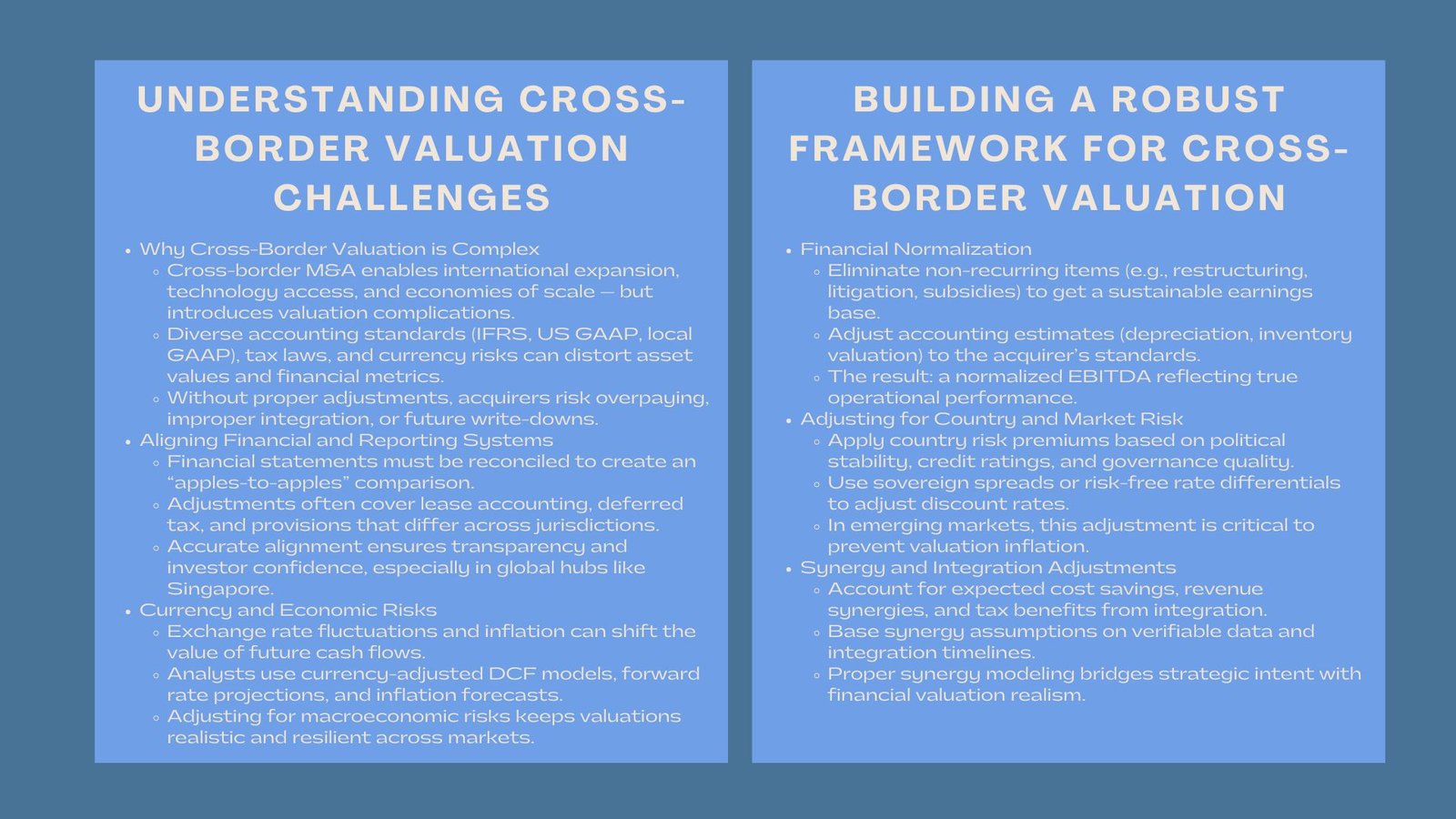

The modern globalized world of business is making cross-border mergers and acquisitions (M&A) one of the key entry points in international growth and strategic diversification. Firms acquire outside their countries in order to access new markets, superior technologies and cost economies of scale which they might not have been able to get locally. These transactions, however, have a complex nature especially with regards to valuation though the rewards are substantial.

It is much harder to calculate the correct value in an international transaction as compared to a local one. The valuation differences that arise due to differences in regulatory frameworks, accounting standards, taxation systems and currency risks should all be put into reconciliation by making systematic adjustments. The absence of appropriate valuation adjustments can result in losses after the acquisition, or unsuccessful integration, even of a promising transaction.

This paper focuses on the complex landscape of valuation adjustments in cross-border M&A deals- how multinational dealmakers address the challenge of financial modeling, risk normalisation, and measuring fair value to deliver transparent and defensible results.

Understanding Valuation Dynamics in Cross-Border Deals

The Challenge of Aligning Different Financial Systems

When it comes to any kind of acquisition, the question is what is the target really worth. This question takes multidimensional character in cross-border transactions. Buyers and sellers tend to work on different financial reporting systems, e.g., IFRS, US GAAP, or regional accounting, that generate different values of assets and performance. Such discrepancies are capable of skewing valuation outcomes when they are not homogenized when conducting due diligence.

As an illustration, a transaction that is reported as per local standards may have a different classification of leases, provisions or deferred taxes thus, resulting in differences in valuation when transferred to the acquirer reporting framework. Accounting alignment adjustments are thus necessary to make the transaction to represent an apples-to-apples comparison.

With the growing globalization of deal environment in Singapore, investors understand the importance of having accurate valuation alignment to address the domestic compliance requirements as well as the international financial disclosure requirements. In the absence of these adjustments, the soundness of the transaction valuation might be undermined and investors may doubt it, causing regulatory oversight.

Economic and Currency Translation Risks

Some of the greatest valuation issues in cross-border transactions are exchange rate fluctuations and inflation differentials. Currency volatility may cause a great variation in the cash flows of a target company when converted to the home currency of the acquirer. In addition, risk assumptions in the process of discounting future cash flows can be changed by macroeconomic factors, such as the interest rate policy or political instability.

Valuation professionals deal with them by constructing currency-adjusted models which include forward exchange rate projections, inflation anticipations, and country-specific risk expenses. This is aimed at converting local performance into an even comparable financial model that depicts the intrinsic and country-adjusted value of the target.

Regulatory, Tax, and Legal Adjustments

M&A valuation across borders should also bear in mind the tax benefits and regulations of conducting business in other jurisdictions. Increase and changes in corporate taxation, transfer pricing regulations and restrictions on profit repatriation may have profound implications on post-acquisition profitability.

Valuation professionals frequently undertake so-called effective tax rate adjustments where they seek to reflect the differences in jurisdictions between the acquirer and target. On the same note, legal compliance adjustments, including environmental or labour liabilities, can have an effect on the enterprise value. Financial models give a more practical forecast of the financial results of mergers by incorporating these modifications.

Building a Robust Framework for Cross-Border Valuation

Normalizing Financial Performance

Normalization of financial statements is one of the initial processes involved in the process of valuation adjustment. Normalization is where non-recurring or single items are eliminated and these items can misrepresent the profitability. As an example, the reorganization costs, settlement of litigation or abnormal government subsidies can inflate or deflate the earnings of a target artificially.

After compensating these items, analysts come up with a normalized EBITDA or net income that is closer to the sustainable earning potential of the target. This is necessary especially in sectors where the volatility is cyclical or where the government plays a major role.

In addition, variations in accounting estimates including depreciation procedures or inventory worth should be adjusted to the standards of the acquirer. Without such changes, the financial model will overestimate or underestimate the real operating performance of the target.

Adjusting for Country and Market Risk

The valuation of a foreign target has to reflect the economic risk picture of its operating market. Political stability, quality of government, and transparency in the business are some of the factors that directly affect country risk premiums that are applied in discount rates.

The models that have been used by valuation experts to adjust the discount rates of each country include the sovereign spread or risk-free rate differentials. These premiums can have a significant impact on enterprise value in the emerging markets where credit risk is elevated.

These country-specific adjustments are a cornerstone of Cross-border M&A valuation adjustments Singapore, where investors must assess the relative risk of target markets across Southeast Asia and beyond. The ability to quantify and adjust for these risks is critical for achieving balanced and defensible valuations.

Incorporating Synergy and Integration Adjustments

Besides standalone valuation, the acquirers should evaluate the impact of integration synergies (cost-cutting, revenue-growth or tax-savings) to the total deal value. Synergy adjustments are the price that an acquirer is prepared to pay that the target is worth more than in separation.

Nevertheless, these forecasts should be well-validated. The exaggeration of synergies may lead to exaggerated goodwill and future impairment losses. As such, the changes in synergy must be based on testable assumptions which are supported by functioning data, integration schedules, and industry standards.

These adjustments, when properly made, close the gap between the strategic value realization and theoretical valuation – turning the financial model into a dynamic planning tool rather than a fixed calculation.

Financial Modeling in Cross-Border M&A

Integrating Valuation Adjustments into Financial Models

The entire M&A valuation activities are anchored on financial modelling. Modeling used in cross-border transactions should incorporate various layers of adjustment between accounting normalization and currency translation on the one hand, and tax and risk on the other hand.

This process normally starts with the basic financial forecasts of the target company. Analysts subsequently modify revenue forecasts relating to market saturation, cost arrangements to regional differences and working capital to local business cycles. Once these operation inputs are implemented, discount rates are modified to indicate the target capital structure as well as country-specific risks.

This holistic modeling approach captures both micro-level business dynamics and macro-level economic conditions, ensuring that the valuation outcome is both comprehensive and defensible. As part of best practice, acquirers frequently engage independent advisors specializing in international mergers and acquisitions financial modeling to validate assumptions and provide an unbiased assessment of fair value.

Cross-Currency Discounting and Scenario Analysis

Among the peculiarities of a cross-border valuation modeling, the cash flows in the various currencies must be handled. Analysts have to choose either to discount future cash flows in the local currency of the target and to convert the terminal value at the spot rate or convert all the cash flows to the acquirer currency upfront at the predicted exchange rates.

Both methods have their benefits and threats. Local currency models reflect operational realism and home currency models offer consistency in the financial reporting. In order to avoid the uncertainty, sensitivity analysis and Monte Carlo simulations are common to test the sensitivity of changes in exchange rates, inflation or cost of capital on valuation results.

Through the use of probabilistic modeling, the valuation professionals will have an easier time quantifying the risks as they could occur and also be able to communicate a series of possible outcomes of the deal, instead of one deterministic number.

Adjusting for Accounting and Reporting Frameworks

In instances where the acquirer and target are subjected to different accounting standards, the reconciliation adjustments are necessary in order to have comparability. As an illustration, the way of treating the lease under new IFRS 16 as opposed to the previous systems would have a huge impact on both the EBITDA and leverage ratios. In the same vein, inconsistency in fair value recognition of financial instruments can result in inconsistency in net asset valuations.

Since Singapore-based acquirers are more and more engaged in international M&A, they should make sure that all modifications are qualified in accordance with the IFRS-compliant reporting standards and local regulatory requirements which are provided by the Accounting and Corporate Regulatory Authority (ACRA). This will result in transparency, less audit risk and greater investor confidence in the post-transaction financial reporting.

Strategic Implications of Valuation Adjustments

The Role of Cultural and Operational Integration

In addition to financial and accounting considerations, cross-border valuation-adjustment should also consider the risk of cultural and operational integration. An attractive target on paper might be executed with some difficulties because of the variation in corporate culture, management practices, or governance norms.

Although these are the qualitative risks that are hard to quantify, these risks may be included in valuation models at an increased discount rate or reduced assumptions of synergy realisation. Early identification of such risks helps to avoid overvaluation and establish expectations of realistic performance in the post-acquisition period.

Navigating Tax and Repatriation Considerations

The taxation is one of the most complicated areas of adjustment when it comes to a cross-border deal. Repatriation of profits, use of tax credits or availability of treaties on double-taxation all have a direct impact on the post-merger returns.

To illustrate, in Southeast Asia, the cash flow forecasts can be significantly affected by not paying tax on dividends or cross-border payments. Making valuation models more reflective of these realities will help investors know the real after tax economics of the transaction.

The city-state is a great place to locate a holding structure in the region due to the wide network of tax treaties and transparent legal framework of Singapore. Nevertheless, the correct structuring and the adjustments of valuations are also necessary to maximize such advantages and meet the requirements of international tax transparency.

Valuation Adjustments and Post-Merger Accountability

Properly organized valuation adjustment procedure does not only put right prices on the bargaining table but also introduces a standard of measurement of the post merger performance. When assumptions of growth in the market and reimbursement of costs or their risk premiums are well documented, the management is able to monitor the actual performance against the valuation model.

This responsibility promotes transparency and aid in determining whether the deviations are caused by external shocks, inefficiency in operations or unsound assumptions. This causes an organization to become increasingly M&A disciplined, as the feedback loop an organization experiences will eventually increase the accuracy of deals made in the future.

The Broader Impact on Corporate Strategy

Aligning Valuation Adjustments with Strategic Objectives

Valuation adjustments do not only constitute technical improvements, but also strategic facilitators. Through matching adjustments and corporate goals, which can be either market entry, acquisition of technology, or cost reduction, decision-makers can make sure that the value of the final deal will be both financial-wise prudent and strategically oriented.

As an example, an acquirer interested in intellectual property or brand value can agree to greater goodwill rates, whereas an acquirer interested in financial benefits can be more concerned with the security of cash flow and the reduction of risk. These goals are put in quantifiable alignment through appropriate value adjustments, which facilitate value generation in the long term.

Ensuring Transparency for Stakeholders

In an environment where investors, regulators and analysts require a higher level of transparency, documented valuation adjustments are indicators of a healthy corporate governance. They indicate that the management has been keen in its cross-border risk knowledge and its mitigation, hence the enhanced trust of the stakeholders.

The M&A ecosystem in Singapore is now a regional standard of transparency and compliance with valuation adjustments being both a financial requirement and a good governance standard.

Conclusion

Accuracy and defensibility of cross-border M&A analysis lie in its valuation adjustments. They help in closing the margin between different financial systems, reduce risks due to currency differences and tax differences and also make sure that the acquisition prices reflect actual economic values.

In the case of acquirers entering foreign markets, the art of valuation regulation goes beyond technical ability, but represents strategic insight, financial integrity and diligent performance. With the trend of cross-border transactions that characterize the growth of corporations in Asia and across the globe, Singapore leads in terms of excellence in valuation and thus provides investors with a stable environment, with transparency to seek opportunities clearly all over the world.

Finally, it is not only the opportunities that must be identified, but quantified in order to make any international acquisition successful. The world is complex, and with global valuation modifications, the organization gets to sail through with a lot of assurance- transforming global aspirations into sustainable value creation.