Professional DCF and Valuation Methods Workshop

Corporate Valuation Techniques: DCF, Multiples, and Asset-Based Approaches

Guide on Professional DCF and Valuation Methods Workshop

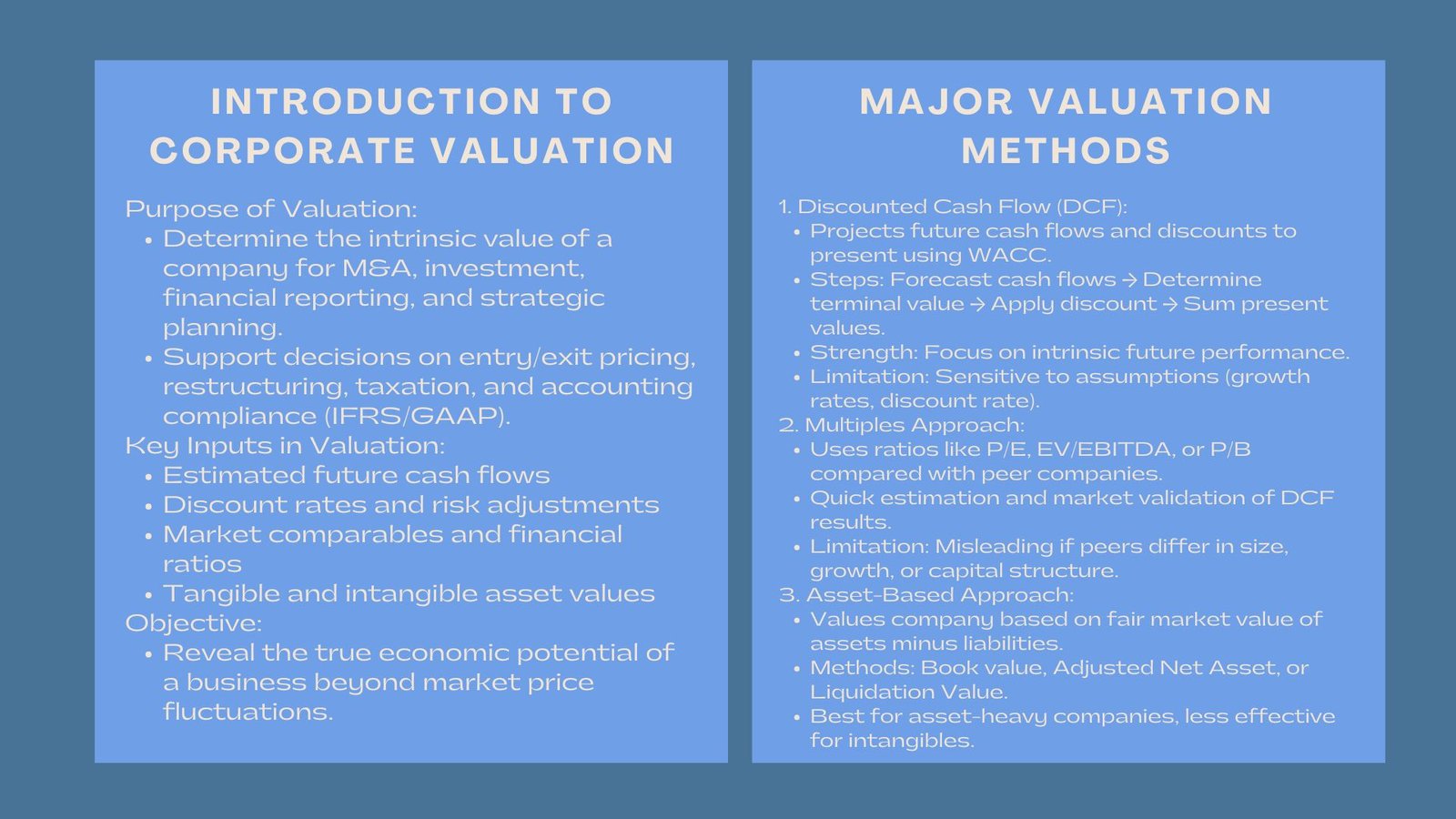

One of the most important activities in corporate finance is to ascertain the real value of a company. In the context of mergers and acquisitions, investment decisions, financial reporting, and strategic planning, valuation offers a necessary basis of the meaning of the true worth of a company.

Although the prices in the market can change day to day, intrinsic value provides a more penetrating perception of the actual economic opportunities of a company. Corporate valuation methods assist in revealing such intrinsic value by quantifying and qualifying fair value. The most popular ones are the Discounted Cash Flow (DCF) method, the Multiples approach, and the Asset-based approach.

Learning About Corporate Valuation.

Analytical Corp valuation is the process of economic value of a whole operation or business as a corporation. It is a foundation of transactions, investment analysis and performance evaluation.

The assumptions and inputs of the various valuation models vary, but the aim is the same, to determine fair value based on the analysis of the future benefits, historical performance, and rights to ownership of the assets.

The Purpose of Valuation

The use of valuation has a variety of strategic and financial uses:

- Advocacy of mergers and acquisition deals.

- Estimation of the price of entry or exit of investors.

- Helping with restructuring, tax, or legal services on the corporate level.

- Allow equitable reporting in accordance with accounting principles such as IFRS and GAAP.

Valuation Models Major inputs.

Some critical inputs in valuation are the estimated cash flows, rate of discount, risk analysis, market comparables, and physical and intangible asset values. True inputs will produce more believable outputs and poor assumptions will skew the perceived value of a company.

Discounted Cash Flow (DCF) Valuation.

How DCF Works

In the DCF technique, the value of a firm is determined by estimating its future cash flows and discounting them back to the present value with the help of a suitable rate, which in most cases would be the Weighted Average Cost of Capital (WACC). The concept under this is that the value of any business equals the future free cash flows of a business in terms of its present value.

Steps in DCF Analysis

- Project future cash flows: Predict cash flows within five to ten years depending on the growth of the business, expenditures, and investments.

- Determinate the terminal value: Model the value of the company above the time of projection by using a perpetuity growth model or exit multiple.

- Discount rate: WACC is used to indicate the time value of money and risk profile.

- Add the present values: Add discounted cash flows and terminal value to come up with the enterprise value.

Advantages and Limitations

The beauty of DCF is that it is based on basics and future ability. Nevertheless, it is very sensitive to assumptions, even minor variations in growth rates or rates of interest can make a big difference.

Professional analysts often use comprehensive DCF-based corporate valuation and financial modeling services for investment and transaction advisory to ensure precision and credibility in their forecasts.

Multiples-Based Valuation

The Theory of Market Multiples.

Multiples approach rates a company based on financial ratios of Price-to-Earnings (P/E), Enterprise Value-to-EBITDA (EV/EBITDA), or Price-to-Book (P/B) among other similar businesses. It is based on the premise that similar firms in the same industry are supposed to trade at similar multiples.

Multiples Approach: The use of the Multiples Approach.

In order to estimate a multiples valuation:

- Find a peer group of companies of the like.

- Divide into appropriate multiples of each (e.g. EV/EBITDA).

- Depreciate the median or average multiple on the metrics of the target company.

As an illustration, assuming that average peer companies are trading at an 8x EV/ EBITDA value, and your company has an EBITDA of 10 million, its enterprise value is 80 million.

Multiples Valuation when to be used.

Multiples come in especially handy where there are market comparables that are reliable. It is quick, convenient and is commonly used as a sanity check of the DCF estimates. Nevertheless, it may be deceptive when peers vary greatly in size, development or capital structure.

Asset-Based Valuation

Defining the Asset Approach

The asset-based method value of a company is calculated as the fair market value of assets of the company plus the liabilities. It is best applicable to companies that have a large number of physical resources – manufacturing, real estate or investment holding companies.

Methods in Asset Valuation

- Book Value Method: This method bases on the figures in the balance sheet of the company without modifications.

- Adjusted Net Asset Method: Records the assets and liabilities at fair market values.

- Liquidation Value Method: It is a way of estimating the amount the shareholders would get in case they sell off the assets and clear the liabilities.

Strengths and Drawbacks

It is simple and consistent where asset information is clear, however, it tends to underestimate firms with large proportions of intangible assets such as intellectual property, brand equity, or human resource.

In practice, analysts may integrate professional asset-based valuation and balance sheet appraisal services for corporate restructuring and fair value reporting to ensure compliance with international accounting and reporting standards.

Valuation Techniques Comparison.

Combining a number of strategies.

There are many methods of cross-checking used in professional valuations. An example is that a DCF could determine intrinsic value and multiples will be used as a market point and the asset approach will serve as a floor value.

Role of Judgment and Expertise.

Valuation is more of an art than a science despite data and models. Assumptions, risk adjustment, and qualitative elements such as management capability and market trends have to be interpreted and factored by the analysts.

Valuation: Why it Matters in Business.

Correct corporate appraisal affects vital choices, e.g. acquisition pricing, financing choices, equity issues, or shareholder value protection. It also is important in regulatory compliance and investor relations.

When companies know their real worth, they can negotiate better deals, draw in investors and strategize the growth with confidence. Conversely, overpricing or underpricing may result in inefficient allocation of capital and low returns.

With the changing face of financial markets, companies are resorting more to advanced valuation models that integrate technology, analytics, and judgment to give an all encompassing view of value.

Conclusion

Corporate valuation is much more than a mathematical exercise, but it is a process of strategy, which unites financial acumen, market intelligence, and prospective analysis. Be it DCF projections, projections or even appraisals of the assets, the idea is to ensure that the true economic potential of a company is captured.

Both approaches bring their own insight: DCF is focused on intrinsic performance, multiples are consistent with the market sentiment, and asset-based valuation makes analysis based on physical resources. They offer a balanced, credible perspective of corporate value together and which is critical in every business decision that determines the future.