Role of Business Valuation in Funding

The Role of Business Valuation in Raising Capital or Funding

Learn the Role of Business Valuation in Funding

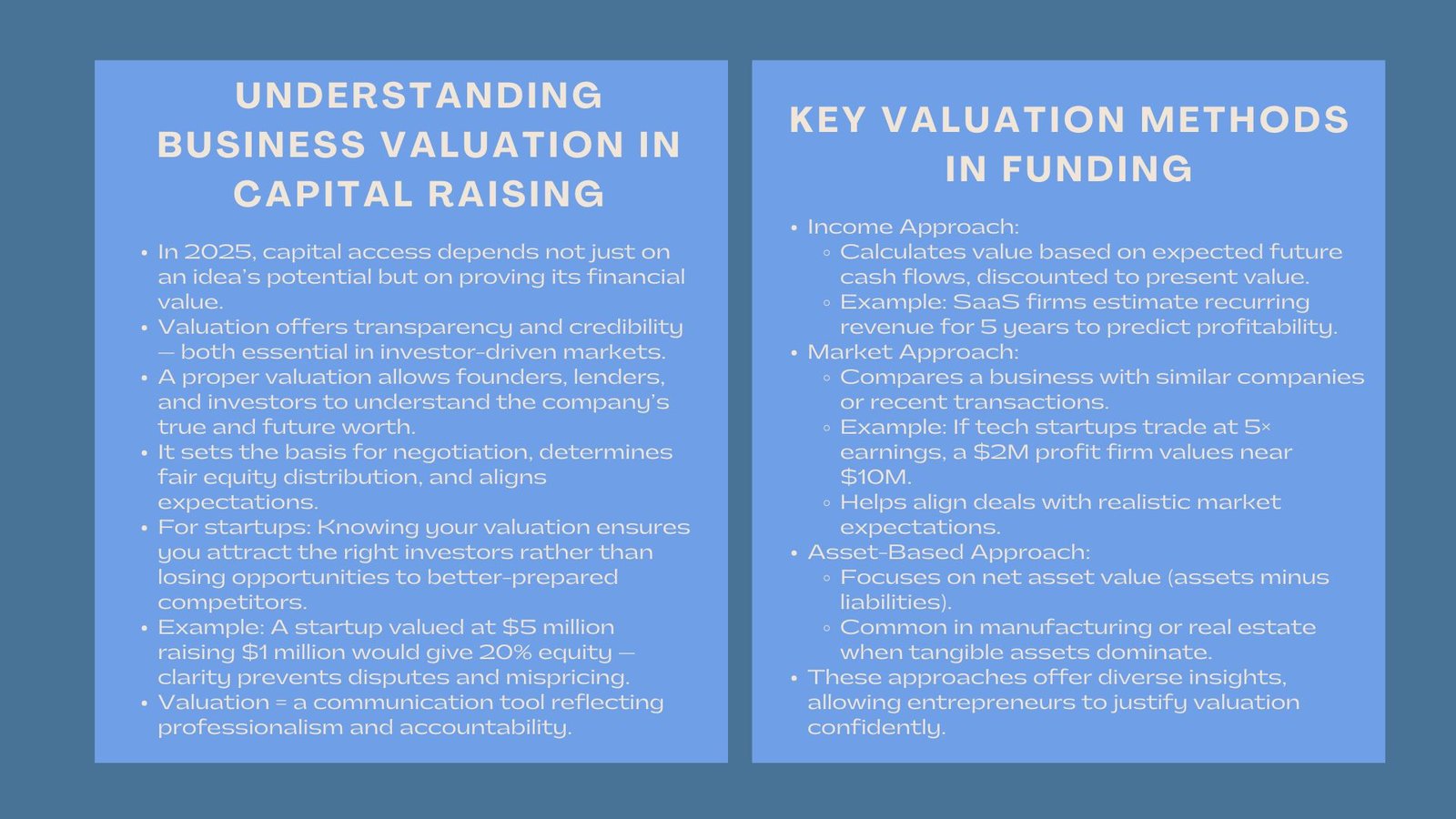

The access to capital will be determined by not just the existence of the promising idea of business in 2025, but by the demonstration of the financial value of the idea, as well. Business people and even organizations find themselves in an advanced investor environment where no one will compromise on transparency, credibility, and proper financial reporting. It is here that business valuation comes in handy.

The properly conducted valuation will give investors, lenders, and founders a clear understanding of the present and the future of a company. It provides a basis of negotiation, assists in creating realistic expectations in terms of funding, and indicates professionalism and readiness. Simply put: have you ever known the actual value of your business: it may help you have the right type of investors or it may help them find a competitor who is more prepared to invest with you.

1. Learning the Business Valuation in Raising Capital.

1.1 The importance of Valuation in the Funding Process.

Business valuation is in essence the measurement of the economic value of a company. In raising capital, this number is used to base the process of equity allocation, pricing how the investment is considered and those who are going to invest in the deal. A precise valuation assists business owners to balance decent ownership rights and retaining ownership rights in the long run.

An example would be when a startup has a valuation of $5 million, and wants to raise 1 million funds, it would probably give 20% equity to the investors. Such figures are usually speculative in nature without a credible valuation and therefore conflicts, mistrust or opportunity losses occur.

To investors, valuation is a measure of how the management knows the financial soundness of the business and the growth potential of the business. Valuation, therefore, is a financial process as well as a form of communication that shows professionalism and accountability.

1.2 The Relationship between Valuation and Investor Confidence.

Investors are risk-averse in nature. They would like to see that the business they are putting money in can be able to give sustainable returns. It is exactly such an insight, data-driven and precise in its estimation of revenue potential, risk exposure and competitiveness in the market that is provided by a solid valuation report.

Venture capital environments tend to use valuation analysis to prove to their limited partners the reason why they should spend their money. This exercise makes sure that the money is invested in the businesses that have quantifiable potential and not speculative potential. Effective valuation thus turns out to be language of trust between the entrepreneur and the investors.

2. The Some of the Major Valuation Techniques in Capital Raising.

2.1 The Income Approach

Income approach- using the method the business value is determined by the cash flows expected in future, discounted at a particular rate to give present value. It is especially applicable to firms whose sources of revenue are constant or where the trend of growth is predictable.

As an example, a SaaS (Software as a Service) firm may estimate repeat subscription earnings within five years. Through this model, valuers determine the value of such cash flows in the present day taking into consideration the market risk and discount rates. Professional advisors offering startup funding valuation services often use this approach to present investors with a clear picture of future profitability.

2.2 The Market Approach

This approach measures the value of a company against other firms of the same industry or region. Through the comparable transaction analysis, valuers determine what has been recently paid by investors on similar companies.

As an example, assuming that an average tech start-up in Singapore is valued at five times the yearly earnings, a similar organization that makes one million dollars per year would be valued at approximately 10 million. Such a market-oriented approach would allow founders and investors to perceive existing expectations and make reasonable deals.

2.3 The Asset-Based Approach

Valuation in some sectors, e.g. manufacturing or real estate, can center around tangible and non-tangible assets. This mechanism is a value calculator that is determined by evaluating the total assets against the liabilities. Although less popular in the initial phases of the startup, it can be used as a crucial benchmark by the established businesses that require debt-based funding or asset backed loans.

3. The Power of Valuation to the Negotiation of the Investors.

3.1 Expectancies that are Realistic.

Proper valuation prevents the parties to engage in negotiations at the same level. Overvaluation may discourage investors who will assume inflated expectations whereas undervaluation may cause undue equity dilution.

To illustrate, in the case of a seed funding a start-up overvalued at that stage, may not be able to deliver the required performance at later stages, thus triggering down-rounds, which are detrimental to reputation. On the other hand, a devalued company can be able to raise funds cheaply but lose ownership in the long run. Evidence based valuation is balanced and can be used to avoid these pitfalls.

3.2 Enhancing Bargaining Power

Entrepreneurs will be better positioned to be more credible and have bargaining power when they are able to support their valuation assumptions with facts and market knowledge. Verbatim financial models, acquiring customers metrics, and revenue projections indicate that valuation is not just random but based on the business principles.

In that respect, valuation becomes a strategic instrument, not a number, which leads negotiations to the results that serves the interests of both sides.

4. The Purpose of Valuation during the Various Stages of Funding.

4.1 Early-Stage Startups

Early stage In early stages, there may not be any traditional valuation metrics (profit, cash flow, etc.). Rather, investors put their emphasis on potential, such as intellectual property, market size and team capability. Professional early-stage valuation services help translate these intangible factors into measurable economic terms.

Another example is that an AI start-up in Jakarta before it can earn any revenue may use valuation experts to evaluate its technology readiness, competitive edge and possible license fee. This gives a plausible explanation on why it should be funded in the first place.

4.2 Growth and Expansion Stages

In case of the scale-ups, valuation is more data-driven. Shareholders look at financial reporting, performance ratios and scalability indicators. A mid-sized firm that is venturing into new markets may apply valuation to calculate the amount of equity to sell in exchange of extra capital to ensure ownership dilution is not too much.

The valuation at this point also affects the perception by investors of the returns adjusted with risks. Transparent and current valuation of companies makes it easier to raise capital on preferred terms.

4.3 Late-stage or pre-IPO Valuation.

The valuation is even more strict in the face of business approaching the public offering or massive institutional investment. Financial statements should be audited, independently valued and other accounting standards (such as IFRS 13) should be followed to earn the trust of investors.

As an example, a fintech company that intends to conduct an IPO in Hong Kong could use various valuation firms to inform enterprise value in various methodologies. It is a multilayered approach that would provide an institutional investor with a sense of fairness and accuracy.

5. The way Technology is changing the value of a business.

Increasingly, the industry demands rapid decision making and insights among various tasks performed by the workers at any specific time.

5.1 Automation and Real-Time Insights.

Online sources have brought entrepreneurs and investors a chance to receive instant data-supported valuations. When combined with financial analytics, artificial intelligence, and cloud computing, the tools process large volumes of data, such as comparables in the market and trend engineering literature, to provide more precise valuations in real-time.

The innovation makes the work with manual spreadsheets less dependent and more transparent, especially in the case of startups that work in dynamic industries such as e-commerce or fintech.

5.2 Scenario and Sensitivity Analysis.

Technology additionally facilitates sensitivity testing where a simulation is conducted on the results of various funding levels by the analysts as a result of certain variables such as the growth of revenues or the cost of capital. As an example, a firm in manufacturing industry may experiment with the variation of interest rates and how these changes will influence its valuation before going to lenders.

These tools enable the process of valuation to be ongoing, allowing business executives to be flexible in response to market changes and make wiser decisions regarding capital-raising.

6. Developing Investor Confidence by Valuation Disclosure.

Investigating the compliance and professional standards is crucial since the existing regulations must be adhered to.

6.1 Compliance and Professional Standards.

Research into the compliance and professional standards would be essential because the current regulations should be followed. Valuations should be up to international standards by the investors. The involvement of professional valuation experts will guarantee the adherence to such standards as IVS or IFRS, reducing audit risk and disagreements. Open reporting of assumptions, procedures and risk aspects is an indicator of integrity and accountability – aspects that are highly appreciated by investors.

6.2 Human Factor of Investor Relations.

In addition to figures, valuation also speaks of the vision, leadership and the direction of the company. Founders create a sense of emotional and intellectual attachment with investors when they explain how value will increase with time. This story, backed up by quantitative valuation data, changes the discourse of funding to long-term partnerships.

Conclusion

Valuation of businesses will no longer become a single process in 2025 but a continuous process that companies require when raising funds or capital. Valuation, in the case of venture capital, forms the basis of investor confidence, bargaining power, and clarity in strategy, even in the case of a pre-IPO company.

A believable valuation not only shows what a business is worth at the present time but also what it will be worth in the future. It is the basis of opportunity and trust to the entrepreneur. To investors, it is the guarantee that the capital would be used prudently. Valuation is among the smartest investments that any business can have in a world that is data driven, transparent, and accountable.