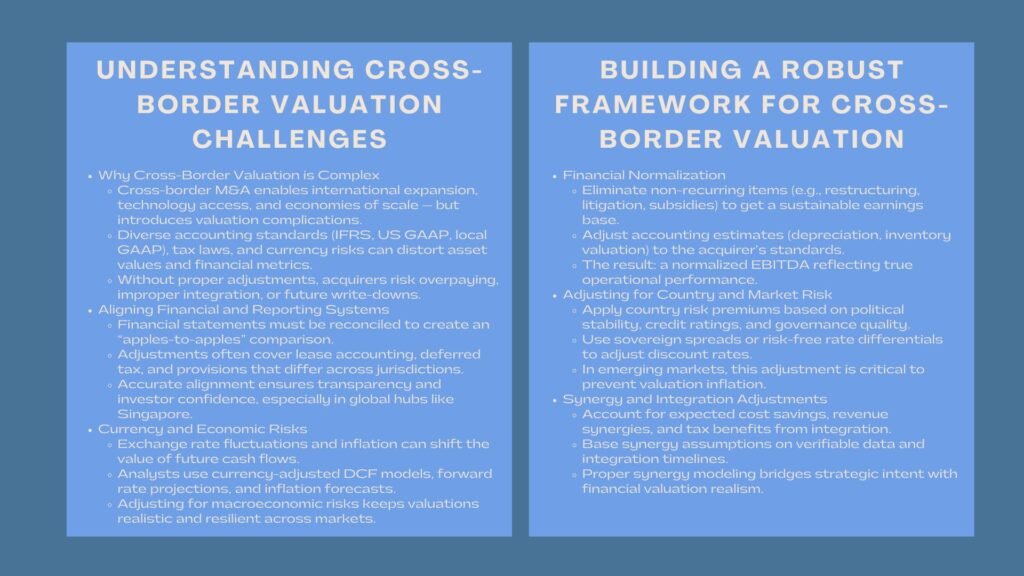

Valuation Adjustments for Multinational Acquisitions

Valuation Adjustments in Cross-Border M&A Transactions Introduction: Valuation Adjustments for Multinational Acquisitions The modern globalized world of business is making cross-border mergers and acquisitions (M&A) one of the key entry points in international growth and strategic diversification. Firms acquire outside their countries in order to access new markets, superior technologies and cost economies of scale […]

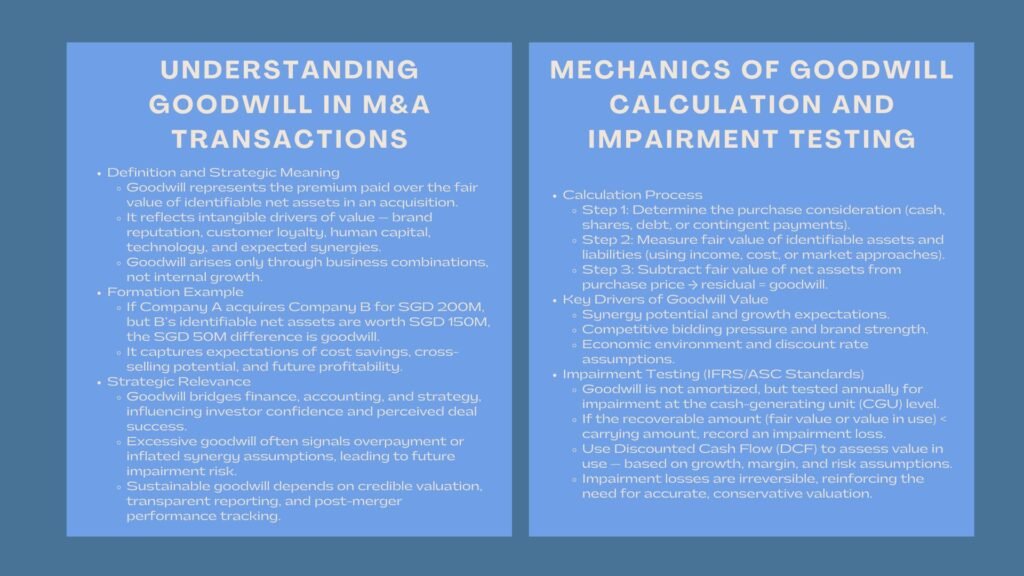

Company MA Goodwill Valuation Certification

Goodwill Calculation and Impairment in M&A Deals Introduction: Company MA Goodwill Valuation Certification Acquisitions and mergers (M&A) are usually associated with payment of premium that is above the fair value of identifiable net assets of a target company. That value-added known as goodwill encompasses the expectations of the buyer about the synergies, brand equity, intellectual […]

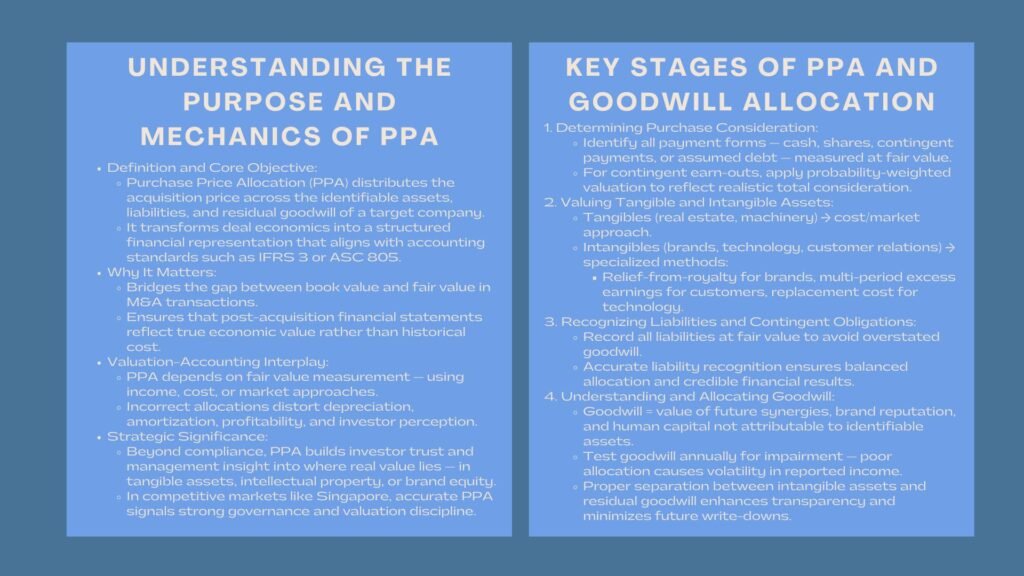

Learn PPA for Business Acquisitions

Purchase Price Allocation (PPA) Explained for M&A Transactions Learn PPA for Business Acquisitions M&As are such transformational events in corporate life that they change the market, unite competitive advantages, and form new value chains. However behind all transactions that involve success is a complicated process of financial accounting that defines how the purchase price is […]

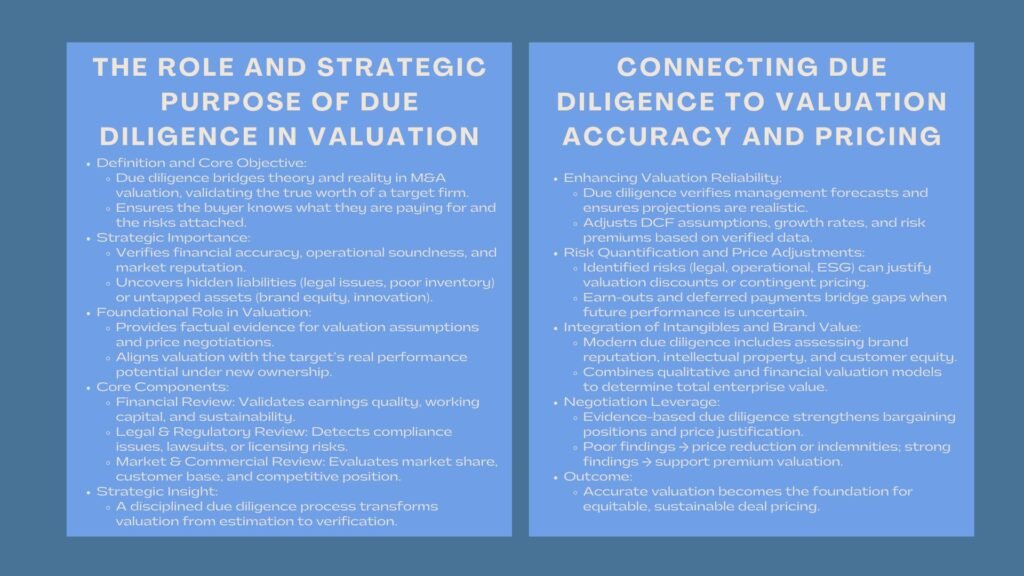

Due Diligence in MA Valuation

Due Diligence in Mergers and Acquisitions: Valuation Perspective Introduction to Due Diligence in MA Valuation Merger and acquisitions (M&A) are an opportunity and a threat in the realm of corporate transactions. In the case of company acquisition, strategic fit is not the only important factor that can ensure success but also finding the real value […]

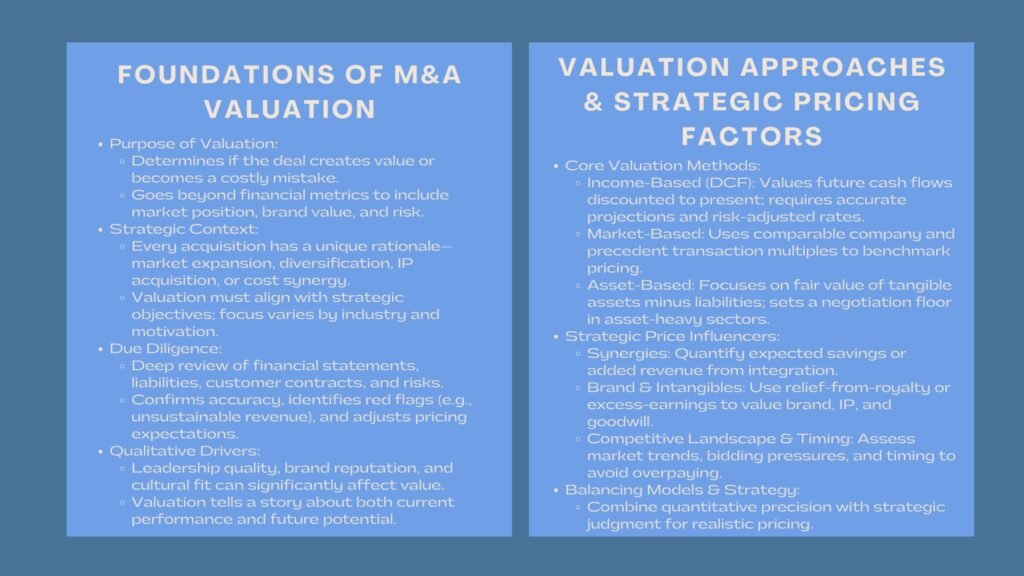

Determining Fair Acquisition Price Workshop

How to Determine the Right Acquisition Price Introduction to Determining Fair Acquisition Price Workshop Mergers and acquisitions (M&A) are also among the most radical decisions that a business can make. It is not just a financial exercise as to what to pay the other company, it is a strategic decision of whether or not the […]

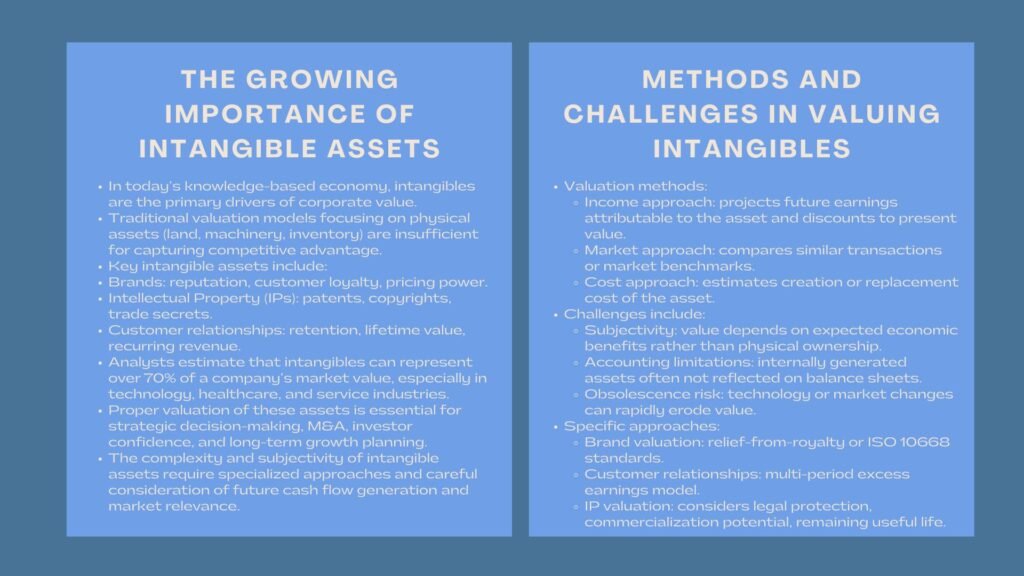

Professional Training on Intangible Company Valuation

Valuing Intangible Assets: Brands, IPs, and Customer Relationships Introduction to Professional Training on Intangible Company Valuation In the modern economy, intangible assets have turned out to be the engines of corporate value. The old traditional models of valuation that emphasize the material property such as machines, land, or inventory cannot be relied upon to reflect […]

Advanced Company Restructuring and Valuation

Corporate Restructuring and Its Effect on Company Valuation Introduction: Advanced Company Restructuring and Valuation In the modern competitive and dynamic business environment, corporate restructuring has taken the strategic need. Restructuring initiatives can have a profound financial impact and valuation to a company no matter the purpose, be it financial distress, market growth, or strategic resetting. […]

Certified Share Price and Company Valuation

Impact of Market Conditions on Share Price and Company Value Introduction: Certified Share Price and Company Valuation The most noticeable financial stability and investor trust indicators include share prices and company valuation. However, they do not act in isolation, as they act dynamically in response to larger market environment, both local and international. The knowledge […]

Accredited Business Valuation Trends Workshop

Emerging Trends in Business Valuation and Deal-Making Introduction: Accredited Business Valuation Trends Workshop The international business environment of valuation and business dealings is fast changing with the technological changes, changing demands of the investors and the ever complicated world of business. Innovative valuation techniques are being embraced to help companies, private equity and investors to […]

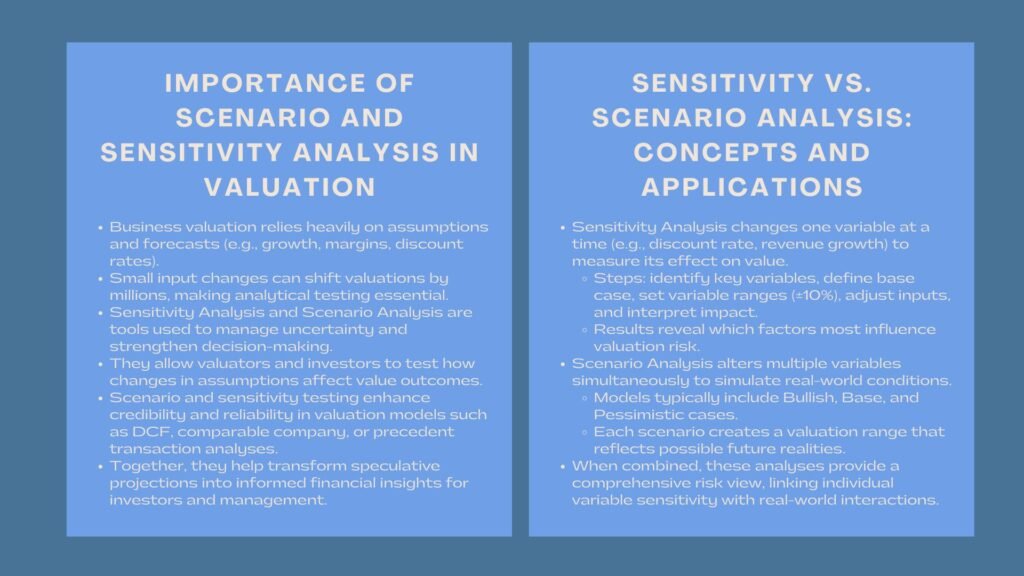

Certified Company Valuation and Analysis Training

Scenario and Sensitivity Analysis for Business Valuation Introduction to Certified Company Valuation and Analysis Training When it comes to business valuation, one needs to know the impact of various assumptions and variables in determining value in order to make an accurate decision. The projections of the future that valuators, investors, and business owners are fond […]