Certified Company Valuation and Analysis Training

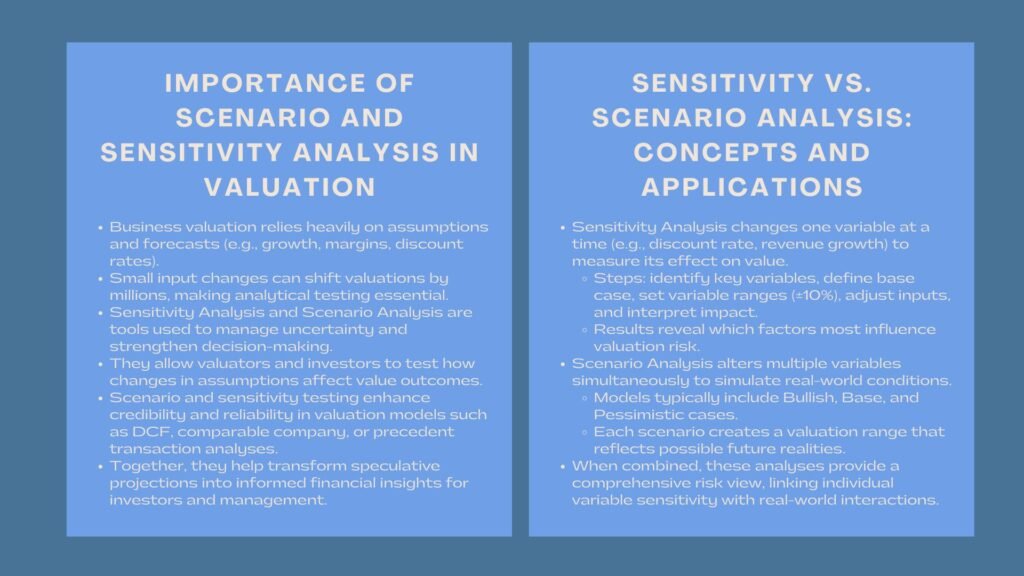

Scenario and Sensitivity Analysis for Business Valuation Introduction to Certified Company Valuation and Analysis Training When it comes to business valuation, one needs to know the impact of various assumptions and variables in determining value in order to make an accurate decision. The projections of the future that valuators, investors, and business owners are fond […]

Accredited Private Public Company Valuation

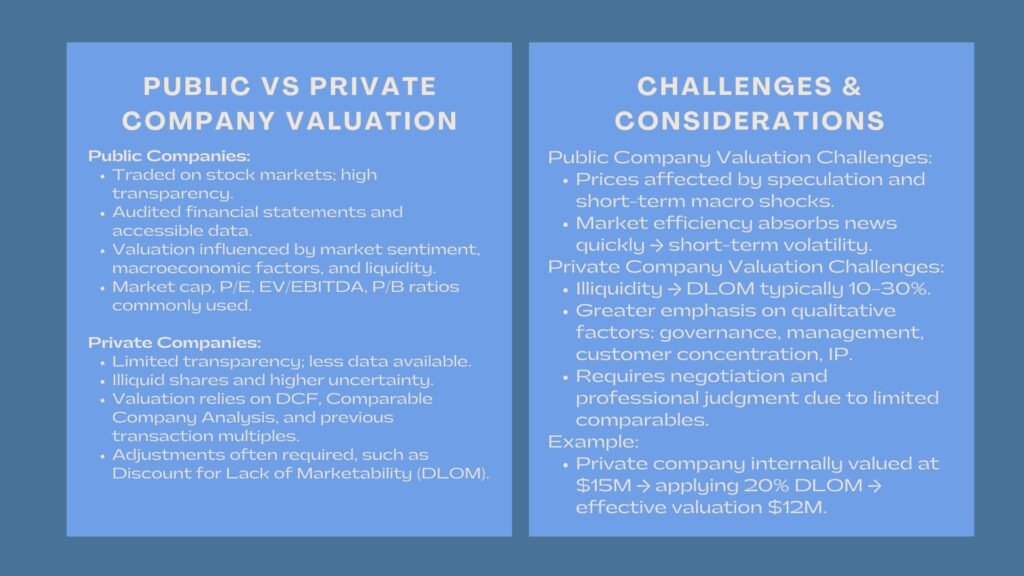

Private vs Public Company Valuation: What Investors Should Know Guide on Accredited Private Public Company Valuation The critical aspect of the sound investment is valuing companies, and it, nevertheless, is determined differently in private and public entities. The valuations of publicly traded companies are part of a clear market where the financial statements are available, […]

Advanced Company Valuation Ratios Certification

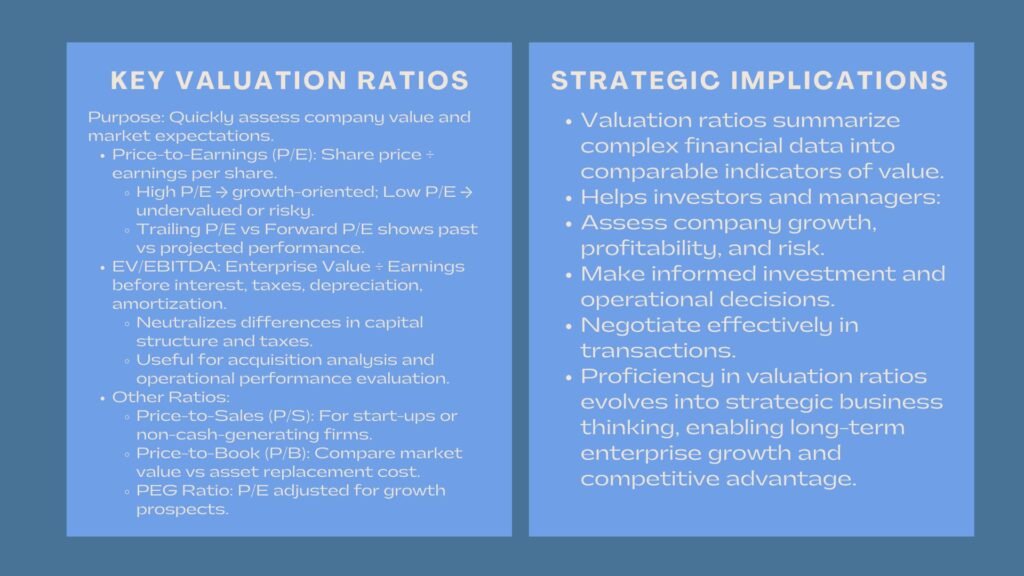

Understanding Price-to-Earnings, EV/EBITDA, and Other Valuation Ratios Learn Advanced Company Valuation Ratios Certification Valuation ratios are one of the most powerful tools of analysis in the world of finance. They let investors, analysts, and business owners compare companies, evaluate market expectations and measure financial performance in a short time. Ratios such as Price / Earnings […]

Professional Investment Analysis and Valuation Workshop

Investment Decision-Making Using Company Valuation Metrics Professional Investment Analysis and Valuation Workshop In order to make investment decisions, it is important to have a solid understanding of the true value of a company. Valuation metrics help form a common language for investors to now compare opportunities and to assess risk more effectively, as well as […]

Key Considerations Before Selling Your Business

Key Considerations Before Selling Your Business: Valuation Insights Understanding to Key Considerations Before Selling Your Business One of the most great financial events of an entrepreneur is the selling of a business. It is the ultimate phase of years of work, investment and growth strategies. Nevertheless, to maximize on a sale, much more than a […]

Certified Business Acquisition and Sale Training

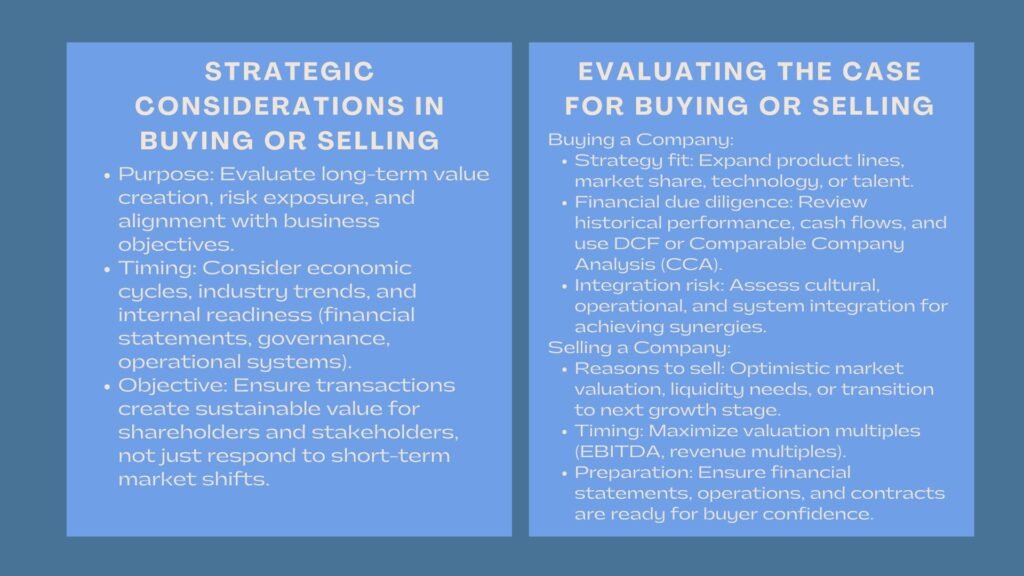

How to Decide Whether to Buy or Sell a Company Guide on Certified Business Acquisition and Sale Training One of the most far reaching strategic decisions the business leaders face is the choice of whether to purchase or to sell a company. It is not about the financial calculations, but the evaluation of the long-term […]

Certified Business Valuation and Accounting Training

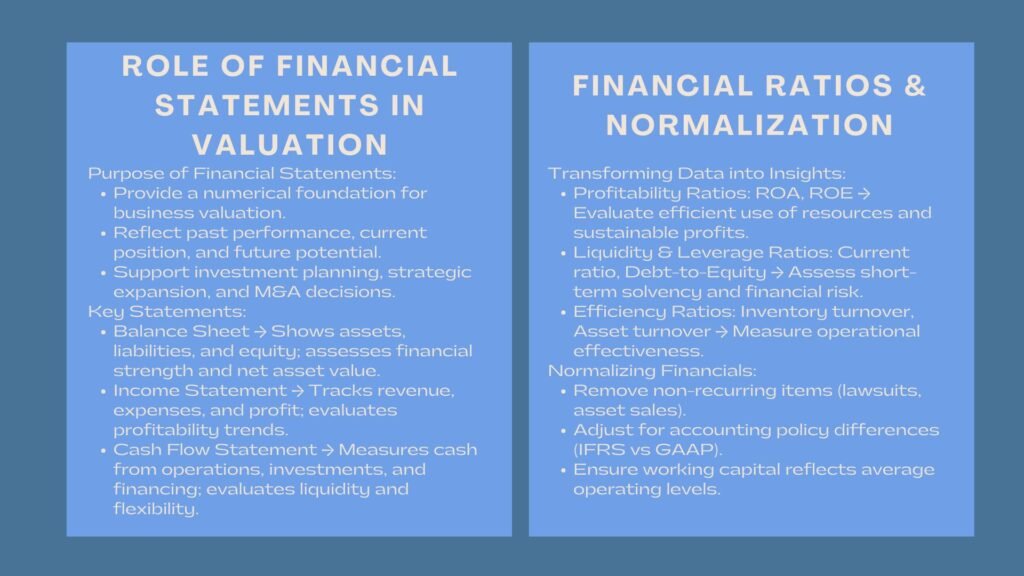

Impact of Financial Statements on Business Valuation Guide on Certified Business Valuation and Accounting Training Any credible business valuation is based on financial statements. They contain the pure numerical support reflecting the previous performance of a company, its current status, and future opportunities. In the absence of proper financial information, the investors, analysts or acquirers […]

Professional DCF and Valuation Methods Workshop

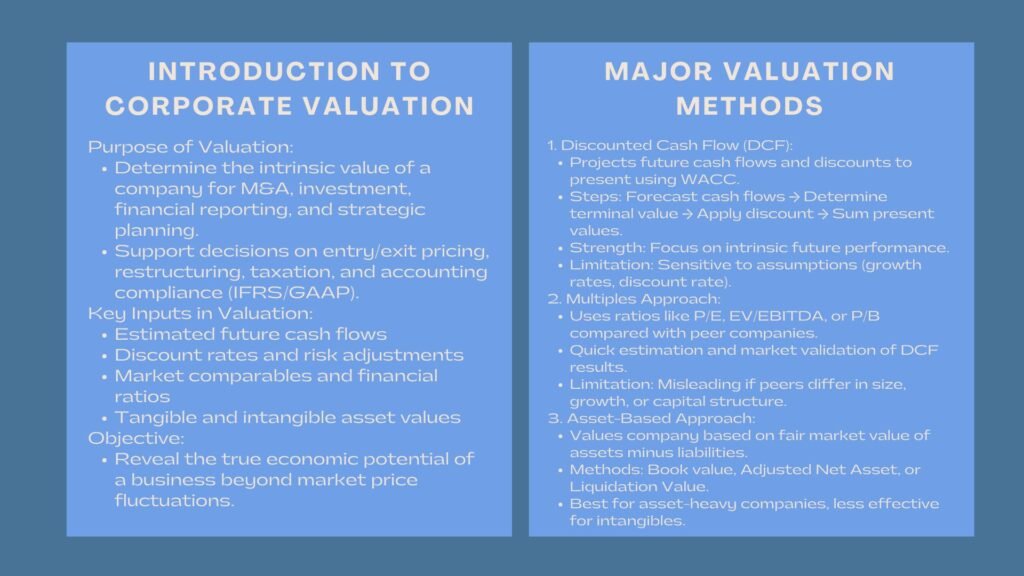

Corporate Valuation Techniques: DCF, Multiples, and Asset-Based Approaches Guide on Professional DCF and Valuation Methods Workshop One of the most important activities in corporate finance is to ascertain the real value of a company. In the context of mergers and acquisitions, investment decisions, financial reporting, and strategic planning, valuation offers a necessary basis of the […]

Certified Share Price Analysis Course

Share Price Analysis: Factors That Influence Market Valuation Guide on Certified Share Price Analysis Course The stock market is said to be a mirror of how a company performs and how the investor feels about the company, but the share prices cannot be anticipated to act in a certain manner. Every price move is behind […]

How to Value a Company Course Singapore

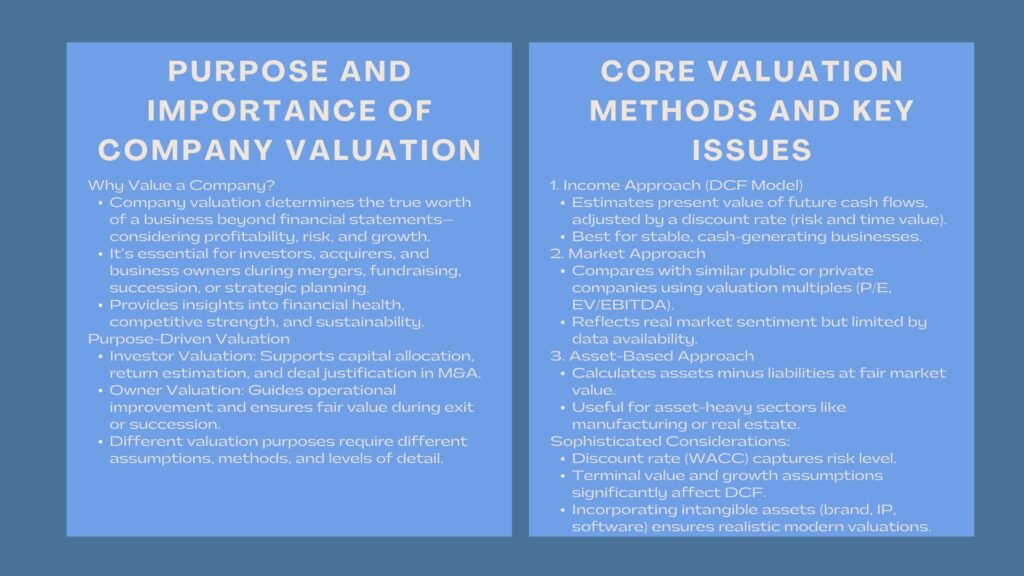

How to Value a Company Course Singapore: Methods and Best Practices One of the most significant and, at the same time, complicated exercises in finance is the determination of the value of a company. You may be the investor who wants to assess the viability of acquisition, the founder who wants to raise funds, or […]